Abenomics Must Deliver More in 2014

January 3, 2014 Leave a comment

Abenomics Must Deliver More in 2014

AARON BACK

Dec. 29, 2013 11:53 p.m. ET

One of the remarkable events of the past year has been the economic turnaround in Japan, driven by central bank stimulus and government spending. That has produced stunning results in the stock market: Japan’s Nikkei 225 has outperformed every other developed market and is among the top gainers in the world for 2013. The Nikkei’s 56% gain year to date has even put to shame the blistering 38% gain for the Nasdaq NDAQ -0.08% Composite, or the 29% rise of the S&P 500.But 2014 will determine if Prime Minister Shinzo Abe has what it takes to truly revitalize Japan—and so ensure the Japanese market’s party doesn’t quickly wind down.

So far, Mr. Abe’s structural reforms—needed to bend Japan’s growth potential upward—have been a disappointment. They’ve focused on small-bore measures such as allowing more high-rise buildings in special economic zones. Policies like these aren’t up to the task of boosting the long-term growth rate, which in turn is essential to tackling Japan’s massive public debt.

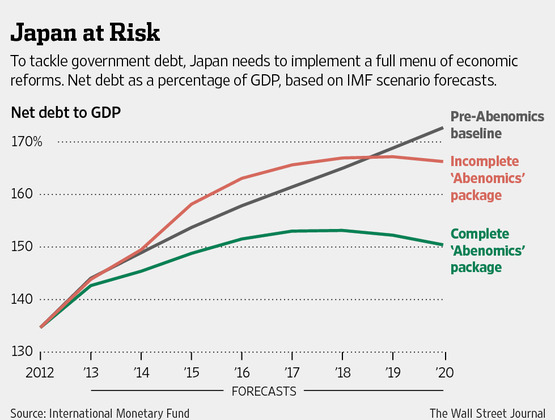

The net debt-to-GDP ratio, which takes account of the government’s substantial assets, stands at 144%, according to the International Monetary Fund. That’s the highest in the developed world after Greece. Japan has so far managed to avoid a crisis thanks to a huge pool of domestic savings. But as its aging savers retire and spend their savings, this pool is set to slowly start draining.

Getting the economy to grow at least 3% through some combination of real growth and inflation is needed to stabilize the ratio of debt to GDP over the next decade, according to the government. Over the past decade, real growth has been around 0.9% per year, while nominal growth has been negative due to deflation.

It won’t be easy. Estimates for Japan’s potential real growth rate range from 0.5% to 0.8%. Thus, even if the Bank of Japan 8301.TO +3.62% achieves its ambitious target of 2% inflation, nominal GDP growth would still fall short. On the other hand, targeting price rises of more than 2% risks letting inflation spin out of control.

To boost the underlying growth potential, Japan could do a couple of things. One option is to increase the supply of workers. This will be tough while the working-age population is shrinking by about 1% per year. Immigration is a political nonstarter. Getting more women to work is a noble goal, but has been tried before.

The other strategy is to boost output per worker, such as by introducing more competition to protected domestic industries. The Trans-Pacific Partnership, an ambitious free-trade agreement with the U.S. and other nations, could help. But talks recently hit a snag, due in part to Japanese resistance to eliminating tariffs on rice and other agricultural imports.

On the domestic side, a new set of reforms is due to in June. The last round was a flop, prompting a sharp selloff in Japanese equities. The day it was unveiled in June of this year, the Nikkei immediately fell 3.8%. This time investors will be looking for bolder moves, such as loosening restrictions on dismissing idle workers.

The yen will likely continue to decline against the dollar, with the Bank of Japan likely to expand its monetary easing as the U.S. Federal Reserve pulls back. In theory this should boost growth by helping Japan Inc.’s export machine, but so far the country’s trade balance has been negative because of the need to import fuel to while nuclear reactors sit idle.

The IMF projects that if Japan undertakes ambitious reforms, it could boost the potential growth rate by one to two percentage points. Do nothing else, and Abenomics would see debt continue to rise at a pace not much slower than the status quo before the Bank of Japan’s big bang stimulus.

It is still too early to write off Mr. Abe’s reform agenda. But if he fails to deliver in 2014, investors would be justified in once again losing interest in Japan.