Korea’s major hotels and duty free shops are feeling the pinch from the weakening yen because their sales have been falling sharply due to a drop in the number of Japanese tourists coming here.

January 12, 2014 Leave a comment

2014-01-06 18:40

Weak yen hits hotels, duty free shops

Yi Whan-woo

Korea’s major hotels and duty free shops are feeling the pinch from the weakening yen because their sales have been falling sharply due to a drop in the number of Japanese tourists coming here.Duty free shops, including Lotte and Shinsegae, saw their sales fall by around 20 to 30 percent last year, while major hotels are suffering from a drop in Japanese guests.

This downward trend is expected to continue for a while because the Japanese currency is likely to lose further ground against the Korean won. The yen fell below 1,000 won per 100 yen during the trading session on Dec. 30, the lowest level since Sept. 9, 2008 when the rate hit a daily low of 996.8 won.

“We estimate our sales have dropped by around 20 to 30 percent last year,” said a Lotte Duty Free spokesman. The affiliate of Lotte Group is the country’s largest duty free retail chain and has stores in Seoul, Busan, Jeju Island and Inchon International Airport, where foreign tourists frequently stop by.

“And we believe that the weak yen is a major cause of the decrease in the number of Japanese visitors who have been crucial to our sales,” he added.

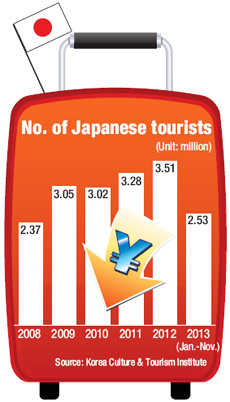

According to the Ministry of Culture, Sports and Tourism, the number of Japanese tourists fell from 3.51 million in 2012 to 2.53 million during the January-November period.

Shinsegae Duty Free, the No. 3 market player, echoed a similar view although it did not give specific numbers.

“There was no merit for Japanese tourists to travel and shop here last year because the cost rose significantly due to the weak yen,” a spokesman of the unit under Shinsegae Group said. “I think our sales-decrease rate among duty free retailers was very similar.”

In particular, Shinsegae said it is keeping an eye on its Busan branch, a former Paradise Duty Free it acquired in 2012. The port city of Busan is regarded as a strategic place for its sales, according to its spokesman.

Shilla Duty Free Shop, the second-largest player, said the business environment was also unfavorable for the conglomerate’s hotel chain, The Hotel Shilla.

In order to keep the business afloat, hotels and duty free shops are strengthening marketing efforts and diversifying revenue sources.

Lotte Duty Free said it will provide more incentives for Japanese travel agencies.

“The Japanese have been our valuable customers for years, and we’ll not give up on them, although it’s true Chinese tourists have emerged as target customers recently,” its spokesman said.

The number of Chinese visitors to Korea has jumped from 2.83 million in 2012 to 4.05 million in the January-November period, according to the Korea Culture & Tourism Institute.

The company said it promised to provide financial incentives to the travel agencies for offering Korea tour packages during its marketing program held in October 2013 in Tokyo and Osaka.

“It’s important to offer Japanese customers various ways to tour and shop in Korea, especially when the travel expenses rise,” the firm’s spokesman said.

He added the firm is also considering more frequently organizing meet-and-greet events between K-pop fans in Japan and Korean celebrities in Seoul.

Shinsegae Duty Free and Shilla Duty Free Shop said they will consider running a similar event.

The Hotel Shilla said that it will focus on drawing business travelers as a part of its sales strategy this year. The Lotte Hotel also said that it will diversify its consumer groups to include those from China and Southeast Asia.