South Korea Private-Equity Firms Start to Target Midsize, Distressed Companies

January 16, 2014 Leave a comment

South Korea Private-Equity Firms Start to Target Midsize, Distressed Companies

KANGA KONG

Jan. 14, 2014 5:13 a.m. ET

South Korea’s private-equity industry is growing, with newer entrants focusing on areas that haven’t received much attention in the past, particularly acquisitions of midsize companies as well as distressed assets.Foreign investors tend to associate Korea with the mega-acquisitions that accompanied global private-equity firms’ entry into the country at a time when conglomerates were putting sizable assets on the block in the wake of the 1998 Asian financial crisis.

But this kind of big-ticket buyout seen during that period “rarely happens” in Korea, which is “more fit as a midsize buyout market,” said Kim Soomin, a partner at Unison Capital, a Japan-based private-equity firm.

In 2012, the last time data were compiled, there were 237 Korea-registered private-equity funds with a total of $40 billion in assets under management, up 25% compared with 2011, according to the Financial Supervisory Service.

While many PE firms concentrate on large transactions—such as Seoul-based private-equity firm MBK Partners, which last year bought ING Groep ING -0.69% NV’s Korea assets for $1.6 billion and Kohlberg Kravis Roberts KKR -2.08%& Co.’s $1.8 billion acquisition of Oriental Brewery Co. from Anheuser-Busch InBev BUD -2.54% in 2009—some are starting to identify opportunities at lower price points.

Hahn & Co., with $750 million committed capital in its first fund, has chosen to focus on midsize or distressed assets. In December, it signed a $375 million deal to buy part of the bulk and LNG business of Hanjin Shipping Co.117930.SE -0.28% , which was battered by the recent global slowdown in trade.

“We’re betting that the shipping industry will get better,” said Scott Hahn, the firm’s founder and chief executive. “There’s inevitable demand for shipping services in Korea, which relies on imports for its natural resources.”

Mr. Hahn said he decided to set up his PE firm in 2010 after noting that many midsize family-run businesses were looking to sell, while more conglomerates were likely to put their units up for sale with a restructuring orientation. “I didn’t see anyone doing these deals,” he said.

In December, Hahn & Co. completed the purchase of Woongjin Foods Co., the beverage-making unit of troubled conglomerate Woongjin Group, for $109 million. It is also preparing for a listing in Hong Kong of Korean camera-module maker Cowell e Holdings Ltd. later this year. Hahn & Co. is registered in South Korea but raised most of the money for its private-equity fund overseas.

Unison Capital spent $161 million of its ¥107 billion (US$1.03 billion) Japan-Korea fund last year to buy Korea’s Nexcon Technology Co., which makes a battery-management system.

Mr. Kim, the Unison partner, said the midsize buyout market is underserved, while markets for both small minority stakes and megadeals will likely continue to be overcrowded.

According to government data, the number of midtier companies in South Korea—mostly suppliers to big conglomerates like Samsung Group and Hyundai Motor Group005380.SE +1.75% —rose by 76% to 2,505 at the end of 2012 from a year earlier, an unprecedented increase.

“The emergence of more private-equity entrants applying further diversified investment strategies in Korea is a natural result of the country’s active M&A market,” said John Kim, co-country head and head of investment banking at Goldman Sachs GS -1.41% in Korea.

These new entrants “are acting as catalysts to help the Korean economy transform and become more knowledge-based,” a goal of the administration of President Park Geun-hye, Goldman’s Mr. Kim said.

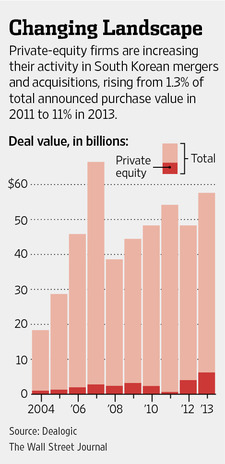

Private-equity acquisitions accounted for 11% of total Korea-targeted M&A deals in 2013, according to Dealogic data, sharply higher than 1.3% in 2011, which was an outlier year that showed a pronounced dip in the private-equity deal size.

Nevertheless, 2013 marked the highest percentage of M&A deals done since the government introduced rules governing the sector in 2004.

Private-equity activity has increased as investor seek better returns compared with prevailing interest rates, which central banks have guided lower to stimulate their respective economies.

The growth of investor interest has fed through to increased competition among private-equity firms, resulting in lower management fees. The most-common PE management fee in Korea in 2012 was 1.12%, down from 1.63% in 2003, according to the Financial Supervisory Service, which hasn’t released data for 2013.

The Korean government has been promoting private equity’s role in the country’s M&A sector.

In September, for instance, Financial Services Commission Chairman Shin Je-yoon said he expected to see private-equity firms taking the lead in buying small and midsize firms, especially given that tougher regulations make it more difficult for Korea’s big conglomerates, such as Samsung or Hyundai, to expand.

Bankers and analysts believe giving a bigger role to PE firms would help the Korean economy. Small and midsize businesses need to acquire better management know-how and reduce their heavy reliance on larger conglomerates by broadening their client bases to overseas players, and that is more feasible when helped by PE firms, said Kim Gyu-lim, senior researcher at the Korea Capital Market Institute.