Dukes of Chinese Moral Hazard; A Risky Shadow-Bank Investment Product May Not Be Allowed to Fail

January 22, 2014 Leave a comment

Dukes of Chinese Moral Hazard

A Risky Shadow-Bank Investment Product May Not Be Allowed to Fail

AARON BACK

Jan. 21, 2014 1:12 a.m. ET

The prospect of a default is haunting China, with the country’s largest bank at the center. At issue are 3 billion yuan ($490 million) worth of investment products, yielding as much as 11.5%, that Industrial and Commercial Bank of China601398.SH +0.88% sold to high-net-worth customers. They are based on loans made by China Credit Trust Co., a shadow bank, to Zhenfu Energy Group, a debt-laden coal miner. China Credit Trust warned last week it may not be able to repay customers when the products mature at the end of this month.Some observers hope that the failure of such a risky investment product—something that has never happened in China—will flush moral hazard out of the system. The scare has become a litmus test for Beijing’s reform drive. Let a small trust product fail, and the rest of the market will snap into shape. But the contagion risks means such an outcome is far from certain.

ICBC’s stance is that it’s only a sales agent and doesn’t have a legal obligation to stand by the products. This response shouldn’t surprise investors. If ICBC said it would backstop the products, it would risk an official reappraisal of how it treats all the other investments it keeps off its balance sheets.

ICBC’s off-balance-sheet wealth-management products were equivalent to around 5% of total assets and 80% of common equity at the end of June, based on several analyst estimates. Bringing all these risks onto the balance sheet would hurt the bank’s otherwise healthy capital ratios.

If the products default, the impact on confidence could be severe. Savers everywhere would question high-yield investment products, and as they pull money away, trust companies will find it harder to roll over loans to the country’s property developers, coal miners and other risky borrowers. A wave of defaults could follow.

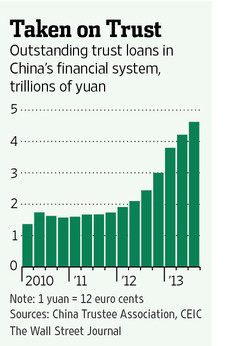

The scale of the problem is potentially large, given the short-term nature of the borrowings. Bank of America-Merrill Lynch economist Lu Ting estimates that a third of the 4.6 trillion yuan in outstanding trust loans will mature this year.

Previously, a third way has always been found. When products sold by Huaxia bank collapsed in 2012, a third-party “credit-guarantee” company swooped in to take responsibility. It’s unclear whether the debts in question this time have a third-party guarantor. China Credit Trust also says it is considering legal action against Zhenfu to recoup investor funds.

Given the unpredictable consequences of default, a deal to make investors whole can’t be ruled out. While such an outcome would calm markets in the short term, it would simply pile on risks in system that can ill afford them.