Chinese Investors Refocus on Domestic Assets; Raising Cash Is an Uphill Task for Chinese Funds That Invest Overseas

January 8, 2014 Leave a comment

Chinese Investors Refocus on Domestic Assets

Raising Cash Is an Uphill Task for Chinese Funds That Invest Overseas

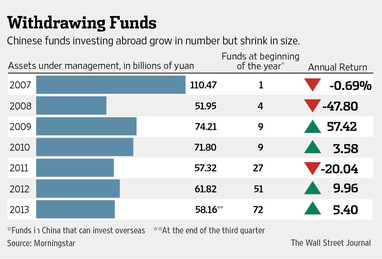

Chinese investors are shying away from overseas markets in favor of domestic assets, even though many funds invested abroad delivered double-digit returns last year.Eager to invest abroad, Chinese investors had flocked to funds that focused on global assets ranging from commodities to stocks shortly after China launched its Qualified Domestic Institutional Investor program in 2006 as part of a gradual effort to open its capital accounts. But these funds have been shrinking in size, and the total assets under management have tumbled by almost 50% from the peak in 2007, according to research firm Morningstar.

As of the end of the third quarter, fund managers based in China, including units of foreign firms, managed 58.2 billion yuan ($9.6 billion), data from Morningstar showed, down from 110.5 billion yuan in 2007 and a fraction of the $84.2 billion the government allows for yuan investments abroad.

Chinese investors have yet to regain confidence in QDII funds after they posted sharp losses during the global financial crisis, and are cashing out as soon as they see profits. The funds posted losses of 47.8% on average in 2008.

With the yuan rising 8.6% in the last three years, many investors would rather invest in domestic assets they feel comfortable with, such as stocks, real estate, and wealth-management products, according to fund managers.

“It’s been hard to raise money,” said Jason Weng, head of QDII funds at Hua An Fund Management Co., one of China’s largest mutual fund managers by assets under management. China is home to 96 QDII funds, and Hua An has four such funds with a total of about one billion yuan invested overseas.

“The financial crisis scared everybody” and now the Chinese “don’t want to park their money in QDII funds.”

The wariness toward going the QDII route comes even though these funds have provided stronger returns than bank deposits. Last year, QDII funds made gains of 5.4% on average, according to Morningstar, while one-year time deposits yielded about 3% and the domestic stock market fell 6.8%.

“Even [QDII funds] with good performance don’t get a lot of attention,” said Anthony Skriba, an analyst with consultancy Z-Ben Advisors.

Hua An’s Hong Kong Selection Equity Fund has returned an annualized 11% in the last three years. But it manages 153 million yuan, a fraction of the 740 million yuan it began with in 2010. Similarly, the Bank of Communications Schroder Global Selected Value Fund, another QDII fund, returned 20% last year, but manages just 166 million yuan, down from 500 million yuan before the financial crisis.

QDII funds are raised in yuan and converted into foreign currency, but the returns are converted back to yuan before they are returned to investors. Since investors aren’t keeping their investments in foreign currency, they don’t necessarily think of QDII funds as overseas investments, fund managers say.

China’s largest banks, charged with selling the country’s fund products, also don’t properly promote funds that have good track records. “There’s no incentive for sales employees” to push QDII funds to their customers, said Yan Qing, co-fund manager of the Bank of Communications Schroder Global Value Fund. In China’s tight credit environment, banks can make more money by getting customers to deposit money into savings accounts, he said.

Also, the average Chinese retail investor isn’t interested in investing abroad, while more affluent Chinese investors can go through other channels, said Felix Ng, a Singapore-based senior analyst with research firm Cerulli Associates.

For example, sophisticated Chinese investors can rely on foreign banks to help them invest in overseas products managed by foreign fund managers, whom they perceive as more experienced than domestic fund managers.

To be sure, there are signs that investor demand may be stabilizing after some QDII funds performed especially well last year. A QDII fund by GF Fund Management Co., the best performing in 2013, delivered 43.4% by investing in Asian stocks. Fullgoal’s China Mid-Small Cap Stock Fund, the second-best performer, delivered almost 40% by investing in Hong Kong stocks.

Fullgoal’s Hong Kong fund started seeing inflows from investors in September, which helped it grow to roughly 120 million yuan from 50 million yuan in the first half of 2013, said portfolio manager Zhang Feng. “If returns are consistently good, investors will come back,” he said. The fund had 300 million yuan when it was launched in 2012.

Large fund houses will continue to offer QDII funds despite lackluster demand from investors, because they are essential to offering customers a comprehensive range of investment choices, said Hua An’s Mr. Weng.