Banking on a Wing and a Prayer; In getting a bigger piece of China, OCBC Bank’s possible $5 billion bid for Wing Hang Bank might also come with something investors won’t like: falling Hong Kong property prices

January 8, 2014 Leave a comment

Banking on a Wing and a Prayer

Buying Wing Hang Bank Would Give OCBC Things Investors Shouldn’t Want

AARON BACK

Jan. 6, 2014 7:57 a.m. ET

In getting a bigger piece of China, OCBC Bank‘s O39.SG -1.01% possible $5 billion bid forWing Hang Bank 0302.HK +1.30% might also come with something investors won’t like: falling Hong Kong property prices.Mid-sized Hong Kong lender Wing Hang has been on the block since September when senior managers said they had a number of interested suitors. On Monday, Singapore-based OCBC said it is now in exclusive talks with Wing Hang. The price, which The Wall Street Journal said is still being negotiated, would represent a nearly 50% premium to where Wing Hang traded before merger talks became public last year.

In November, OCBC Chief Executive Samuel Tsien told analysts potential acquisitions would fit certain “mega trends,” including growing trade between China and Southeast Asia, and the rise of offshore yuan trading. Wing Hang’s 16 mainland branches and sizable cross-border corporate lending business seems to fit the bill. It doubles the size of its mainland branch network and would increase OCBC’s China exposure to around 25% of its loan book from 15% currently, according to estimates by UBS.

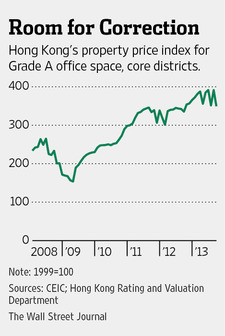

But with Wing Hang’s China business comes Wing Hang’s Hong Kong real estate, including its offices and investment properties. While some Hong Kong banks value such properties at cost on their books, Wing Hang does so at current market value. This means its balance sheet has benefited from the frothy market, but is vulnerable to a downturn. Barclays expects commercial property prices to fall by 20% over the next two years, and estimates that a 10% fall in 2014 could dent Wing Hang’s profits by 3.7% and its book value by 2.7%.

The risk of a substantial correction is real. Hong Kong’s interest rates are tied to the U.S. via a currency peg and the recent rise in rates has taken the punch out of prices. Moretaper equals more pain in Hong Kong. Meantime, China’s economy, a major source for Hong Kong property demand, is slowing again.

Any problems in Wing Hang’s property loan book should be manageable, due to the stringent loan-to-value regulations imposed on mortgages by Hong Kong regulators and its low loan-to-deposit ratio. But a faltering property market is likely to crimp profits as loan origination dries up.

OCBC’s offer pegs Wing Hang at around 1.9 times end-June book value. That is in line with current valuations of other Hong Kong banks, according to Barclays. But it assumes too much about the health of Hong Kong’s property market. OCBC investors would be better skipping this China play.