January 24, 2014 8:32 am

Rate support for leveraged buyouts fades

By Henny Sender

The profits of the Hilton buyout and IPO won’t be repeated soon

When Hilton went public at the end of last year, its listing was great news for its owners at Blackstone. It was also good news for the Federal Reserve, which acquired more than $4bn in Hilton debt that had been on the Bear Stearns balance sheet as part of JPMorgan’s purchase of the troubled security firm in 2008.

In addition, Hilton’s recovery was spectacularly lucrative for the hedge funds that invested in Hilton debt. And there was a lot of debt since Blackstone put in less than 20 per cent equity, paying for its $27bn purchase with more than 80 cents on the dollar in debt, or well over $20bn in total.

Some of the smartest debt investors in the world traded the debt, including Centerbridge Partners, Oaktree Capital Management and Greg Lippman, the former Deutsche Bank mortgage credit trader, who is now the chief investment officer of hedge fund MaxLibre.

Both Centerbridge and Oaktree began buying the debt at its nadir below 50 cents on the dollar and rode it all the way up to the high 90s. Meanwhile, Mr Lippman came so late to the trade in late 2012 that in some cases he paid above par for the debt and still made a decent return on his investment. These investors were attracted to the trade since hotels are among the most cyclical and volatile ways to bet on a real estate recovery driven by easy money. And, the most junior debt offered the greatest potential upside as a way to play Hilton.

Hilton was one of the most levered of all the leveraged buyouts of the peak years. Nevertheless, the hedge funds that piggybacked on Blackstone also made a lot of money primarily because of the Fed’s easy money policies that brought interest rates way down, in turn making it easier for Blackstone to pay down Hilton’s debt load.

Today, there is widespread optimism on Wall Street about prospects for this year. But the single most important factor in the best trades of the last few years – such as the Hilton trade – was declining rates, and that trend is coming to an end, suggesting that the general optimism is overdone.

Although the Fed has made it clear that it plans to keep rates lower for longer than was the case a few months ago, the central bank may not be as effective on keeping rates where it wants them to go. Moreover, even if rates rise on the expectation of stronger economic growth, that growth probably will not be strong enough to offset the negative of rising rates, a big bearish factor for both the credit market and the stock market.

Moreover, the Hilton story, among other things, is a reminder that the main beneficiaries of the Fed’s easy money policies are levered investors, and the real results of quantitative easing are reflected more in rising asset prices than in the real economy.

The Hilton story had a happy ending for all investors who had faith that it would eventually work out, though that outcome was not always obvious. When Blackstone restructured the debt in 2010, the firm put in equity and paid off some of the junior debt at 45 cents on the dollar. Holders who took part in the Blackstone orchestrated debt restructuring in 2010 (some of whom paid less than 50 cents on the dollar in the secondary market) ended up with $1.16, pocketing accrued interest and a percentage of the profits on the deal, alongside Blackstone.

There are factors beyond the Fed that contributed to the success of the Hilton trade. Blackstone had always made it clear that it had ambitious plans to grow Hilton and that determination to transform the formerly sleepy business helped both the story and confidence. Moreover, Blackstone was visibly behind Hilton, both putting more money in at the depth and making a market in the debt so holders knew they could get a bid if they wanted to sell.

It was clear that Blackstone would not walk away, as other private equity firms abandoned overleveraged buyouts. In addition, the banks were more co-operative than they may have otherwise been, mindful of the fees that Blackstone doles out to them. They agreed to sell their junior debt to Blackstone for that low 45 cents on the dollar at a time when it was clear that the worst was behind both the credit markets and Hilton itself.

But sadly for investors today, all this is history now. The saga of Hilton is not likely to be repeated any time soon.

January 23, 2014 6:45 am

Money markets sound alarm for ECB

By Ralph Atkins in London

Rapid withdrawal of liquidity has pushed up overnight lending rate

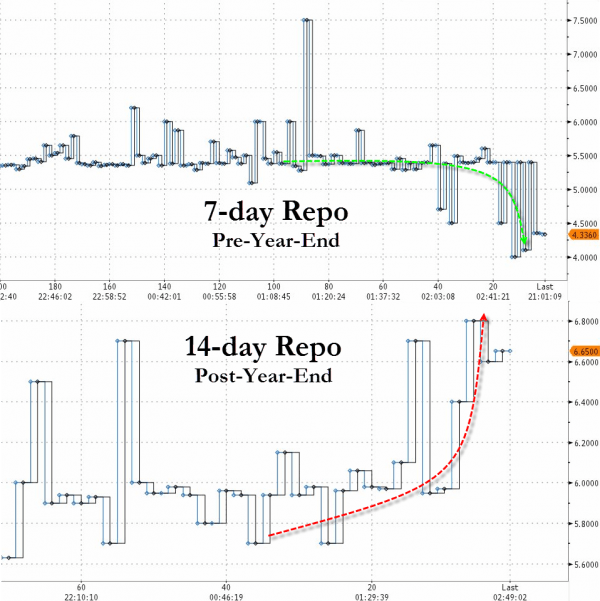

Sudden rises in very short-term market interest rates – the cost of borrowing overnight, for instance – usually spell trouble. Soaring Chinese interbank borrowing costs at the end of last year highlighted the central bank’s difficulties in curbing the most egregious financing practices of the country’s banks.

Less noticed beyond a few specialist circles, the European Central Bank has this year also seen market interest rates rising – not as acutely as in China, but possibly sufficiently to force a change in strategy.

As in China the rises reflect shifts in the banking landscape – something the ECB is keen to encourage. But the risk is of rising market rates feeding through into higher borrowing costs for businesses and consumers when economic growth remains weak. An unwanted, premature monetary policy tightening – via higher market interest rates – could tip the eurozone into a dangerous deflationary slump.

Sweeteners

The ECB’s problem is largely self-inflicted. When the eurozone debt crisis was at its most intense in late 2011, Mario Draghi, the new ECB president, decided to flood banks with a “wall of money”.

Eurozone banks were urged to take advantage of cheap three-year ECB loans, or “longer-term refinancing operations”, but to ensure sufficient take-up the ECB sweetened its offer with an early repayment clause. Rather than being locked into holding ECB funds on their books for the full three years, banks could repay after a year.

The sweetener helped ensure the LTROs were successful in averting disaster: banks borrowed more than €1tn and the eurozone crisis eased, at least temporarily.

By the time the early repayment clause could be exercised in January 2013, the situation had changed. With the eurozone clearly on the mend and financial tensions eased, repayments quickly flowed.

At the end of last week €450bn had been repaid. And the ECB’s balance sheet has shrunk significantly: relative to gross domestic product, it will soon be smaller than the US Federal Reserve’s.

Withdrawing all that liquidity has pushed up market interest rates. As a result of cuts in official ECB interest rates, the euro overnight index average (Eonia) – an interest rate benchmark – had crashed almost to zero (excluding spikes caused by technical factors). This week it was back above 35 basis points.

You can argue that LTRO repayments are good news. Banks are repaying ECB money because their finances are healthier and they can borrow again in markets.

Strikingly, a quarter of LTRO repayments have been by banks in Spain, on the eurozone’s crisis hit “periphery”, according to Barclays. “A higher Eonia is a small price to pay for a return of investors to the periphery,” says Laurent Fransolet, the bank’s head of fixed income research.

The rises so far in Eonia are also modest compared with the peaks seen during the crisis years. What is more, repayment of the LTROs – which were the eurozone’s answer to “quantitative easing” – are making easier an eventual exit from the ECB’s exceptionally loose monetary policies.

While the Fed has struggled to calibrate manually the tapering, or scaling back, of its asset purchase programme without creating turmoil in global financial markets, the pace of the ECB’s exit is driven by the market; banks repay ECB funds as their finances improve.

Wrong kind of exit

In the long run that might arguably produce better economic outcomes. The snag is that this seems precisely the wrong time for an ECB exit.

While the LTROs were designed to avert a looming bank crisis, the ECB’s task in coming months is to prevent sharp falls in eurozone inflation from turning into a deflationary shock. The slow pace at which the Fed is unwinding its crisis policies has kept the euro high against the dollar, adding to downward pressure on eurozone prices.

Mr Draghi could try to override the automatic tightening effects of LTRO payments, but that may not be easy. Given that banks are repaying LTROs, take-up of any fresh offers of long-term ECB loans might be embarrassingly weak.

The ECB could cut its main policy rate again – already at just 0.25 per cent. Beyond that, the only alternative may be full-blown US-style quantitative easing, an option it has resisted so far.

We are not at that point yet. Mr Draghi points out rightly that there is no clear relationship between measures of “excess liquidity” and Eonia – LTRO repayments are only part of the story. But the ECB is braced for an acceleration in repayments. From this month the maturity of outstanding loans has fallen below a year, making them less useful to banks needing to impress regulators.

The warning lights are flashing in money markets.

January 24, 2014 8:57 am

Regulators warn on non-traded Reits

By Anjli Raval in New York

Investors are betting heavily on a shadowy type of US property investment even as regulatory scrutiny of the sector intensifies.

Like their publicly listed counterparts, so-called non-traded real estate investment trusts (Reits) own income-generating property portfolios. But these unlisted Reits, which raise funds through share sales by broker-dealer networks, tend to target mom and pop investors and have come under fire in recent years.

They lack transparency, have high management fees and broker commissions, and are illiquid assets that do not have mark-to-market pricing – an accounting practice that allows investors to assess the fair value of a company’s assets.

Even as criticism about the sector’s opacity by the Financial Industry Regulatory Authority has mounted, non-traded Reits raised a record $19.6bn in 2013, up from $10.4bn in 2012, according to data by Robert A Stanger & Co, an investment bank that tracks the industry. This year they are expected to hit the $20bn mark.

The securities industry’s self-funded regulator is expected to file industry guidelines with the Securities and Exchange Commission as early as next month. Non-traded Reits will be required to provide better information on fee structures and report changes in the value of underlying properties more swiftly.

Income-oriented investors have been drawn to Reits, which distribute at least 90 per cent of their taxable income to shareholders annually in the form of dividends. But as anxiety surrounding rising interest rates battered public Reit stocks last year, their private counterparts only grew in popularity.

“While some of these non-traded Reits have performed well, other companies have been very bad investments,” said Ben Strubel, president of Strubel Investment Management. “A lot of unsophisticated investors don’t know what they’re getting into and are at risk.”

Fees and commissions can rise to 12 per cent of the original investment and investors are often locked in for seven to 10 years.

Finra has warned investors that their returns, upon liquidation, may be less than the original investment. It has also flagged the dubious marketing tactics of some brokers and expressed concern about companies using leverage to pay out distributions that exceed operating cash flow.

Market participants say the influx of cash may spur non-traded Reits to make riskier property purchases, which could eventually come back to burn investors in the real estate vehicles.

This is still a relatively new industry which is moving towards lower fee structures and more frequent valuation guidelines. The demand is there for these assets

– Keith Allaire, Robert A Stanger & Co

Although a portion of outstanding shares may be redeemable annually, non-traded Reits usually return money to shareholders only through “liquidity events” such as the sale of real estate, a takeover or a stock exchange listing.

American Realty Capital Healthcare Trust, which has assets valued at $1.7bn and is headed by Reit mogul Nicholas Schorsch, is set to list its common stock in what analysts expect to be up to $20bn of liquidity events of non-traded Reits during the next two years, up from about $17bn in 2013.

“Illiquidity is not necessarily a deficiency,” said Keith Allaire, managing director at Robert A Stanger & Co. “This is still a relatively new industry which is moving towards lower fee structures and more frequent valuation guidelines. The demand is there for these assets.”