|

Chaebolution and the Perils of Sum-of-the-Parts (SOTP) Valuation

등잔 밑이 어둡다 or “It is dark under the lamp”, a local Korean proverb

“Nature has made up her mind that what cannot defend itself shall not be defended.”

– Ralph Waldo Emerson (1803-1882)

“I started the passenger car business because I believed that it would surely be an important strategic business in Korea after 10 or 20 years. I know that we cannot make money in the first five or six years even though we invest 10 billion dollars. However, I know that the 10 billon dollars would surely raise the national competitiveness of our automobile industry in the long run.”

– Samsung Chairman Lee Kun-hee

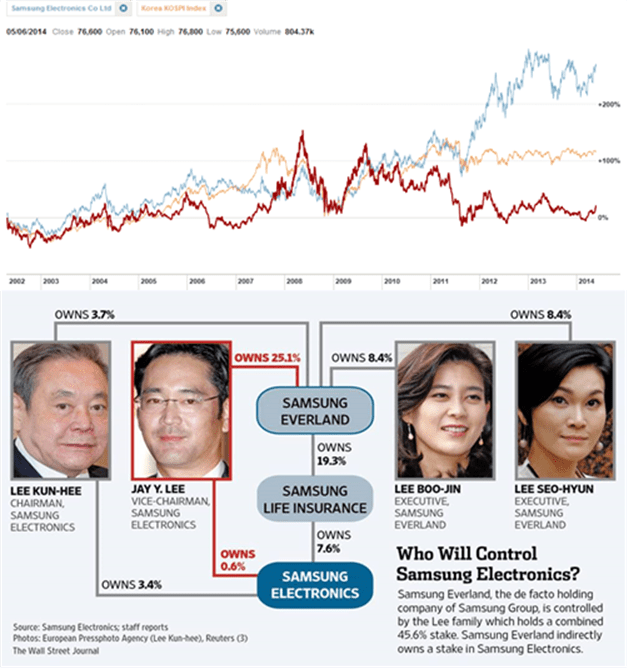

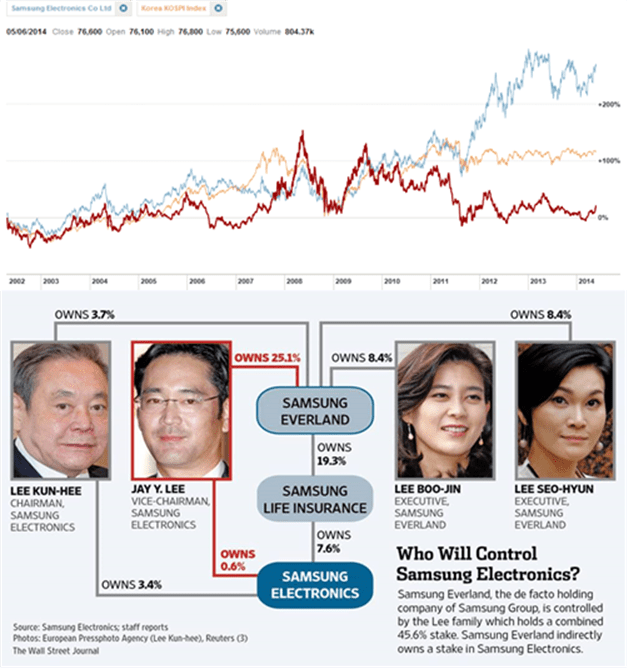

The “Chaebolution” movement – the transition towards meaningful restructuring for the diversified Korean conglomerates with complex circular shareholdings – is marking its most significant event last week. Samsung Group announced that Samsung Everland, which sits at the apex of an intricate web of circular shareholding, is going for listing and conversion into the Group’s holding company by early next year. Such spider web shareholdings is said to fester self-dealings, tunneling and expropriation activities by the controlling shareholders at the expense of long-suffering minority shareholders, resulting in the “governance discount” for Korean shares. With the listing, Samsung Group affiliates could account for over 30% of the market value of all listed companies in Korea. We like to argue that until a business group has gone through its own “chaebolution”, investors mechanically using sum-of-the-parts (SOTP) valuation method in summing up the imputed values of individual segments will be overestimating the enterprise value for conglomerates. This is because managers have incentives to manipulate and transfer earnings from segments operating in industries with lower valuation multiples to those with higher multiples, as doing so will lead to higher equity valuations. Compared to firm-level earnings, segment-level reports often involve more managerial discretion and are subject to less auditor scrutiny. To understand the implications of Samsung Group’s conversion to a holding company structure as part of the “forced refocusing” theme in Korea and Asia, we need to travel back twenty years ago with Samsung’s chairman Lee Kun-hee in his Porsche.

A car buff who loved to race around his company-owned racetrack, Lee had announced plans for Samsung Motors in 1994. This was a year after Lee undertook the famous burning ceremony of phones to demonstrate Samsung’s commitment to quality. The Great Samsung Machine cranked up its powerful efficient levers and the strategy was implemented at an incredible speed. Only two and a half years after the conclusion of the technology transfer agreement with Nissan, Samsung had completed construction and tooling of a $3-billion state-of-the-art production facility in Pusan that was ready to produce 240,000 cars per year. This is a remarkable feat because Samsung was able to leverage its brand reputation, group synergy in resource sharing, and market power in cross-subsidization by the flagship Samsung Electronics and various affiliates, such as direct subsidy and debt guarantees to procure the necessary capital at low cost. Lee was in a rush to “prove” his leadership credentials both inside Samsung and beyond after taking over the top post from his patriarch father Lee Byung-chull in 1987. After succeeding his father, Lee’s first project was the establishment of Samsung General Chemical, a foray that ended in failure. Lee needed a “next big thing” and Samsung Motors fits as the perfect legitimacy-seeking business.

Despite rave reviews, coupled with a trendy design studio in Los Angeles, Samsung Motors sold 45,000 cars, mostly to employees, when the first production output rolled out in March 1998. Samsung Motors had driven straight into the Asian Financial Crisis, with its woes compounded by the global excess of auto production capacity. Due to Lee’s insistence to locate the new factory in the home province of the former president Kim Young-sam, Samsung Motors suffered a severe cost disadvantage – nearly 40% more in setup costs per car than the competitors. Samsung Motors had to shutter its auto factory in Dec 1998 and declared bankruptcy in mid-1999, owing creditors over $3.7bn. It has been estimated that the startup’s total losses ultimately came to $13bn. In May 2000, Samsung Motors was sold to Renault. In place of cash payments, Lee handed creditors shares in Samsung Life (032380 KS, MV $19.9bn) as collateral for the debt on condition…

<Article snipped>

Samsung Electronics Vs LG Electronics and KOSPI – Stock Price Performance, 2002-2014

There is a Korean saying: 등잔 밑이 어둡다, or “It is dark under the lamp”. In applying SOTP as the lamp to light up the value of Asian conglomerates with their multiple business segments and affiliates, it is critical for value investors to STOP first to investigate the critical governance factor under the lamp. This dark source under the lamp is the master controller of the transient light thrown out to shine the segmental profits. The SOTP valuation method tends to overestimate firm value if not adjusted for inter-segment profit transfer and that the measurement errors increase with segment valuation dispersion. Understanding managers’ incentives to manipulate segment-level earnings is critical in pricing these companies properly.

To read the exclusive article in full to find out more about the implications of the forced refocusing on Samsung Group and its business affiliates, including the impact of the hidden debt guarantees and contingent liabilities, and the accounting and equity valuation insights of the chaebolution on other conglomerates such as the Hyundai Motor Group, please visit:

Value Unplugged 2014 and Value Investing Seminar in July in Italy

Value Unplugged 2014 (www.valueunplugged.com) in Naples, Italy is now full. We’ll gather in a small, relaxed setting to learn and make friends. We’ll also attend Ciccio Azzollini’s sold-out Value Investing Seminar in July in Trani, Italy — the definitive summer conference for value investors – as one of the keynote speakers.

http://www.valueinvestingseminar.it/content_/relatori.asp?lan=eng&anno=2014 |

|

“In business, I look for economic castles protected by unbreachable ‘moats’.”

– Warren Buffett

The Moat Report Asia is a research service focused exclusively on competitively advantaged, attractively priced public companies in Asia. Together with our European partners BeyondProxy and The Manual of Ideas, the idea-oriented acclaimed monthly research publication for institutional and private investors, we scour Asia to produce The Moat Report Asia, a monthly in-depth presentation report highlighting an undervalued wide-moat business in Asia with an innovative and resilient business model to compound value in uncertain times. Our Members from North America, the Nordic, Europe, the Oceania and Asia include professional value investors with over $20 billion in asset under management in equities, secretive global hedge fund giants, and savvy private individual investors who are lifelong learners in the art of value investing.

Learn more about membership benefits here: http://www.moatreport.com/subscription/

- Individual subscription at $1,994 per year:

https://www.moatreport.com/individual-subscription/?s2-ssl=yes

Our latest monthly issue for the month of June investigates the world’s #1 ODM (Original Design Manufacturer) and global #5 manufacturer of a consumer healthcare device product that is used frequently, even daily, thus providing the foundation for stable recurring cashflow. This company is also a hidden champion in a niche product segment (50-55% of group’s sales) that has become a high-growth fashion product currently accounting for less than 10% of the overall industry. The company is able to mass-manufacture this niche product, but not the giants, because of its unique process IP in flexible manufacturing system and know-how to handle large-scale complex orders. The manufacture of this product itself is difficult to replicate and requires FDA/CE licenses because of its medical device nature and the entry barrier is not capital but the know-how and R&D expertise. In particular, the manufacturing integrates different fields of science including polymer chemistry, physics, optics, engineering, materials control, process control, microbiology, and, injection molding. The firm has also developed a proprietary system of tracking the manufacturing process of different sets of product so that if a quality issue arose, when and where the problem set of products was being produced could be swiftly identified, thus diminishing the scale and cost of product recall. This system has helped the firm win the long-term trust of its ODM customers to place stable large orders. The Big Four giants do not have such a system and have to incur substantial losses from product recalls. The company also possess its own brand which has many loyal followers and support in its home market where it enjoys a 30% market share and contributes to 25% of group’s sales while sticky ODM customers account for 75% of group’s sales, mainly from the Japan market. As a result of its wide-moat advantages, the firm enjoys a consistently high ROE of 41%, double or triple that of the giants. From FY07 onwards, even during the depths of the Global Financial Crisis in 2007/09, the firm has not raised equity. Since listing in Mar 2004, the company has only done one rights issue in May 2005. Also, it is able to sustain a strong stable cash dividend payout (>70% with 3% yield) with its healthy net-cash balance sheet (net cash $30m; net cash-to-equity ratio 23%) and proven management execution in prudent capex expansion to support sustainable quality earnings growth. M&A deals in the healthcare and medical device sector has been growing due to their strong defensive nature and giants seeking growth to overcome their own patent cliff. The firm will always be an attractive takeover target by giants who wish to swallow it up to possess its valuable flexible manufacturing system and know-how to fill their own missing competency gap and hence will enjoy long-term downside protection in its terminal value. In the battle between “ODM vs Brand”, we find the story of the company to be quite similar to that of TSMC (2330 TT, MV $103bn), now the largest ODM foundry in the world. “Skate to where the puck is going to be, not where it has been,” as hockey legend Wayne Gretzky advised. In our view, the profit and valuation premium in the value chain will start to skate to the “Inno-facturers” who are the hidden ODM innovators (the brand behind brands) consolidating the industry, such as TSMC and this company. While its valuation is not cheap with EV/EBIT (FY13) at 20.6x, when we compare EV/EBIT relative to ROE, the company is relatively cheap, by as much as 130-220% when compared to giants and other comparables. When we compare EV/EBITDA relative to ROE, the valuation gap is 90-160%.This long-term valuation gap implies that the company, with its far superior and sustainable ROE, could potentially double to $2.4bn, as it continues to consolidate its niche product segment and enter into a new product cycle of an innovative product whose patents are expiring in 2014/15 (US/worldwide) to make ASP/margin improvements in sustaining quality profits and cashflow. Its share price has dropped 18% from its recent high and underperformed the index by 26% in the last six months. This will present a buying opportunity for long-term value investors who can penetrate beyond conventional valuation metrics because of a deep understanding of its business model and underlying source of its wide-moat advantages. In Asia, many firms break apart or become value traps due to shareholder conflict, envy and differences in opinion on the business direction of the company. The stable long-term corporate culture infused by the late founder, who established the company in 1986 with the current executive chairman and 2 other key shareholders, to combine the energy and ideas of everyone to work hard to keep the business running forever is underappreciated.

Our past monthly issues examine:

- The Home Depot of Asia which has the largest market share in its home country and now seeks to expand regionally. It is one of the few home improvement retailers in the world which is able to achieve a structural negative cash conversion cycle (CCC) at -39 days for resilient, recurring and sustainable operating cashflow to enable the expansion of its store network while keeping a healthy balance sheet. It is hard to achieve negative cash conversion cycle (CCC) as a home retailer as compared to a supermarket retailer as the product nature is more durable. Even Home Depot, Lowe’s and Bed Bath & Beyond (BBBY) are not able to achieve a negative CCC. Led by the capable owner-operators since 1995, the company is a pioneer in proactively creating awareness and demand in the minds of consumers that upgrading your home can be fun and in incremental affordable steps. Its creative branding has resulted in the firm to become the “first on customers’ mind”, or what Charlie Munger elucidated as the “psychological wide-moat” advantage. 80% of sales are generated customers looking for home improvement and renovation ideas and solutions. Growth is supported by the management’s proven ability to identify and cater to dynamic changes in customer preferences. The firm’s comprehensive pre and aftersales service creates brand loyalty and sustains long-term sales. The merchandizing management is tailored to the peculiarities of customer preferences in each area to drive same store sales growth with creative customization by store, location, season and events. Its key strategy to expand its profit margin is to increase its higher-margin house brands and product-mix management. Its EBITDA/sqm of $400/sqm was higher than Home Depot until Home Depot experienced a rebound last year to $500/sqm. The firm’s resilient sales are supported by its unrivalled network of diverse locations throughout the country. Its bold vision and successful “Blue Ocean” execution in the highly fragmented second-tier markets has created a powerful wide-moat advantage that will last for many years to come. In short, the management have proven their ability to execute in difficult market and industry conditions especially in the past 5 to 7 years during the 2007/09 global financial crisis with the firm emerging much stronger. The Illinois Institute of Technology engineering graduate and quiet billionaire owner behind the home retailer is one of the few Asian business tycoons who has the thirst to scale up the business in a sustainable way, as opposed to opportunistic ventures, having been largely influenced by his early years experience observing the success of American wide-moat firms. If we can adjust the EV/EBITDA valuation metric to reflect the CCC, the company’s EV/EBITDA of 18.5x will be lower at 10-11x, while Home Depot’s EV/EBITDA 11x will be higher at 13x. Noteworthy is that Home Depot has a negative free cashflow throughout FY1989-2001 (13 consecutive years!) and yet market cap has climbed from $1.5bn to $103bn. Home Depot compounded despite the ugly valuations during the capex ramp-up. This once again highlights that the power of wide-moat is often underappreciated, misunderstood and overlooked. When Home Depot generated $180m in operating cashflow in FY1992, quite similar to this Asian firm now, Home Depot is valued at $5bn (vs $3bn). Store network is expected to double in the next 4-5 years, representing a potential doubling in market value.

- The Northeast Asian-listed company who is the world’s largest maker of an essential component with applications in apparel, shoes, diapers, car seats etc. All top 20 global athletic shoe brands, including Nike, Adidas, Reebok, Sketchers, UnderArmor are customers and this Asian innovator with R&D capabilities has forged long-term “spec-in” partnerships with them. Its broad product offering is protected by over 110 patents. By locating its Pan-Asian production plant network in China, Taiwan, Vietnam and Indonesia close to its major clients, including sales/customer service centers and warehouses in US and Europe, the firm is better positioned to understand their requirements, deliver fast and meet their needs. While top 10 athletic shoe brands account 40% of its revenue, the firm has a diversified clientele base of over 10,000 customers, giving it resilience and growth with both the established and emerging brands as clients. The company is trading at PE14e 12x, EV/EBITDA 7.1x and EV/EBIT 10.6x with a dividend yield of 3.9%. Interestingly, its EBITDA margin is double that of Adidas and its 8.7% net margin is higher than Adidas’ 5.4%, though below Nike’s 9.8%. Given the tipping point of its Pan-Asian production network and contributions from its new products and as capex tapers off in the next few years, free cashflow could be around $50-60m and applying a P/FCF of 15x would yield a market value of $750-900m,, representing a potential upside of 100-150%. Thus, the firm offers a similar quality growth trajectory to Nike/Adidas with its unique knowledge-based business model and yet trades at a more attractive valuation and higher dividend yield as downside protection.

- The Middleby of Asia commanding a dominant market share of over 80% in hypermarkets, 50% in chain outlets, 30% in 4- to 5-star hotels in China and an overall 30% in its home market. Yet, no single customer accounts for more than 5% of its revenue. Just to recall for value investors, NYSE-listed Middleby, with its sleepy and boring business, has compounded 100-fold from around $50m to $5.7bn since its tipping point in 1999. The founders of this Asian family business demonstrated clear dedication in building up the company with its wide-moat business model backed by a strong and unique distribution/marketing network in finding, winning and binding new customers to build massive brand equity and long-lasting relationships with clients over time. Their devotion to its core product for nearly 20 years results in maximum problem-solving skills, innovative strength and product leadership and hence, to ever greater customer benefit that will protect the company to consolidate the fragmented market and provide ample opportunities to continue its profitable growth. The company is currently trading at PE13e 15.8x and an undemanding EV/EBIT 10.1x and EV/EBITDA 9.5xand its growth potential based on its unique business model is not priced in. There is a structural re-rerating of niche business models with (1) diversified client base, (2) steady revenue streams, (3) lean capex requirements that creates ample free cashflow and defensive growth. Based on PE, P/CFO and EV/EBIT, the company is trading at a 40-50% discount to the foreign listed comparables despite more efficient use of assets in generating profits and cashflow. It has an attractive 7% earnings yield growing at 20% over the next 3-5 years and a 3.8% dividend yield that is supported by its strong cashflow generation ability, steady revenue stream and lean capex requirements to limit downside risks in valuation. Based on the growth plans to penetrate new product and customer segments; build its third plant in India in addition to the ones in its home market and in China; and potential bolt-on acquisition opportunities with its healthy balance sheet in net-cash position, it has the potential to double its operating cashflow in the next 3-5 years and market value could double, representing an upside potential of 100-140%.

- An emerging Asian Walgreens which is a top 3 community pharmacy operator in its home market. Walgreens is a classic neglected American compounder up over 272-fold to $54 billion from under $200m as it quietly consolidates the market. Over the decade, we observed that it is difficult to scale services-based businesses without an entrepreneurial mindset, committment and execution and thebold and unique management system of the company since 2000 allowed the pharmacists to be part-owner of the business which will lead to increased level of commitment and an owner’s mindset in growing the business for the long-term in the community. The firm has strong cash generation ability due to its negative cash conversion cycle (CCC) in the business model to help the business stay resilient during difficult times and to fund capex needs internally without straining the business model scalability as the network expands. The centralized logistics system provide regular deliveries to all of its community pharmacies enables the outlets to maximize retail space without the need to have space to keep stocks. This also enables the community pharmacies to optimize retail space to carry a wide range of products which is important as consumers increasingly have top-of-mind recall for the company as the destination to go to for their healthcare needs. Like Walgreens, the company believed in the power of embedding technology into the business model to better compete and its financial and warehousing/inventory management systems are integrated with its in-house POS (point-of-sale) system which is linked among all its community pharmacies and head office via virtual private network. The company is founded by five college friends who were somewhat frustrated that their pharmacy degrees were underappreciated and under-rewarded as compared to their medical degree counterparts even though they had studied hard for 4-5 years and had in-depth medical knowledge. They were eager to prove themselves that they are as capable, if not more so. This restless spirit to prove their capabilities resulted in them coming together to be entrepreneurs and they wish to provide the platform for similar restless pharmacists to apply their hard-earned knowledge acquired in the university. We find that this common purpose and camaraderie spirit is rare in Asian companies and makes the company unique to scale up sustainably. The company is currently trading at a EV/EBIT of 13.9x and EB/EBITDA 12.6%. In the next two to three years as the company expands its network of outlets, operating cashflow (CFO) could increase 50-60% and a re-rerating could result in a doubling in market value.

- An Asian-listed pharmaceutical company which has a dominant franchise in a neglected but growing disease and is a leader with a domestic market share of 49% in this niche segment and is the only fully-integrated player amongst the few pre-qualified WHO firms, giving it >30% EBITDA margin, better pricing power compared to the competition, and significant advantage over other players in ramping up the global business from the current 30% market share in the most-common treatment drug (vs Novartis 50%). Furthermore, the pharma company has the second-highest GP/TA (gross profit/ total asset) ratio in the industry at 56.3% and the most conservative accounting practice in the industry which “depresses” earnings relative to its peers i.e. it is the only domestic firm which expenses, and does not capitalize, all R&D. With the new plant for formulations export to US, the deepening of the niche drug franchise, growing wins in chronic pain and other niche areas and the commercialization of the potential blockbuster product of blood thinner by FY16/17, EBITDA could potentially double to $200m in the next 4-5 years, triggering a valuation re-rating to a market value of $3.4bn, a 130% upside.

- An Australian-listed company with market value $405m, EV/EBITDA 7.5x, EV/EBIT 10x, div 3%, 70% domestic market share whose management made the controversial bold decision to stop overseas exports in order to focus on cultivating the higher-margin domestic market with innovative marketing strategy and new products and is potentially doubling its supply in the next 3-5 years. It is in its 10thyear of listing after piling the foundation in consolidation, investment, rationalization for its next stage. It has an all-time low debt-equity position 18.6% with healthy balance sheet. “Buffett of Nordic” recently increased position between Apr-Sep this year in the peer comparable of the company and the billionaire investor announced in Nov an acquisition of a rival in a wave of global consolidation and with the view on a sustained recovery in product prices.

- A Northeast Asia-listed company with global #1 market share leadership in 4 different products, including making the components for an innovative consumer product whose sales have climbed from $90 million to $526 million in the recent three years. The company is a hidden global consolidator with underappreciated growth. The stock is trading at PE 11.5x, EV/EBITDA 9x and generates a sustainable dividend yield 5.75%.

- A Taiwan and Southeast-Asian-listed entrepreneurial company, both with a dominant 80% domestic market share and have innovative business models to generate substantial cashflow to support both expansion and a 4-5% dividend yield.

- There is also a behind-the-scene conversation with the CEOs of the companies to understand their thinking process in building up the business.

The Moat Report Asia Members’ Forum has been getting penetrating quality dialogues from our subscribers.Questions range from:

- The nuances of internal dealings in Asia, including the case discussion of the recent deal in which HK billionaire’s Lee Shau-kee Henderson Land acquiring Towngas or Hong Kong & China Gas (3 HK) from his family holdings, seemingly déjà vu from the early Oct 2007 transaction when the market peak.

- The case of F&N Singapore spinning out its property unit FCL Trust and getting “free” special dividend-in-specie and the potential risk in asset swap restructuring to deleverage the hidden debt in the entire Group balance sheet.

- The dilemma of whether to invest in a Southeast Asian-listed company and hidden champion with a domestic market share of 60% due to family squabbles and a legal suit over the company’s ownership.

- Discussion of the wise and thoughtful 107-year-old Irving Kahn’s investment into a US-listed but Hong Kong-based electronics company with development property project in Shenzhen’s Qianhai zone and the possible corporate governance risks that could be underestimated or overlooked, as well as their history of listing some assets in HK in 2004.. This is also a case study of “buy one get one free” in John’s highly-acclaimed book The Manual of Ideas in which the “free” property is lumped together with the (eroding) core business to make the combined entity look cheap and undervalued. What are the potential areas that value investors need to watch out for when adapting the SOTP (sum-of-the-parts) valuation method in Asia?

- And many more intriguing questions.

Do find out more in how you can benefit from authentic and candid on-the-ground insights that sell-side analysts and brokers, with their inherent conflict-of-interests, inevitable focus on conventional stock coverage and different clientele priorities, are unwilling or unable to share. Think of this as pressing the Bloomberg “Help Help” button to navigate the Asian capital jungle. Institutional subscribers also get access to the Bamboo Innovator Index of 200+ companies and Watchlist of 500+ companies in Asia and the Database has eliminated companies with a higher probability of accounting frauds and misgovernance as well as the alluring value traps.

|

|

P.S.1 Here is a little more about my background:

KB Kee has been rooted in the principles of value investing for over a decade as an analyst in Asian capital markets. He was head of research and fund manager at Aegis Portfolio Managers, a Singapore-based value investment firm. As a member of Aegis’ investment committee, he helped the firm’s Asia-focused equity funds significantly outperform the benchmark index. He was previously the portfolio manager for Asia-Pacific equities at Mirae Asset Global Investments, Korea’s largest mutual fund company. He holds a Masters in Finance and degrees in Accountancy and Business Management, summa cum laude, from Singapore Management University (SMU). KB had taught accounting at his alma mater in Singapore Management University and had also published an empirical research paper Why ‘Democracy’ and ‘Drifter’ Firms Can Have Abnormal Returns: The Joint Importance of Corporate Governance and Abnormal Accruals in Separating Winners from Losers in the Special Issue of Istanbul Stock Exchange 25th Year Anniversary Best Paper Competition, Boğaziçi Journal, Review of Social, Economic and Administrative Studies, Vol. 25(1): 3-55. KB has trained CEOs, entrepreneurs, CFOs, management executives in business strategy, macroeconomic and industry trends in Singapore, HK and China.

P.S.2 Why do I care so much about doing The Moat Report Asia for you?

My personal motivation in embarking on this lifelong journey has been driven by disappointment from observing up close and personal the hard-earned assets of many investors, including friends and their families, burnt badly by the popular mantra: “Ride the Asian Growth Story!” I witnessed firsthand the emotional upheavals that they go through when they invest their hard-earned money – and their family’s – in these “Ride The Asian Growth Story” stocks either by themselves or through money managers, and these stocks turned out to be the subject of some exciting “theme” but which are inherently sick and prey to economic vicissitudes. They may seem to grow faster initially but the sustainable harvest of their returns is far too uncertain to be the focus of a wise program in investment. Worse still, the companies turned out to be involved in accounting frauds. Their financial numbers were “propped up” artificially to lure in funds from investors and the studiously-assessed asset value has already been “tunnelled out” or expropriated. And western-based fraud detection tools and techniques have not been adapted to the Asian context to avoid these traps.

After a decade-plus journey in the Asian capital jungles, it has been somewhat disheartening as I observe many fraud perpetrators go away scot-free and live a life of super luxury on minority investors’ hard-earned money. And these perpetrators make tempting offers to various parties in the financial community to go along with their schemes. When investors have knowledge in their hands, we have a choice to stay away from these people and away from temptations and do the things that we think are right. With knowledge, we have a choice to invest in the hardworking Asian entrepreneurs and capital allocators who are serious in building a wide-moat business.

|