Slump in Trading Threatens a Wall Street Profit Engine; Industry Could Post 11th Trading Decline in 16 Quarters

January 8, 2014 Leave a comment

Slump in Trading Threatens a Wall Street Profit Engine

Industry Could Post 11th Trading Decline in 16 Quarters

SAABIRA CHAUDHURI and JULIE STEINBERG

Jan. 6, 2014 7:52 p.m. ET

The trading boom that helped reshape global investment banks over the past decade is sputtering, raising fears that one of Wall Street’s biggest profit engines is in peril.Executives have warned that lackluster markets could lead to year-over-year declines in fixed-income, commodities and currency trading revenue when banks begin reporting fourth-quarter results next week. That would mark the fourth consecutive drop and the 11th in the past 16 quarters.

Few corners of banks’ trading operations have escaped the slump. A 10-year commodities rally has fizzled, while foreign-exchange trading volume has fallen sharply from its 2008 peak. Since the financial crisis, investors have eschewed exotic fixed-income securities in favor of low-risk government bonds, which are less profitable for banks, and overall trading volumes have dipped.

A rash of new regulations, meanwhile, have prompted Wall Street firms to exit from once-lucrative businesses such as energy trading and storing and transporting physical commodities.

The slump has gone on so long that some observers are beginning to question whether it is part of an ordinary down cycle or a more permanent shift.

“I think it is worrying,” said Oppenheimer analyst Chris Kotowski, who expected trading revenue to have hit bottom and stabilized by now. “You can’t turn around a fundamental trend…if that’s what this is.”

Mr. Kotowski cited the big transformations that have rocked global markets in the past few years, such as new technologies. Those advances have helped level the playing field by allowing institutions to make some trades on their own, reducing the amount banks bring in for matching up orders.

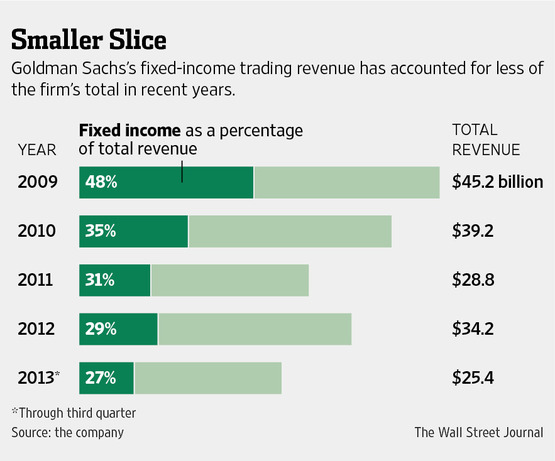

For Goldman Sachs Group Inc., fixed-income, currency and commodities trading historically has been a crucial profit engine. Yet the New York investment bank is expected to post a 21% decline in trading revenue from fixed-income, currencies and commodities, or FICC, in the fourth quarter from the same quarter a year earlier, according to estimates from Citigroup Inc. C +0.77% analyst Keith Horowitz. Goldman is on pace for its worst year for FICC trading since the financial crisis.

While rival Morgan Stanley is expected to post an 8% increase in fixed-income, currency and commodities revenue in the fourth quarter, according to Mr. Horowitz, its business has shrunk considerably since the crisis and is smaller than rival Goldman’s. Big commercial banks like J.P. Morgan Chase JPM +0.58% & Co. and Citigroup also have trading operations, but they represent smaller chunks of their overall revenue. Citigroup Chief Financial Officer John Gerspach in late December warned that the bank’s trading results would be down slightly year-over-year, while J.P. Morgan senior executive Michael Cavanagh in November said client trading volumes were “down slightly.”

Overall, revenue from fixed-income, currency and commodities trading is expected to drop an average of about 11% at Goldman, J.P. Morgan and Bank of America Corp.BAC +1.52% , according to estimates from Mr. Horowitz.

The declines have prompted waves of job cuts and departures. In the first half of 2013, there were 19,554 FICC traders at the 10 largest global investment banks, down from 25,257 in the first half of 2008, according to London research firm Coalition, whose parent is majority-owned by McGraw Hill Financial Inc.

Deutsche Bank AG DB +0.71% last month said it would sell or shut down almost all of its global commodities businesses, sparking about 200 layoffs. UBS AG UBS +1.00% in the past year has laid off some traders as part of what the firm calls a shift toward more focus on managing customers’ wealth.

Some of the traders who remain in the industry are bracing for decreases in year-end compensation. Compensation for J.P. Morgan’s fixed-income, currency and commodities traders is projected to drop 5% from last year’s levels, said people familiar with the bank’s plans. At Citigroup, bonuses for salespeople and traders will range from flat to down 2% from last year’s levels, said people familiar with the bank’s plans.

“Fixed income is going to remain quite a tough business” in 2014, said Richard Staite, an analyst with Atlantic Equities.

The trading boom began in the early 1980s, as bonds, after a decade of weakness, embarked on a rally that has spanned more than 30 years. The emergence of derivatives—instruments tied to the value of bonds, currencies, commodities, stocks and other securities—helped fuel more trading activity. In the early 2000s, low interest rates and strong demand for mortgage securities kicked the boom into higher gear, and Wall Street refocused operations to profit from that.

While the financial crisis temporarily slammed the brakes on trading in 2008, it roared back the next year, helping salvage bank profits at a time when lending and other banking activities were moribund. Since 2009, however, trading has been slowly fading, prompting bankers to worry whether the glory years will ever come back.

To be sure, the slump could reverse. Revenue declines aren’t expected to be as severe in the fourth quarter as they were in the third, when Goldman reported a 44% drop in FICC revenue from a year earlier and Morgan Stanley posted a 43% drop, excluding accounting adjustments tied to Morgan’s debt prices. Citigroup and J.P. Morgan reported declines of 26% and 8%, respectively. Mr. Horowitz expects J.P. Morgan to post an 8% decline and Bank of America a 3% dip.

Brad Hintz, an analyst with Sanford C. Bernstein & Co., said improvement could be around the corner, as the U.S. Federal Reserve begins to wind down its bond-buying program. That could nudge investors into more profitable bonds and other securities, bolstering banks’ trading revenue.

But a robust recovery still seems far away. London-based brokerage ICAP PLC on Jan. 3 reported that foreign-exchange volumes on its trading platform were the lowest on record in December, down 23% from the same month in 2012. Average daily trading volume in the U.S. bond markets, meanwhile, fell 3.6% in 2013 through Dec. 6 from the same period a year earlier, according to the latest available figures from the Securities Industry and Financial Markets Association.

In commodities, bank trading revenue clocked in at $6 billion in 2012, the last full year for which data are available, according to Coalition. That was down more than 50% from its 2008 peak.

Some areas of banking showed strength in the fourth quarter. Riding a bull market for stocks, equities trading is expected to be a rare bright spot in the fourth quarter. Stock underwriting also performed well.

Goldman is expected to deliver a per-share profit of $4.14 for the fourth quarter, down 26% from the same period a year earlier, according to analysts polled by Thomson Reuters. Citigroup is projected to register a 51% jump in per-share earnings as the bank rebounds from a year-ago quarter weighed down by heavy charges. J.P. Morgan is expected to post a 5% decline.

Analysts expect Morgan Stanley to report 4% profit growth for the quarter, driven in part by its strong underwriting and wealth-management division. It also is expected to show revenue growth for the quarter, the only bank among the top six in the U.S. that is anticipated to do so.

“All in all, we would say it looks slightly weaker and more stagnant than we would have thought a couple of months ago. But, on the other hand, it’s stable, and stability counts for a lot in a group that has shattered investor confidence with negative surprises,” said Mr. Kotowski of Oppenheimer.