Slew of IPOs to Test Whether New China Stocks Have Broken an Old Pattern

January 22, 2014 Leave a comment

Slew of IPOs to Test Whether New China Stocks Have Broken an Old Pattern

Eight Chinese Stocks Will Make Their Debuts in Shenzhen Tuesday; Will They Rise, Then Fall?

Updated Jan. 20, 2014 9:13 a.m. ET

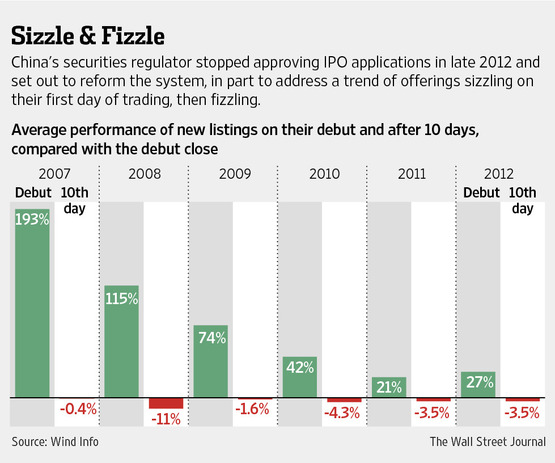

China’s securities regulator is about to find out whether changes it implemented to the application system for initial public offerings will cure offerings’ tendency to start strong and then lose steam.When Neway Valve (Suzhou) Co. made its debut on Friday, marking the first new listing in mainland China in more than a year, it kept to the script of starting convincingly. Shares rose 43% to 25.34 yuan ($4.19), just below the opening-day upper limit of 25.43 yuan. But on the second day of trading, the valve manufacturer’s shares fell by the maximum 10% permitted, in line with a trend that, in part, prompted the China Securities Regulatory Commission to stop approving IPO applications in November 2012.

Neway’s weak second-day performance is likely to have put investors on alert ahead of the launch of eight new stocks on Tuesday, said Zhou Lin, an analyst with Huatai Securities

The Shenzhen Stock Exchange is listing the eight stocks on two of its three boards. The eight companies have raised a total of $783 million.

The regulator unveiled IPO rules late last year that aim to reduce the government’s control over markets. China is steering its IPO system in a direction that will make it more similar to those in developed economies, in which the government determines whether companies meet disclosure requirements, leaving the market to determine share prices.

One of the shortcomings of the old system—under which the regulator made decisions ranging from whether a company would remain profitable to how an IPO should be priced—was that it was slow for most applicants. Under the new system, the regulator is letting individual firms decide when to list.

Among the eight companies that will debut on Tuesday, three will list on the SME Board, a marketplace for small and medium-size enterprises, while five will list on the ChiNext board, a market for startups.

Analysts say they are bullish about the debuts of all eight stocks, although they differ about their prospects. One analyst forecast the average increase will be 20%, while another said most of the eight could rise by more than 40%.

“Speculative buying will continue to dominate the market, as these stocks have smaller capitalization, indicating they are easier to be chased up, and the industries of some are hot topics right now,” said Jacky Zhang, an investment adviser with BOC International (China) Ltd.

Zhejiang Wolwo Bio-Pharmaceutical Co. attracted the most ardent investor attention during its fundraising period. The tranche of stock sold to retail investors was 175 times subscribed and raised 506 million yuan ($83.6 million), 39 times its 2012 earnings. The average price/earnings ratio of its peers for 2012 was 49, indicating the drug maker’s price could have some upside when the stock starts trading on ChiNext.

Part of Zhejiang Wolwo’s appeal is that it is expected to benefit from government support as a participant in a so-called strategic emerging industry.

Taken as a whole, the new listings will be “the real test for investors’ risk tolerance for new shares,” Mr. Zhang said.

The stocks that will list on the SME Board are household-appliance manufacturer Guangdong Xinbao Electrical Appliances Holdings Co., electrical apparatus manufacturer Shanghai Liangxin Electrical Co. and auto parts manufacturer Changzhou Guangyang Bearing Co.

Aside from Zhejiang Wolwo, the additions to the ChiNext board will be pharmaceutical-equipment producer Truking Technology Ltd., education service provider Guangdong Qtone Education Co., machinery manufacturer Chengdu Tianbao Heavy Industry Co. and Hangzhou Sunrise Technology Co., a maker of electricity flow meters.

Chengdu Tianbao raised the smallest amount among the companies, at 308 million yuan, while Hangzhou Sunrise raised the most, with 1.1 billion yuan.