Beijing says it wants to change its ways on big financial issues, but making that happen is proving tough

January 17, 2014 Leave a comment

China’s Best Intentions, Mixed Results

Changing Its Ways on Big Financial Issues Is Proving Tough for Beijing

AARON BACK

Jan. 15, 2014 4:26 a.m. ET

Chinese policy makers excel at promising all the right things. Implementation is another matter. Take the reform-minded People’s Bank of China, which has pledged to rein in credit growth and interfere less with the yuan exchange rate. In 2013, progress was mixed on both counts.On credit growth, the good news is that it has started to slow, reflected in the total social financing figures released Wednesday. The government’s broadest measure of credit creation, it showed that new financing issued in the fourth quarter was down by 17.9% from a year earlier, reversing massive growth earlier in the year.

Driving the slowdown has been the PBOC’s deliberate withholding of liquidity, which led to cash crunches on the interbank market three times last year. Despite this, the stock of outstanding financing still rose by 18.8% in 2013, according to estimates by Bank of America-Merrill Lynch. That exceeds the nominal GDP growth of about 10%, meaning the ratio of debt to GDP continues to rise.

For the PBOC, squeezing credit even harder won’t be easy. For one, less credit means slower growth in an economy that lost some momentum at the end of the year. And as The Wall Street Journal reports, bureaucratic infighting between the PBOC and a parallel banking regulator, the China Banking Regulatory Commission, has held back progress.The banks themselves are powerful lobbies in this regard.

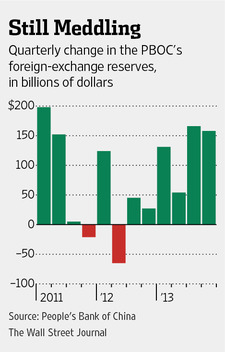

On the exchange rate, top central bank officials were adamant last year that they’ve accumulated enough reserves and aim to scale back intervention and allow the yuan to trade more freely.

In fact, concerned that a quick rise in the currency could harm growth, Beijing has stuck to its old playbook of allowing slow, controlled appreciation—letting the yuan rise 3% against the U.S. dollar in 2013, with little volatility. The central bank is clearly holding back the currency, soaking up trade and capital inflows. Foreign-exchange reserves rose by $324 billion in the second half. China now holds $3.8 trillion, more than enough to buy a year’s worth of economic activity in Germany.

Investors’ eyes light up when reformers in China talk about change. But contrary to popular belief, Beijing isn’t a monolithic decision-making juggernaut that pushes through new ideas. The country’s reform drive will ultimately rest on turning words into deeds.