China Money Market Rates Soar; Financial System Shows Fresh Signs of Stress Ahead of Lunar New Year Holiday

January 22, 2014 Leave a comment

China Money Market Rates Soar

Financial System Shows Fresh Signs of Stress Ahead of Lunar New Year Holiday

SHEN HONG

Updated Jan. 20, 2014 4:43 a.m. ET

SHANGHAI—China’s financial system is showing fresh signs of stress with short-term borrowing costs for banks soaring on heavy demand for cash ahead of the Lunar New Year holiday and rising worries over the vast shadow-banking sector.The rising rates in the money markets is also hammering stocks with the benchmark Shanghai Composite falling past the key level of 2000 to 1991.25, its weakest in almost six months and down 5.9% this year, the worst performer in Asia.

The scramble for funds has been sparked by individuals and companies rushing to buy gifts for the weeklong break starting at the end of next week while banks are also hoarding cash ahead of the usual month-end regulatory requirements.

There is also concern over China’s loosely regulated shadow-banking sector where pressure is rising on Industrial & Commercial Bank of ChinaLtd. 601398.SH -0.29% and shadow lender China Credit Trust Co. to bail out investors facing a nearly $500 million hit. Investors are watching to see if a potential default would spark turmoil throughout the banking system.

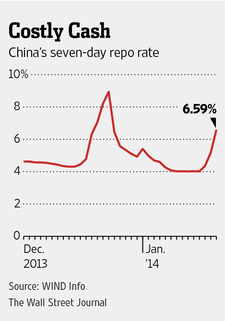

The benchmark cost of short-term loans between banks, the weighted average of the seven-day repurchase agreement rate, rose to 6.59% on Monday, from 5.17% Friday and 4.35% Thursday. The current level marks the rate’s highest since Dec. 23, when it hit 8.94%.

Over the past year, there have been severe liquidity crunches in June, October and December as the central bank has maintained a largely unsympathetic approach to banks’ cry for cash because of its push to weed out risky lending.

In all three instances, it has refrained from offering a lifeline to cash-deprived lenders until the very last minute when the situation threatened to get out of control.

But in a sign that the Chinese central bank is already weighing tactics to deal with the liquidity shortage this time round, it gauged demand earlier Monday for a new type of liquidity injection tool that appears to aim at addressing the coming holiday-specific needs for cash.

In a routine weekly exercise, the People’s Bank of China asked major money market participants whether they are interested in borrowing cash from the central bank via the 21-day reverse repurchase agreements, a short-term loan to commercial lenders. It also gauged demand for the more commonly used repos and bills.

“The central bank is expected to continue with its prudent monetary policy. It will inject a small amount of cash only when funding costs breach its tolerated limits. It will keep interest rates fluctuating at relatively high levels,” Bank of Communications Schroder Fund Management Co. said in an investor note.

A major challenge for China’s policy makers this year is to rein in the fast and dangerous expansion of the country’s shadow banking system, a category that includes all types of credit outside formal bank channels and is a major factor in China’s rising debt levels.

“But even if the PBOC uses the 21-day reverse repos in the end, I expect the overall magnitude of liquidity injection for the Spring Festival period to be smaller than last year’s,” said Chen Long, an analyst at Bank of Dongguan. He added that the authorities look determined to keep a relatively tight monetary policy so as to rebalance a credit-driven economy.

The holiday shutdown starts Jan. 31, the nation’s most important holiday, when an estimated 3.62 billion people will take to the air, roads and railways to be with family.

“The traditional Spring Festival travel crush has already begun, so there are a lot of people drawing a lot of cash at the moment,” said Mr. Chen. “The central bank’s priority is rescuing a panicky market when needed but not releasing an excessive amount of cash into the financial system.”