Betting on Bricks and Mortar of Chinese E-Commerce

January 12, 2014 Leave a comment

Betting on Bricks and Mortar of Chinese E-Commerce

ABHEEK BHATTACHARYA

Jan. 7, 2014 11:12 p.m. ET

Global Logistic Properties MC0.SG +1.05% finds itself in a landlord’s sweet spot. The largest provider of warehouses in China by area, the Singapore-listed firm is a play on the country’s fast-growing e-commerce sector. Online retailers such as Amazon’s China operations occupied just 4% of space in 2010, and that’s since risen to 22%. There’s still room to expand.

GLP operates a network across 33 cities in China, while most of its rivals are local players. Few offer modern facilities. And supply should stay uncompetitive. Local governments prefer to sell land for higher-priced homes or office space, instead of logistics.

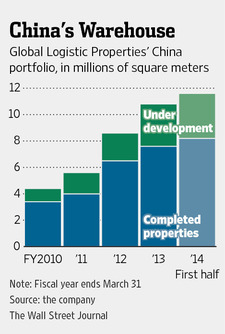

GLP also operates businesses in Japan and Brazil, but its largest market is China, where McKinsey expects online sales to triple by the end of the decade. The company’s aggressive development pipeline in China seeks to meet that demand, adding 40% to the size of its existing portfolio. Of course, this also represents a liability should China’s economy stumble and that space remain unleased. The company says it has a backlog of tenants looking to occupy much of this space.

How GLP deals with broader financial stresses is relevant given its history. Many of its properties and executives come from U.S. warehouse giant Prologis, whose debt forced it to offload Asian assets in 2008. The good news is that GLP’s net debt stood at 16% of equity as of Sept. 30, and hasn’t strayed above 40% in the last two years. Prologis’s net debt peaked at 197% of its equity in September 2005.

GLP’s fund-management business helps here, too. The company brings outside investors into separate funds to develop GLP warehouses. This limits the parent company’s debt load and development risk, while creating a stream of management fees and keeping the properties in its sales network. The funds it manages tripled to $11.4 billion in October from a year before, as it spun off some of its Japan properties and started a China fund.

Much of this optimism is baked into GLP’s stock, which is 8.6% below an all-time high hit in November. It now trades at a 10.1% discount to its net asset value for the fiscal year ending March, based on CLSA estimates. But given the development potential, this isn’t too expensive compared to Prologis’ 12.6% discount to its NAV.

GLP has the benefit of operating in a sector brimming with demand. So long as China’s economy doesn’t turn over, its warehouses should stay filled as well.