Asia’s Domestic Demand Means Less Focus on Exports

January 8, 2014 Leave a comment

Jan 6, 2014

Asia’s Domestic Demand Means Less Focus on Exports

By Michael S. Arnold

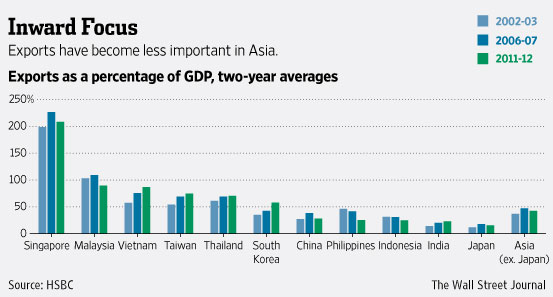

Why has Asia continued to record strong economic growth in recent years, despite the West’s struggles? Partly it’s because more Asian trade is remaining within Asia. But it’s also because for many Asian economies, exports simply are less important than they used to be.The chart shows that for Asia excluding Japan, exports as a percentage of gross domestic product declined to 42.6% in 2011-2012 from 47.1% five years earlier.

Of course, the picture is not uniform. In a few countries exports have continued to grow as a share of GDP: Vietnam and India stand out as success stories, with their export sectors blooming as competitiveness has improved. Elsewhere, as in South Korea and Taiwan, it’s more a reflection of weak domestic demand – export share there is ”going up for the wrong reasons, if you will,” says Frederic Neumann, co-head of Asian economics for HSBC.

Generally, though, the trend in Asia is toward economies that rely more on domestic demand and less on the West. In China, this is part of a deliberate policy choice to emphasize consumption as a growth driver. In Malaysia, Indonesia and the Philippines, the falling export share reflects the emergence of a strong and vibrant consumer class.

China, of course, is the elephant in the room: Its exports accounted for just over half of all exports from the region in 2012. It’s no surprise, then, that as China goes, so goes Asia as a whole.