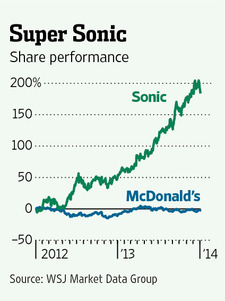

Shares of Drive-In Chain May Be Overcooked; Sonic Has Appreciated 200% in Past Two Calendar Years

January 8, 2014 Leave a comment

Shares of Drive-In Chain May Be Overcooked

Sonic Has Appreciated 200% in Past Two Calendar Years

SPENCER JAKAB

Jan. 5, 2014 2:35 p.m. ET

The cardinal rule with fast food is to get it while it’s hot. Shares of Sonic SONC -0.60%Corp, the world’s largest drive-in chain, seem like they have been under the heat lamp for a while, though.Investors probably won’t be left with a bad taste in their mouths when the company on Monday reports fiscal first-quarter results for the period through November. It has met or exceeded analyst estimates seven times in a row. Expectations of 13 cents in earnings per share, according to FactSet, up from 11 cents a year earlier, look achievable.

The question is how much more to pay for a stock that has appreciated by 200% over the past two calendar years. There is some meat there, to be sure, but a fair bit of filler and breading, too. For example, same-restaurant sales have been growing and the chain has been expanding geographically. Like last year, management expects “low-single-digit” expansion in same-restaurant revenue in fiscal 2014.

But total sales didn’t grow. Those at company-owned stores have dropped slightly each of the past two fiscal years, while franchises just about compensated for it.

Earnings growth has come mostly from clever deployment of capital. This includes a debt exchange, swapping low-performing locations for better ones and a margin-boosting investment in a new point-of-sale system.

Most of all, it has been about buybacks. Last fiscal year, Sonic repurchased 6% of its shares. This year it plans to spend more on buybacks but, at the current price, will be able to afford less than 4% of them, blunting the boost to earnings per share.

Much of the stock’s appreciation seems to have come from a re-rating of the entire sector, with the exception of McDonald’s Corp, over the past couple of years. That leaves Sonic at a lofty 23 times forward earnings, although in line with the average of six fast-food peers.

Some of those companies look expensive, too. Yet most of them have an emerging-markets story to tell. Sonic isn’t a concept likely to work in Moscow, Beijing, São Paulo or Mumbai. Cold weather, smog, crime and a dearth of cars, respectively, aren’t conducive to a drive-in dining experience.

After two great years, investors should consider lighter fare.