6 out of 10 KOSPI equities trade below 1x P/B

January 19, 2014 Leave a comment

6 out of 10 KOSPI equities trade below 1x P/B

Kim Byung-ho, Cho Si-young

2014.01.17 16:49:12

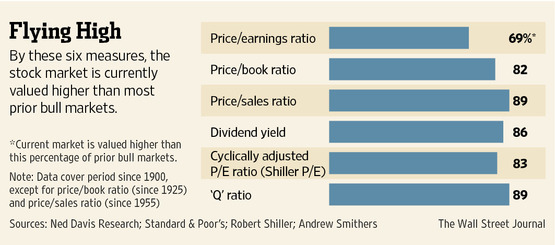

Six out of 10 constituents of the benchmark Korea Composite Stock Price Index (KOSPI) saw their market capitalization fall short of the book value as the index has not yet recovered to the 2,000 mark earlier this year. Views are divided over this situation. Some interpret it as a rise in the number of relatively undervalued stocks while others believe it reflects heightened fears over growth. In these circumstances, investors are anguishing over how to pick stocks. 61 percent or 364 out of 597 listed firms on the KOSPI, on which data is available, had a price-to-book value ratio (P/B ratio) of below one time, according to FnGuide that performed the analysis commissioned by the Maeil Business Newspaper Friday. The analysis is based on closing prices on January 16 and net asset values as of end of third quarter of last year. A P/B ratio under one time indicates a company’s market cap is smaller than its liquidation value. This boils down to the fact that six out of 10 listed firms traded below their liquidation value. The financial investment industry recommends hunting for stocks with high return on equity (ROE) and low PBR and low price-to-earnings ratio (PER) as a way to choose shares. “PBR and PER, which compare assets and earnings on financial statements with share prices, are reliable gauges to select cheap shares,” said Choi Chang-ho, head of investment strategy at Shinhan Investment. Among the KOSPI stocks with over 100 billion won ($94.3 million) market cap, Hyosung, SK, Seah Steel and Korean Reinsurance meet all of the criteria of high ROE, low PBR and low PER, according to Daishin Securities.