Nestlé in Biotech Deal to Test Foods on Human Cells

January 12, 2014 Leave a comment

Nestlé in Biotech Deal to Test Foods on Human Cells

JONATHAN D. ROCKOFF and JOHN REVILL

Updated Jan. 7, 2014 7:36 p.m. ET

Nestlé SA, NESN.VX -0.15% the maker of Gerber baby food and Nescafé instant coffee, is deepening its research into the link between diet and disease with an unusual biotechnology partnership that it hopes will help it develop more profitable products.Under the deal, Nestlé will obtain brain and liver cells from Cellular Dynamics InternationalInc. ICEL +0.63% and study how nutrients found in foods affect these human cells, according to Emmanuel Baetge, director of the Nestlé Institute of Health Sciences, a research arm of the Swiss company. Nestlé aims to use the insights to develop nutritionally enhanced drinks, smoothies and other products that it can market as having medical benefits.

The companies are expected to announce their agreement this week. They wouldn’t disclose the financial terms.

CDI Chief Executive Robert Palay said 18 of the top 20 pharmaceutical companies buy its cells, but that Nestlé is the first food company to do so. CDI makes brain, liver and other cells from stem-cell-like cells, which are in turn made from mature human cells.

Nestlé scientists have begun studying the CDI cells to see how the fatty acids found in avocados and olive oil interact with neurons, with the hope of finding applications for aging consumers, Dr. Baetge said. Nestlé scientists are also studying the cells for possible applications in obesity, diabetes and Alzheimer’s.

Nestlé, which has spent a decade investing in nutritionally enhanced food, is attempting “to take advantage of the space between food and pharmaceuticals,” Dr. Baetge said in an interview. He said such products may “command greater margins of return” than traditional food products.

But they face skepticism from some nutritionists and doctors, who believe that tackling complicated diseases requires far more than tweaking food ingredients.

So far, adding nutrients “never worked very well except” against the few conditions linked to their absence, said Marion Nestle, a professor of nutrition, food studies and public health at New York University. Diseases “have multiple causes, and food is very complicated and diet is very complicated,” said Dr. Nestle, who has no relationship to the company.

Gayatri Devi, director of New York Memory Services in New York City, said a healthy diet can play an important role in preventing the onset of Alzheimer’s disease, but she said adding a nutritional or other product isn’t necessary because a patient simply should eat healthily and stay fit. “It makes no sense to have a poor diet, then add this on,” she said. Dr. Devi said she is skeptical about products promising to help with Alzheimer’s. “They may have very minimal effect, if any,” said Dr. Devi, who is also a clinical associate professor at New York University School of Medicine.

Government regulators such as the U.S. Federal Trade Commission, meanwhile, have been cracking down on the health claims for some nutritionally enhanced foods, asking for supporting evidence or barring the claims.

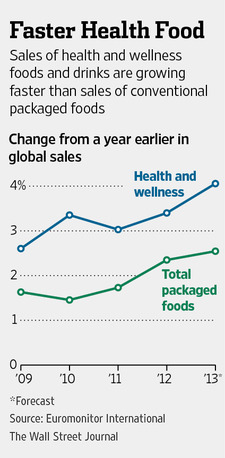

The world-wide market for health and wellness food and beverages is forecast to grow to $944 billion by 2018 from $772 billion in 2013, according to market-research company Euromonitor International. It estimates that sales of health and wellness items—which includes products with health benefits—will grow 22% during the time period, 50% faster than for conventional packaged foods.

Nestlé already has spent years trying to find sales growth in what it calls the intersection of food and pharmaceuticals, a space known in the business as “phood.” It developed a milk protein that it said could help fight cavities, and a chocolate component that aimed to limit the absorption of bad cholesterol. Some of its efforts have flopped: the company had grand plans for a yogurt containing probiotic bacteria, but the product, called LC1, lost out to a heavily marketed rival yogurt from Danone. BN.FR -1.24% SA.

Nestlé has been investing substantially in recent years to build up its position in medical foods, spending $2.5 billion in 2006 to buy Novartis AG NOVN.VX +0.62% ‘s medical nutrition business, and investing in several smaller companies making medical foods.

Nestlé’s sales of medical foods have grown from around 1.6 billion Swiss francs ($1.77 billion) in 2010, although the company declined to reveal by how much. Nevertheless, health foods remain a small part of Nestlé’s nutrition and health-care business, which reported sales of 10.7 billion Swiss francs for 2012.

Nestlé’s rivals have also been making big investments in nutritional or medically enhanced products. French food company Danone spent €12.3 billion ($16.7 billion) to buy Dutch baby-food and nutrition company Numico in 2007.

In 2013, Danone’s medical-nutrition division launched Souvenaid, a dairy-based drink containing a patented combination of nutrients that the company markets through doctors for people with the early stages of Alzheimer’s disease.

Analysts estimate such products could have margins exceeding 20%, five percentage points higher than the operating profit margin recorded by Nestlé.

Companies will have to prove the effectiveness of medical foods and nutritionals if consumers are going to view the products as worthy complements to medicines, said Diana Cowland, a Euromonitor analyst. “Many consumers believe a pill is going to solve a problem quicker than food or a drink,” she said.