Biomedical research budgets: The party’s over; But if you want to go to the after-party, it’s in Asia

January 12, 2014 Leave a comment

Biomedical research budgets: The party’s over; But if you want to go to the after-party, it’s in Asia

Jan 11th 2014 | NEW YORK | From the print edition

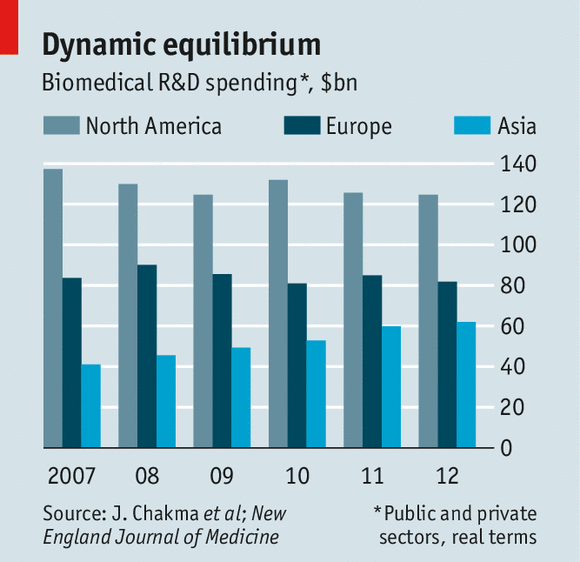

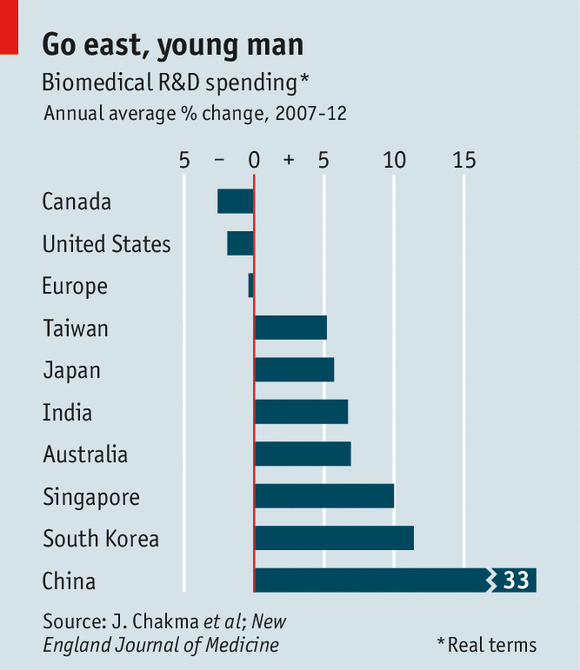

LIKE many other things, biomedical research is moving east. A paper published in the New England Journal of Medicine by a team led by Justin Chakma of Thomas, McNerney & Partners, an American venture-capital firm, shows a marked shift in spending from Europe and North America to Asia. In China, where the most recent five-year plan has made such research a priority, the amount disbursed increased, in real terms, by an average of 33% a year between 2007 and 2012. In Japan it was up by an average of 6% each year. In the United States it fell by 2% a year. As a consequence, America’s share of the total shrank from 51% in 2007 to 45% in 2012.Overall, Mr Chakma found, researchers on the three continents looked at (which, since “Asia” included Australia, are the locations of pretty much all the biomedical research that is done) chewed through $268.4 billion in 2012. Adjusted for inflation, that was only 2.4% higher than in 2007. By contrast, between 1999 and 2006 the figure grew by an average of 10% a year.

Part of this deceleration is a consequence of American drug companies reining in their research arms. Their spending fell by 15% in real terms over the six years Mr Chakma focused on, from $83.3 billion to $70.4 billion. But taxpayers, too, are forking out less. Last year, the budget of America’s National Institutes of Health, the world’s largest sponsor of biomedical research, was $29 billion, $1.7 billion below that of 2012—and 22% less, in real terms, than it was a decade ago.

What effect these shifts will have on biomedicine’s bottom line—more and better drugs—remains to be seen. Japan has a mature pharmaceutical industry, so should do well. At the moment, though, China’s research record is patchy, with too many trivial and pointless “me too” studies, and a disturbing amount of outright fraud. With luck, the application of large quantities of yuan and the return of researchers trained in the methods of Western laboratories will change that.

The slowing of the growth of total global spending is more worrying, though the amount of time drugs take to develop means its effect may not be seen for a while. American regulators approved 27 new drugs in 2013, and 39 in 2012, a number not seen since 1996. In ten years’ time the present day may seem like a golden age.