Swiss National Bank Warns of $10 Billion Loss on Huge Drop in Value of Gold Holdings; if the SNB can take a loss like this on gold, who knows how less experienced punters have fared

January 8, 2014 Leave a comment

Swiss Bank Warns of $10 Billion Loss

Huge Drop in Gold Prices Would Weigh on Earnings

JOHN REVILL And LAURA CLARKE

Updated Jan. 6, 2014 9:15 a.m. ET

ZURICH—The Swiss National Bank SNBN.EB -0.19% Monday said a huge drop in the value of its gold holdings would push it to a $10 billion loss, suggesting more investors would feel the brunt of the biggest fall in the price of the precious metal in three decades.The value of the SNB’s gold holdings slid 15 billion Swiss francs ($16.6 billion) in 2013, the Zurich-based central bank said, as the price of the precious metal skidded 28%, its largest drop since 1981. The loss swamped a roughly 3 billion Swiss francs gain on foreign currency positions and a 3 billion Swiss francs profit earned from the sale of a fund that had held troubled assets of UBS AG UBSN.VX +1.00% .

The SNB, one of the world’s biggest holders of gold, said the paper loss would force it to cancel dividends to shareholders for the first time since it was founded in 1907. The central bank also said it wouldn’t be able to make additional payments to Switzerland’s 26 cantons, which are similar to U.S. states, and the federal government for the first time since 1991.

Gold, often used as a haven investment, began falling in the spring amid speculation the U.S. Federal Reserve would scale back its bond-buying program as the economy recovered without generating concern over inflation. The Fed’s bond purchases had supported demand for gold as a hedge against inflationary risks associated with this type of economic stimulus.

Analysts said the slide in gold prices, which rallied sharply during the financial crisis, would likely continue amid signs that growth was picking up in the key U.S. economy and concerns about financial crises, particularly in still-stagnant Europe, had receded.

“The natural drivers behind the rally in the gold price between 2008 and 2012 are not in place anymore,” said Alessandro Bee, economist at Bank J. Safra Sarasin.

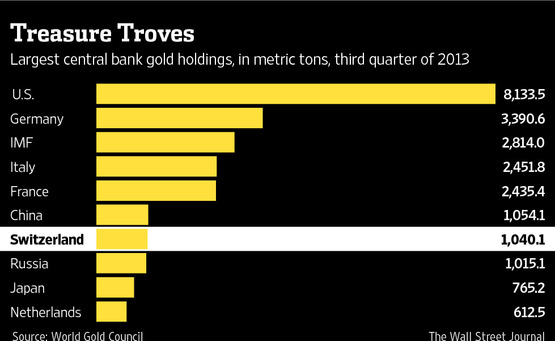

The SNB’s loss on its gold holdings, which amounted to 1,040.1 metric tons at the end of 2012 and are kept in bars and coins, will likely a stoke a political controversy in Switzerland, where the right-wing Swiss People’s Party, is pushing for a national vote on requiring the central bank to keep to at least 20% of its assets in gold. The central bank has said its flexibility would be limited by such a requirement, which could force it to buy more gold or reduce its holdings of other assets, such as currencies.

The SNB’s loss may be a prelude to other investor losses on their gold holdings, analysts said.

“Anyone who bought gold after 2010 is currently in the loss zone,” said Andreas Megg, head of equity and commodity strategy at Bank Vontobel VONN.EB 0.00% in Zurich.

Already, some investors have reduced their exposure to the precious metal.

Amid the price volatility, Paulson & Co., the hedge fund led by billionaire investor John Paulson trimmed its holdings in the SPDR Gold Trust GLD +0.29% —the world’s largest gold exchange traded fund. A regulatory filing showed Paulson scaled back its stake to 10.2 million shares by the end of the second quarter, from 21.8 million shares held at the end of the first quarter.

In September, Russia’s central bank sold gold for the first time in a year. Since 2010, Russia has accounted for 30% of all gold purchases made by central banks that report to the IMF.

Gold began its descent in April, when the spot price dived by $200 an ounce over two days amid mounting concern the Fed would scale back its program of monthly bond purchases, known as quantitative easing. The concerns led to a massive liquidation of holdings in gold-backed financial products.

Estimates place the total amount of gold ETF holdings liquidated over the course of 2013 at 900 metric tons. Of that, some 500 metric tons were outflows from the SPDR gold ETF, leaving total global holdings in gold-backed exchange-traded funds at around 1,800 metric tons today.

The precious metal took a further hit in May when a regulatory filing revealed billionaire investor George Soros, who once dubbed the metal “the ultimate asset bubble,” lowered his investment in the SPDR Gold Trust by 69,100 shares to 530,900 in the first quarter, valuing his stake at $82 million. In June, prices fell below the $1,300 per ounce mark for the first time since 2010 after Fed Chairman Ben Bernanke said the central bank could reduce its monthly bond purchases by the end of the year if the U.S. economy improved.

The drop followed a sharp run up in gold prices since 2009 that was driven by investor expectations that the unconventional measures, such as quantitative easing, used by the Fed and other central banks would fuel inflation. Gold has traditionally held its value better than stocks or bonds during times of rapid inflation. But inflation in the U.S. has remained tame, and investors have been more concerned with grabbing higher-yielding investments than having exposure to less risky assets.

The SNB, which is majority owned by Switzerland’s cantons, said it would provide a detailed report on its 2013 annual results on March 7, 2014.

For 2012, the SNB reported a net profit of 6 billion Swiss francs, from which it allocated 1.5 billion Swiss francs in dividends and 1 billion Swiss francs to the Swiss Confederation and the cantons.

Jan 6, 2014

Swiss National Bank Takes Hefty Gold Hit

The Swiss National Bank—effectively one of Europe’s premier investment houses as well as a Very Serious Central Bank–offered a reminder Monday that it’s not only wild-eyed gold bugs that have been stung by the rout in the shiny stuff.

The central bank said in a press release that it will report a loss “in the order of 9 billion Swiss francs” (that’s around $10 billion) for 2013, including a thumping loss of 15 billion francs on its gold holdings. That’s a wallop that more than negates the 3 billion francs it made out of foreign-currency positions. More details, including definitive figures, are due March 7.

As a result: “The SNB cannot make a profit distribution, as stipulated in the National Bank Act and the profit distribution agreement between the Federal Department of Finance and the SNB. This affects both dividend payments to shareholders and the profit distribution to the Confederation and the cantons.”

The losses on gold are not exactly a surprise. The central bank churns out statistics on its balance sheet on a regular basis and the breakdown on gold has not made pretty reading as the gold price has slumped (it fell by 28% last year).

The SNB holds 1,040 tons of gold, according to the World Gold Council, making up slightly less than 10% of its assets. This is substantially less than held by the U.S., Germany and Italy.

It is important to remember here that while the SNB has pretty large reserves, and those losses are on the chunky side, it is not in it just for profit. Far from it; the FX and gold reserves are there to give the central bank wiggle room in monetary policy and to act as a rainy-day fund for potential crises, and the total racked up quickly after it slapped a cap on the Swiss franc in 2011—a policy that has led it to buy euros in large amounts.

Still, if the SNB can take a loss like this on gold, who knows how less experienced punters have fared.