Flipping the Coin on the Value of Stocks ‘Experts’

January 4, 2014 Leave a comment

Flipping the Coin on the Value of Stocks ‘Experts’

SPENCER JAKAB

Updated Jan. 2, 2014 3:04 p.m. ET

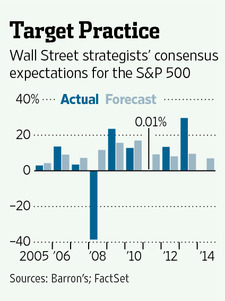

Look out above! Financial markets are full of surprises. But before 2014 even started, an annual ritual followed a set script: Wall Street strategists predicted further gains for stocks. Perhaps the only head-scratcher is that their targets imply a mere 7% rise in 2014 following what was the best year for the S&P 500-stock index since 1997.

Still, most of those targets are now about two weeks old; back then they implied an increase of a little over 10%. That has been the magic number on average for strategists polled by sister publication Barron’s over the past decade, a gain of about 10%. A rank amateur could do worse than making the same guess because the average gain for the S&P over its history has been the same.

Even so, the odds of having egg on one’s face would be good. The average strategist error over that period was 11.8 percentage points. They were off by 50 percentage points in 2008.

That strategists’ average error is larger than their average predicted gain should give investors pause. Larger, more detailed samples arrive at similar conclusions. An eight-year study of 68 stock-market experts by CXO Advisory, for example, tracked 6,582 predictions over several years. It found their collective accuracy was 47.4%, a bit worse than a coin flip.

Why? Statistical noise is one explanation, but another can be found in a classic economic paper from 1980 by J. Scott Armstrong, “The Seer-Sucker Theory: The Value of Experts in Forecasting.” He found a small degree of expertise in any subject is useful but that accuracy actually declines slightly with great reputation. A perusal of some household names batting below .500 on CXO’s list seems to confirm this.

Does that say anything about 2014’s prediction? Based on the Barron’s results, the largest misses have come in years such as 2000 and 2008 as strategists extrapolated several years of gains or, as in 2009, became temporarily cautious around a bear market. So after five straight years of gains, forecasts of further advances in 2014 should be viewed cautiously.

For investors drawn to pundits like moths to a flame, though, Mr. Armstrong’s paper has one piece of advice: “Don’t hire the best expert, hire the cheapest expert.”