Stop the Chinese frauds, an additional auditor option

January 16, 2014 Leave a comment

Stop the frauds, an additional auditor option

Dan joined FT Alphaville in September 2013 after stints on Lex and as the FT’s Investment Correspondent in New York. Send him ideas or call him up.

| Jan 14 13:50 | 2 comments | Share

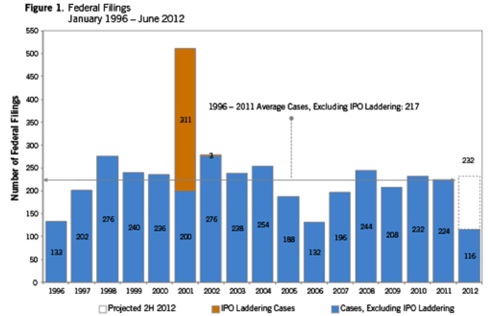

How might Chinese fraudsters be stopped? SkyTides, an investment firm started by a former auditor, has a suggestion: Special Attestation Reports. The reason is that auditors live by two words: material and reasonable. So while they need to keep an eye out for fraudulent-type behavior, it is not their central preoccupation.Indeed, one of the things that jumps out in a post by Seeking Alpha contributorSkyTides on the subject is just how common alleged fraudulent behaviour has been since the US passed Sarbanes-Oxley, which was designed to prevent future Enron-like deceptions. This can be judged by the number of fraud-related securities lawsuits filed, at least:

SkyTides are concerned about the recent spate of alleged Chinese reverse merger frauds that have embarrassed all four of the big accountants. Typically involving collusion between a few insiders and related parties, these are hard to spot.

Using as an example NQ Mobile — which is defending itself from allegations byMuddy Waters that it is a fraud — SkyTides writes:

It is very hard to blame the auditors for an undetected fraud given that they are simply following the rules prescribed to them by the U.S. regulators, PCAOB, the SEC and Sarbanes Oxley itself.

An auditor’s role is not currently focused on detecting fraud. The auditor’s role is actually very narrow. The fact is that the financial results of NQ could be auditable and determined to be correct by the auditors but collusion may still be occurring. NQ’s internal controls could also be functioning appropriately and could receive a passing grade when NQ’s auditor, PriceWaterhouseCoopers Zhong Tian CPAs Limited Company ((PwC)), reviews management’s assessment of internal control.

With all of the testing that the U.S. regulators, namely the PCAOB and the SEC, have prescribed and mandated, nowhere in that testing is a substantial amount of time, on a percentage basis to the total time an auditor needs to complete their audit and internal control attestation, allocated for a broad and all encompassing review and attestation related to fraud.

At present an auditor audits the financial statements to ensure they are free of misstatements, and attests to the internal controls — a la Sarbanes Oxley. SkyTides has a suggestion:

We suggest a third role be mandated by the PCAOB or SEC, or both, with the approval of the U.S. Congress, that involves Special Attestation Reports focused on the detection of fraud. To further ensure the firms performing the testing are motivated to do their best to complete their work, the design of testing and the results of testing that is opined on in the Special Attestation Reports should be required to be made public upon their completion. This also positively impacts the investing public as their understanding and trust in the regulatory environment should improve.

But why, you ask.

The need for this change is broad and is a result of both the misunderstood role of the auditor, and the limited liability an auditor takes on when they issue an auditor’s report. There are several instances where the auditor’s role and the disclosure of what the auditor does and does not do has been in question by the public lately. Herbalife’s (HLF) stock recently skyrocketed on the news that the auditor had not declared HLF a pyramid scheme upon releasing HLF’s re-audited financials. Bill Ackman (“Ackman”), a well-known short seller, reacted by correctly stating, “It is not the role of Herbalife’s auditor to determine if the company is a pyramid scheme.”

They also point out that an executive based in China has little to fear from the US authorities. If Hong Kong will let Edward Snowden go then…

The benefit of a Special Attestation Report is that it is a specific one-off, unlike an audit where the accountants would rather not get into their methods in public.

A Special Attestation Report is different. These reports are designed by a firm such as Deloitte, and approved by management before they are executed. The Special Attestation Report is issued after a firm completes a unique set of tasks that are designed with unique concerns such as for the detection of fraud (the “Program”). The firm that issues the Special Attestation Report is much more likely to be willing to release their report and findings publicly as the risks associated with doing so are much less limited given that all they are supposed to do is complete specific detailed tasks that are outlined in a Program.

In the case of NQ, for instance, this could be calling a list of customers at random to see that they really exist.

Now the rub. Aside from the expense and the fact that each attestation would have to be designed specific to each company, there is the presumption of possible guilt for all Chinese-listed companies.

In designing these reports, SkyTides argues:

Geographic and country-specific issues such as whether the country has a history of fighting extradition to the U.S. for prosecution of crimes should also be considered. For example, Chinese companies should be subject to a higher chance of being randomly selected solely because of the extradition issue. This is not discrimination. It is U.S. regulators adapting to the current environment and protecting investors which is supposed to be paramount. We need a level playing field.

Tell us, Mr Chinese businessman, when exactly you stopped beating your wife.

Still, such reports might have more credibility than the standard special committee of existing independent directors that is set up when Muddy Waters pops up to attack.

We asked Carson Block, the face of Muddy Waters, what he thought about the idea.

He is no fan of the accountants:

We agree that the public massively wrongly perceives auditors as being safeguards against public company fraud. There is a good argument that investors would be better protected against public company fraud if there were no audits – audits do little more in the fraud context than create a false sense of security.

But he likes the idea of the test as proposed for NQ, with modifications:

We would propose an additional test for the attestation process because interactions with state-owned mobile carriers are likely to be as susceptible to collusion as are interactions with state-owned banks.

The additional test would be for NQ to furnish the verifying party with an electronic copy of all of its mobile billing transactions from the past month. This database would contain the method of billing and phone number for each subscriber. The verifier should randomly select a sample (e.g., 100 numbers), and ensure they are not duplicated throughout the database. The verifier should then call those numbers and verify that the user is in fact a paying NQ user. It would be important to have the technology to ensure that NQ has not arranged for the numbers to be forwarded. The verifier should perform this exercise with respect to China and non-China purported users.

Assuming that the verification team has not been tampered with and the technology safeguard is in place, this would be a fool-proof means of verifying either NQ’s claims or our thesis.

Chinese companies with bona fides, who wants to be the first special attestation volunteer?