A tippler’s guide: What SABMiller’s lager sales say about the state of African economies

January 26, 2014 Leave a comment

A tippler’s guide: What SABMiller’s lager sales say about the state of African economies

Jan 25th 2014 | JOHANNESBURG | From the print edition

FOR most people the letters BBC denote the British Broadcasting Corporation. For fans of Real Madrid, the world’s richest football club, they stand for Bale, Benzema and Cristiano (Ronaldo), the team’s goal-guzzling forward line. For investors in Africa’s stockmarkets, BBC means banks, breweries and cement. The biggest companies listed on African exchanges are typically BBC firms. And in places where official statistics are scarce or unreliable, their trading figures are often a good guide to how much lending, spending and building is taking place in African economies.

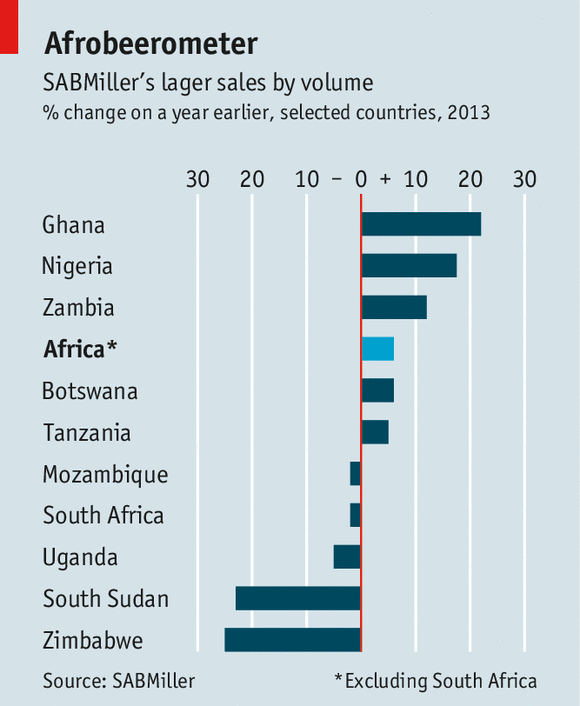

SABMiller is a BBC behemoth. It is one of the world’s leading brewers, with chunky operations in 15 African countries and a presence in a further 20 markets on the continent through its alliance with Castel, a French company. Africa is now SAB’s fastest-growing market. Lager sales by volume rose by 6% in the year to the fourth quarter of 2013 compared with growth of just 1% in its operations worldwide. So its latest trading statement of January 21st is a useful barometer to the state of Africa’s economies.

In this section

A tippler’s guide

Related topics

Some of the numbers are startling. A slowdown in the flow of dollars into Zimbabwe last year has squeezed the economy much harder than is generally understood. Lager sales there fell by a quarter (see chart), as big a slump as in South Sudan, where factions are fighting for control of the country. Mozambique has been one of the world’s fastest-growing economies, but its beer sales are weak. This suggests that sporadic attacks along the country’s north-south highway by the militia of Renamo, the main opposition party, now seem to be harming the economy.

Other African markets look healthier. Though lager sales fell in South Africa, SAB’s home market, revenue nonetheless rose, as consumers switched to pricier brews. Sales volumes rose by 12% in Zambia, though the figure is flattered by purchases by traders in advance of January’s increase in excise duties. Nigeria is a newish market for SABMiller in which it faces competition from Guinness and Nigerian Breweries. Yet the firm was still able to report volume growth approaching 20%. Ghana appears to be growing even faster.