The Business of Risk Is Booming; As Fines Sting, a Hiring Spree for Compliance Staff

January 17, 2014 Leave a comment

The Business of Risk Is Booming

As Fines Sting, a Hiring Spree for Compliance Staff

GREGORY J. MILLMAN and SAMUEL RUBENFELD

Jan. 15, 2014 8:13 p.m. ET

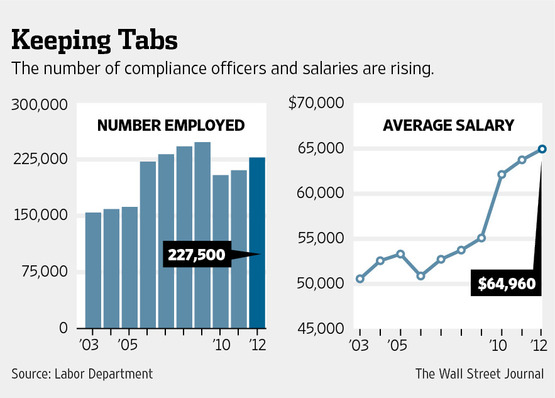

In a U.S. economy struggling to create jobs, at least one field is booming: compliance. Hefty fines and other penalties have jolted companies, especially banks, into a compliance hiring spree, as governments at home and abroad tighten business laws and regulations and ramp up their enforcement activity.“We’re in a battle royal for talent in the compliance space, across the board,” said Corey Gunderson, who heads the risk-and-compliance practice of research consulting firm Protiviti.

Banks, which are under heightened scrutiny, have been hiring thousands of people in their compliance departments: HSBC Holdings HSBC +0.54% PLC said it added 1,600 compliance employees last year, and J.P. Morgan Chase JPM +3.03% & Co. is bringing in what it calls a “SWAT Team” after agreeing to make billions of dollars in settlement payments.

The hiring spree makes the compliance field hotter than many others. According to the Bureau of Labor Statistics, the U.S. unemployment rate for compliance professionals was 5.7% in last year’s third quarter, compared with the overall jobless rate of 7.2% in the same period.

“The regulatory environment in the U.S. is driving the hiring,” said Paul McDonald, a senior executive director at human-resources consulting firm Robert Half International Inc.RHI +4.00% The outlook is “very bright for anyone entering into compliance as a career.”

Starting salaries are on the rise as well, growing by an average of more than 3.5% a year since 2011, according to data compiled by Robert Half. U.S. starting salaries for professional occupations as a whole are expected to rise 3.7% in 2014, the firm said.

At a large company, a chief compliance officer can expect to earn from about $162,000 to $232,000 this year, Robert Half said. At small and midsize companies, salaries are slightly lower, but the rate of increase is nearly identical.

Despite all the opportunities, few young people start out aspiring to a career in compliance. These jobs aren’t easy. They require keeping up with increasingly strict and complex regulatory systems around the world, and sometimes elicit skepticism or hostility from colleagues.

In the past, compliance officers tended to spend more of their time on issues such as disclosure and working with auditors, although regulators have stiffened requirements in those areas too.

Failure to Comply

Some of the biggest compliance-related penaltiesof 2013:

J.P. Morgan Chase $5.1 billion related to mortgages

Johnson & Johnson $2.2 billion related to drug marketing

SAC Capital $1.8 billion for insider trading

Transocean $1.4 billion for Gulf oil spill

UBS $885 million for mortgage-backed bonds

RBS $612 million for interest-rate complications

Total SA $398 million for alleged bribery

Weatherford $252 million for alleged bribery

(Sources: WSJ staff reports, Society of Corporate Compliance and Ethics)

Odell Guyton, former chief compliance officer at Microsoft Corp. MSFT +2.74%and now head of global compliance at electronics manufacturer Jabil Inc., said more of his work now involves what he calls “preventative law,” or “helping [managers] to understand the business of the company, and helping them navigate around these land mines they may not be aware of in terms of compliance risk.”

Compliance officers at some companies rank relatively high on the corporate ladder, reflecting the heightened risks companies face for regulatory infractions. The downside is that compliance staff can be held accountable for lapses, along with the rest of the company.

U.S. Assistant Attorney General James Cole warned corporate compliance officers recently that if they fail to cooperate with the government in any investigations there will be “real consequences.”

Those stakes make compliance a high-pressure job. One trade group found in a 2012 survey that 60% of compliance officers had considered leaving their position because of job stress.

Hector Sants, the former compliance chief for Barclays BARC.LN +1.63% PLC, quit his job in November after taking a leave of absence because of stress and exhaustion; his tenure at the scandal-plagued British bank lasted just 10 months.

New laws and enforcement have changed the job of the typical compliance officer. The 2010 Dodd-Frank law and the Sarbanes-Oxley Act of 2002 have prompted firms to emphasize risk assessments and ethics and to provide a way for employees to report suspected misconduct.

Stepped-up enforcement of the Foreign Corrupt Practices Act also has spurred companies to put more effort into internal controls, reporting and training. The 1977 law, which bars U.S. companies from bribing foreign officials to gain a business advantage, also contains a provision known as the “books and records” section, which requires companies to keep accurate accounting records. Many of the FCPA enforcement actions taken against companies are for inaccurate record keeping.

For those willing to bear the burdens of a compliance career, experience isn’t always necessary. Intense demand is forcing companies to look beyond the limited ranks of job seekers with compliance backgrounds to those with project-management, operations and technology expertise, according to Stewart Goldman, head of risk and compliance for the Americas at executive- search firm Korn/Ferry. KFY +1.07%

Melissa Lea, chief compliance officer for business-software maker SAP AG SAP +0.28%, said she finds a legal background is useful, but not necessarily mandatory, for compliance officers.

“What I look for personally is a passion for compliance and for training,” she said. “So much of the job [involves] communicating. The communications skills have to run the full spectrum.”