Despite Slowdown, Employers in China Gave Bigger Raises

January 16, 2014 Leave a comment

Jan 14, 2014

Despite Slowdown, Employers in China Gave Bigger Raises

Employers in China gave bigger raises last year on average than those elsewhere in Asia, a fresh sign that the country’s job market remains resilient despite slowing economic growth.

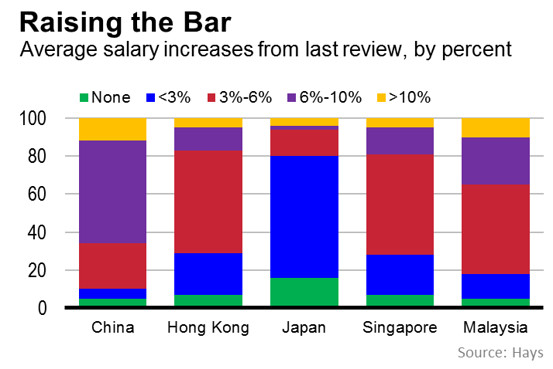

According to a survey by recruitment firm Hays, two-thirds of employers in China said they gave their workers raises during the last round of reviews of 6% or more—more than any other country surveyed. A majority, or 54%, of said they gave raises of between 6% and 10%, while 12% said they gave raises of more than 10%. Only 5% of employers in China said they gave no raises at all.

In contrast, in Asia as a whole, just 22% of employers said they gave raises between 6% and 10%, while only 7% said they doled out more than 10%. Across the region, paltry raises were common. In Hong Kong and Singapore, the survey notes, the majority of employers gave raises between 3% and 6%. And in Japan, despite the economic stimulus measures dubbed the Abenomics in 2013, 80% of employees received raises of 3% or less.

The survey featured 2,600 companies in China, Hong Kong, Japan, Singapore and Malaysia in professional sectors like sales, marketing, engineering, human resources and accountancy & finance.

Chinese workers can also take heart in the fact that employers in China said they also plan to continue their generosity. For the next review, 58% of employers in China said they intend to give their staff a raise between 6%-10%, compared with less than a quarter of employers across Asia, the survey showed.

Although the Chinese economy is slowing, it is still widely expected to expand by about 7.5% in 2014, according to researchers, which the survey notes is still “impressive by international standards.” That has lent support to the nation’s labor market, especially the services sector. Human-resources consultancy Manpower Group found in its own surveythat 14% of employers in China expect to increase staffing levels in the first quarter of 2014, with only 2% expecting to decrease levels, a level it calls respectable.

According to the survey, 63% of respondents across Asia said business activity had increased over the past 12 months and 71% expect it to increase this year.

“That’s strong evidence in support of a local economy that is both confident and providing job,” Christine Wright, Hays’ operations director for Asia, said in the survey. “But Asia’s continual demand for high-level skills remains a challenge.”

While the China’s factories are relocating to smaller cities to lower their operating costs, large cities such as Beijing and Shanghai are attracting more service companies, financial institutions and banks, creating demand for candidates with experience in specialized areas like financial planning and analysis, commercial analysis, control, audit and compliance, Hays said.