About That Morningstar Cover Jinx

January 26, 2014 Leave a comment

About That Morningstar Cover Jinx

By John Rekenthaler | 01-23-14 | 08:45 AM | Email Article

Black Cats and Broken Mirrors

All right, I confess: I cheated with the headline. There’s no longer the sense among industry watchers that Morningstar’s Fund Manager of the Year Award serves as a jinx. This year, I’ve only seen one such article–a blog in U.S. News & World Reportcalled “The Curse of the Morningstar Top Fund Manager”–and even that was a head fake, as the article ended up being more about investor behavior than about the performance of FMOY funds.

But it’s a good excuse to run the numbers.

For all funds with managers who won an FMOY Award since the honor was first given in 1998, I compared the fund’s future Morningstar Risk-Adjusted Return against that of the category average.* The time periods were the following: one year, three years, five years, and 10 years.

* If the manager ran more than one fund, I chose the largest, most visible fund, rather than double count that manager’s award.

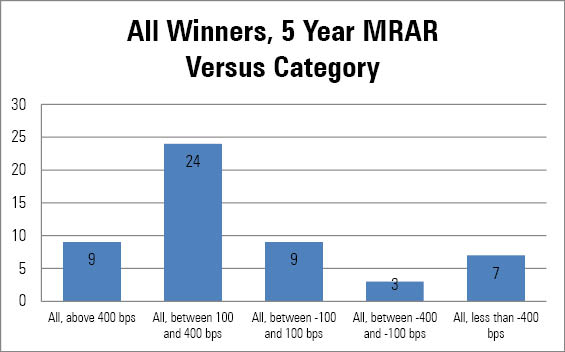

Below are the following one-year results, sorted into five buckets: 1) the fund’s MRAR was at least 4 percentage points per year higher than the category average; 2) the fund’s MRAR was between 1 and 4 percentage points higher; 3) the fund’s MRAR was between 1 percentage point lower and 1 percentage point higher; 4) the fund’s MRAR was between 4 percentage points lower and 1 percentage point lower; and 5) the fund’s MRAR was more than 4 percentage points lower.

(The cutoffs for the buckets are entirely arbitrary, but choosing different cutoffs does not change the analysis. As always, this analysis is from the perspective of the ongoing investor, so it does not include front-end sales charges but it does include all components of annual expenses.)

– source: Morningstar Analysts

In the year after the managers won, the FMOY Award funds regressed toward the mean, as one would expect. Overall, though, their performance remained modestly above average, as they were 34 funds making the top two quintiles and 24 funds landing in the bottom two quintiles. At the extremes, four funds out of the 57 in the sample had MRARs of greater than 8%, and five had MRARs of less than negative 8%.

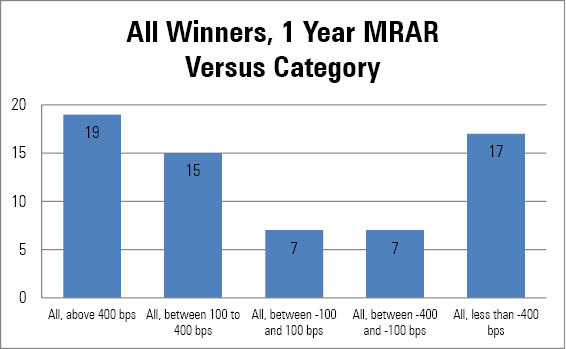

While risk-adjusted performance is the best way to score success, per standard academic theory, it’s worth checking to see if total returns tell a different story. They do not, as shown by the chart below:

– source: Morningstar Analysts

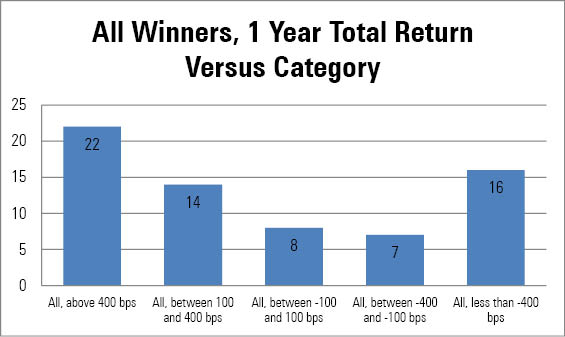

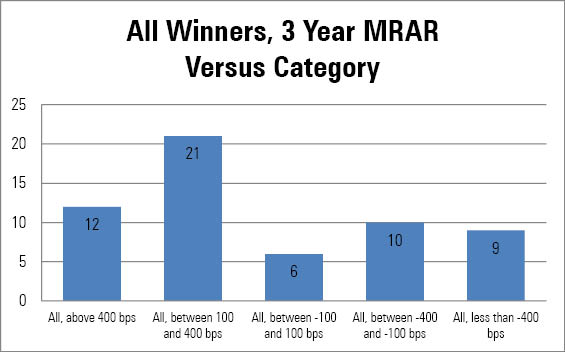

Extending past one year, the numbers sharply improve. Winners (that is, funds landing in the top two quintiles) outnumber losers (funds in the bottom two quintiles) by an almost 2:1 margin for three years and by 3:1 for the five- and 10-year periods.

– source: Morningstar Analysts

– source: Morningstar Analysts

– source: Morningstar Analysts

This looks to be a straightforward tale. There’s little short-term information in an FMOY Award. Winners perform slightly better than randomly over the next 12 months. Over longer time periods, however, there is a good deal of information. This makes sense as, despite its name, the FMOY Award is something of a career achievement, given to a successful manager who happens to have had a particularly good year.

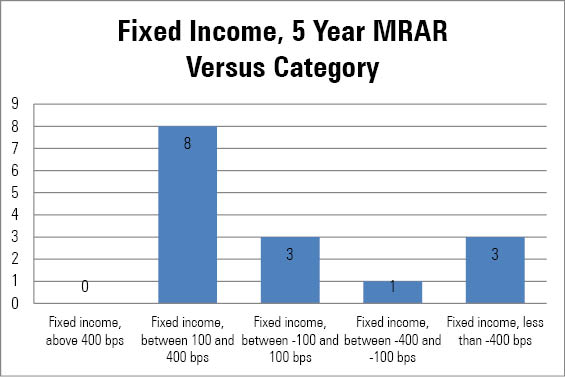

The effect holds for all three asset classes that receive the award–Domestic Stock, International Stock, and Fixed Income. (Yes, the Domestic Stock group is responsible for the modest one-year success. But I suspect that is luck; I see no reason why Morningstar’s Fund Research team has the ability to identify one-year winners with U.S. stock funds but not elsewhere.)

For example, the five-year results by asset class:

– source: Morningstar Analysts

– source: Morningstar Analysts

– source: Morningstar Analysts

I suspect that whispers of the curse will persist, as by chance three or four FMOY winners each decade figure to post a bottom-decile return the following year, thereby giving periodic opportunity for new anecdotes. There’s nothing to the general claim of a jinx, though, not as far as I can see.

Note: Morningstar’s Kailin Liu and I have each previously written on this topic, using a similar approach and arriving at broadly similar conclusions. Those articles are hereand here.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar’s investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

John Rekenthaler is Vice President of Research for Morningstar.