Wells Fargo Is Now No. 1 Bank Profit Maker

January 16, 2014 Leave a comment

Wells Fargo Is Now No. 1 Bank Profit Maker

J.P. Morgan Hurt by Legal Costs

DAN FITZPATRICK and SHAYNDI RAICE

Jan. 14, 2014 2:12 p.m. ET

J.P. Morgan saw fourth-quarter earnings fall from a year earlier amid regulatory settlements and weak trading results. Maureen Farrell breaks down whether the skies are finally clearing for the bank. Photo: Getty Images.J.P. Morgan JPM +0.07% Chase & Co. on Tuesday relinquished its position as the U.S. bank with the highest annual profit, capping a year marked by a slew of regulatory and legal issues.

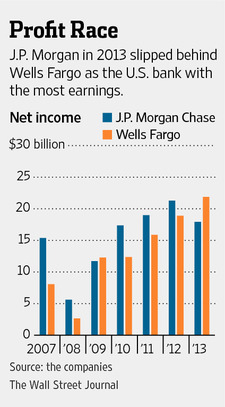

The New York bank ceded the spot it held since 2010 to Wells Fargo WFC +0.07% & Co. after J.P. Morgan reported fourth-quarter earnings of $5.28 billion, down 7.3% from a year earlier.

At San Francisco-based Wells Fargo, fourth-quarter earnings rose 10% to $5.6 billion and full-year earnings rose 16% to $21.8 billion. That was enough to surpass J.P. Morgan’s $17.9 billion, a figure that was down 16% from 2012, as legal costs cut deeply into the bank’s bottom line.

Wells’s ascension is largely symbolic—J.P. Morgan would have remained on top had it not been for $11.1 billion in legal expenses—but it does underline the rapid expansion of a West Coast bank that uses a horse-drawn stagecoach as its corporate icon.

Results from both banks showed signs of a healthier U.S. economy as J.P. Morgan and Wells made more loans to businesses and fewer of their consumers defaulted on loans, allowing the lenders to set aside less money for future losses. A recent rise in long-term interest rates should also help banks raise prices on new loans.

But both companies also struggled with a late 2013 slowdown in mortgage refinancings. Wells Fargo’s companywide revenue dropped 5.8% to $20.67 billion, while J.P. Morgan’s dropped 2% to $23.15 billion.

Chief executives from J.P. Morgan and Wells hedged otherwise optimistic outlooks during analyst calls. Wells Fargo Chief Executive John Stumpf cited more interest from consumers about buying homes and cars and more demand from businesses. But he added: “Am I saying there’s a full recovery and there’s going to be a watershed moment this year? No.”

Wells’s toppling of J.P. Morgan happened largely because J.P. Morgan agreed to roughly $22 billion in payouts to resolve a number of government probes and lawsuits. Just last week, the bank announced $2.6 billion in settlements tied to onetime client and convicted fraud figure Bernard L. Madoff, a payout that dragged down fourth-quarter results by $850 million.

J.P. Morgan’s legal expenses of $11.1 billion were more than double the amount from 2012. Wells doesn’t break out legal expenses, but an expense category that included those costs logged in at $821 million, down 63% from 2012.

Shareholders seem to be taking some of J.P. Morgan’s problems in stride. Shares of both banks were each up less than 1% Tuesday. In 2013, shares of J.P. Morgan and Wells Fargo both increased 33%

J.P. Morgan has enjoyed a run of strong profits since the financial crisis. The last time J.P. Morgan trailed Wells or any other U.S. rival in annual profit was 2009, when Wells Fargo outearned J.P. Morgan by more than $500 million and Goldman Sachs Group Inc. GS +0.41% also had higher profit than J.P. Morgan. (By some profit metrics, Wells hasn’t beaten J.P. Morgan in nearly a decade.)

Once a sleepy bank largely concentrated on the West Coast, Wells is expected to top all other large U.S. banks in profit once full-year results are released later this week forBank of America Corp. BAC +2.07% ,Citigroup Inc., C +0.43% Goldman andMorgan Stanley. MS +0.75%

Wells also can claim a higher return on equity, another measure of profitability, and since late 2011 it has been the U.S.’s largest bank by stock-market valuation, an important yardstick for investors.

Mr. Stumpf and J.P. Morgan CEO James Dimon on Tuesday played down the significance of the reversal in rank. J.P. Morgan’s chief told reporters that “the company is doing really well” based on a review of the “underlying numbers.”

“That is what’s important,” he added. “Being the best, not the biggest.”

Mr. Stumpf, who supplanted Mr. Dimon last year as the highest-paid U.S. bank CEO, said in an interview he isn’t worried that his bank’s annual profit status will mean more scrutiny from U.S. regulators and noted that he doesn’t see much benefit to size.

“I’ve never met a customer yet who said, ‘I want to bank with you because you’re so big I can just be a number,'” he said.

RBC Capital Markets analyst Gerard Cassidy said the annual-profit title is a purely a “symbolic” victory for Wells. He argues that Wells wouldn’t have beaten J.P. Morgan absent the legal charges and adds that J.P. Morgan should be able to outearn Wells again once litigation costs subside.

J.P. Morgan could reclaim its position this year as higher borrowing costs reduce homeowner’s demand for mortgages—a potential weakness for Wells, the U.S.’s largest home lender.

Mortgage-banking income at Wells dropped 49% in the fourth quarter from a year earlier. New originations totaled $50 billion, compared with $125 billion a year earlier. Wells Fargo Chief Financial Officer Timothy Sloan told analysts that the mortgage business will improve once the purchase market heats up, which typically happens in the spring.

J.P. Morgan is still the largest U.S. bank by assets, another important measurement in the banking industry. It is also far larger than Wells outside the U.S. and in the investment-related businesses that give it clout on Wall Street.

But two purchases J.P. Morgan made in 2008 that gave it added heft—New York securities firm Bear Stearns Cos. and the banking operations of Seattle thrift Washington Mutual Inc.WMIH -0.38% —are hurting J.P. Morgan’s results as regulators and investigators work through a backlog of banking-industry activity. In a recent $13 billion settlement with the Justice Department resolving probes of precrisis mortgage-bond sales, about 80% of the payout was tied to the actions of Bear and Washington Mutual, according to people close to the company.

J.P. Morgan’s dominant presence on Wall Street also exposes the bank to more earnings volatility than Wells Fargo, which still makes most of its money from consumer-banking customers. In the fourth quarter, J.P. Morgan’s investment banking and trading profit slumped 57%, due largely to a $1.5 billion loss from an accounting adjustment tied to its massive derivatives portfolio. Profit in its consumer unit was up 19% for the quarter and 2% for the year as it cut 16,500 consumer employees amid the mortgage slowdown. It also halted an expansion of its branch network at roughly 5,600 locations.

Like J.P. Morgan, Wells Fargo became much larger during the 2008 crisis by pursuing weaker rivals. Its purchase of Wachovia Corp. gave it the nation’s biggest branch network and a presence for the first time in nine southern states and eastern states, including New York. Wachovia, based in Charlotte, N.C., was then on the brink of failure thanks to a large portfolio of risky mortgages.

But Wells Fargo so far has sidestepped the outsize legal problems that bedeviled J.P. Morgan because many of the Wachovia loans hadn’t been bundled into mortgage securities and resold to investors—a process that formed the basis of multiple lawsuits and government probes once those securities went bad. Before the crisis, it also hadn’t loosened credit standards on its own loans as much as some other large lenders.

J.P. Morgan’s crisis-era acquisitions brought “surprisingly high” legal costs, said Jeffery Harte of Sandler O’Neill & Partners. “I can’t imagine Wells Fargo’s legal costs will be anywhere close to that.”

Asked Tuesday whether J.P. Morgan’s legal troubles are over in 2014, Mr. Dimon said “I’m going to take a rain check on that.”