Agonizing Choices for Lives Saved by Miracle Drugs

GEETA ANAND

Updated Jan. 24, 2014 10:33 p.m. ET

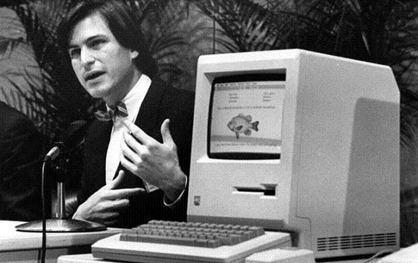

Megan’s mother, Aileen, lifts her into bed from her wheelchair after school. Lexey Swall for The Wall Street Journal;Seven months ago, Megan Crowley made a gutsy decision: to undergo a radical surgery to straighten out her spine, which has been crippled by Pompe disease. Photo: Lexey Swall

PRINCETON, N.J.—Sixteen-year-old Megan Crowley lay facedown on an operating table last June as her surgeon tried to straighten her spine, badly contorted by a genetic disease that nearly killed her as a little girl.

The doctor had warned Megan that she stood a 5% chance of dying from the risky surgery, but she eagerly chose it anyway. Her 15-year-old brother Patrick, stricken with the same rare disease, refused the procedure and awaited news of her at home.

In the operating room, an alarm suddenly blared: Megan’s nerve signals had flatlined, suggesting paralysis. “Megan, wiggle your toes!” her surgeon, David Roye, recalls yelling, waking her from anesthesia. She tried, to no effect.

Megan’s and Patrick’s choices are the kind of agonizing ones now confronting a generation of Americans like them whom biotech breakthroughs have kept alive—but haven’t fully cured.

The two have Pompe disease, which progressively weakens muscles. Until about a decade ago, heart failure killed most babies with Pompe within a few years.

The siblings’ fate turned in a remarkable family drama: Their father saved their lives by helping develop a drug that restored their hearts, a story told through several Wall Street Journal articles since 2001.

But the drug couldn’t stop Pompe (pronounced pom-pay) from degrading Megan’s muscles. By her freshman year at Princeton High School, she needed a respirator and wheelchair. She couldn’t speak clearly or smile. Her spine bent about 100 degrees.

Dr. Roye offered a risky and painful way to help Megan sit up like other kids. “I would drill screws into your vertebrae,” he told her, “and put rods in to anchor them to your ilium,” or hip bone.

Children like Megan and Patrick, having survived once-fatal rare diseases, often must decide again and again as they grow older whether to endure interventions for their diseases’ complications.

These procedures can bring a better or longer life. They also can be excruciating and, even when successful, can leave the patient waiting for breakthroughs for disabilities that remain.

Some patients decide intervention just isn’t worth the agony. Patrick also lives on a respirator with a bent back, and his muscles continue to degrade. But he refuses operations.

“No!” he screams when asked in an interview if he would consider spinal surgery.

“It’s been hard for us sometimes, and we’ve struggled with it,” says their father, John Crowley, of their choices. “But we’ve learned to accept that what makes sense for each kid is different,” he says. “We realize the risk-benefit for Patrick.”

Thousands with other once-fatal rare diseases confront lifetimes of such risk-benefit decisions. Hundreds in the U.S. with Fabry disease, which leaves patients with severe heart and kidney problems, are alive thanks to a treatment developed in 2003. But they face decisions about surgery for continued complications.

So do patients who previously would have died of Hurler-Scheie Syndrome and Hunter Syndrome. New treatments have saved lives, but patients often remain disfigured and suffer spinal compression. They confront difficult decisions about whether to undergo procedures such as spinal-fusion surgery.

People with Gaucher disease, which causes crippling bone pain, can live longer and with fewer symptoms thanks to biotech drugs first developed in 1991. But for some, the disease continues to turn their bones brittle, forcing them to decide whether to undergo painful joint surgery.

“They face an ongoing series of new challenges and unknowns that we never envisioned when we developed these therapies,” says Priya Kishnani, chief of medical genetics at Duke University Medical Center. “They’re alive and they want us to help them decide when enough is enough. Who am I to judge?”

Roughly 1,000 people are on a Pompe drug in the U.S. and face many of the choices Megan and Patrick do.

Megan, who turned 17 last month, was diagnosed with Pompe at age 1 in 1998. Tests revealed her body made a defective version of an enzyme that digests sugars in muscle cells. Those sugars built up, disrupting cell function.

Doctors diagnosed Patrick with Pompe a few months later. Mr. Crowley and his wife, Aileen, are healthy. But both carry a mutation in the same gene, giving their children a 25% chance of developing Pompe. Their eldest son, John Jr., 19, doesn’t have it.

In 1998, there was no treatment for Pompe. When doctors told Mr. Crowley the children had few years to live, he quit his job as a drug-company executive and started a biotech firm to seek a treatment.

He succeeded. In 2003, Megan and Patrick, then 6 and 5, began receiving the medicine their dad helped develop. It kept their hearts from failing.

But Pompe continued to weaken other muscles. During early elementary school, they were strong enough to sit up. Their spines started to sag by age 9. They “puddled” into their wheelchairs, Dr. Roye says.

As Megan’s body bent, her left lung compressed at age 11, making it harder to breathe and speak. Patrick suffered similar symptoms.

The siblings faced their disabilities differently. Despite her spine’s collapse, Megan whizzed around school in her hot-pink electric wheelchair. “She wants people to know she’s there,” says her homeroom teacher, Julie Dunham. “She bedazzles with her spirit and personality and her desire to achieve.”

Patrick, more sensitive to curious staring, shunned crowds and social events, retreating to his bedroom to play videogames when he could.

As the pair’s spines curved more, the risk of fracture increased. In 2011, doctors suggested surgery.

The parents balked at putting them through a procedure that wasn’t vital to survival. Anesthesia is risky for a child on a ventilator, and one with a degenerative muscle disease often doesn’t recover strength lost in surgery.

Megan changed their minds. Mr. Crowley in 2012 returned from a trip to find her room redone in pink-and-black wallpaper. He says he asked if she wanted to live with such garish colors.

“It doesn’t matter,” she replied. “In a couple of years I’m outta here.”

“Where are you going?”

“College, of course.”

It sank in: Megan, who wasn’t supposed to live to elementary-school age, might go to college. Mr. Crowley says he envisioned her bent way over, wheeling to class on a far-off campus.

““They’re alive and they want us to help them decide when enough is enough. Who am I to judge?””

—Priya Kishnani, chief of medical genetics at Duke University Medical Center

“Nothing else makes her look deformed except for her spine,” he told his wife. “Maybe we should start thinking about the surgery.”

When Megan heard there was an operation that might let her sit straight, “it was like Everest,” says Andrew Condouris, her learning aide. “Once she knew it was there, she just had to do it.”

Patrick had the opposite reaction. “No, no, no, I’m good!” his parents say he shouted when asked if he would consider surgery.

In the summer of 2012, Megan’s parents took her to Dr. Roye, a specialist in straightening children’s spines at Columbia University Medical Center. He told Megan he thought he could achieve “about a 50% correction,” he says. “Think of the operation as giving you an internal brace to keep you from collapsing into your chair.”

Then, the warning: “There is a small chance you won’t survive the procedure.”

Megan didn’t speak as they drove home, turning up Katy Perry on her headphones, she says, to drown out emotions that swung from excitement at the prospect of sitting straight to terror about possibly dying.

In October, Megan wheeled to her dad as Sunday-night football played. “I’ve made my decision,” she told him.

Mr. Crowley says his stomach tightened. The possibility of losing her terrified him.

“I want to have my operation,” Megan told him.

“Why?”

“I don’t like the way I look and I don’t like the way I feel.”

It was the first he’d heard Megan complain about her appearance. That night in the kitchen, Megan laid out a schedule. She wanted her sweet-16 birthday party in December and her surgery the next June. She would recover for junior year.

As Megan’s birthday neared, she reserved the Westin Hotel ballroom and invited 200 guests. “This might also be my wedding,” Megan told her parents—in hopes, she says, that reminding them that marriage might not be in her future would persuade them to spend liberally.

On Dec. 15, 2012, in a bright-pink sequined dress, Megan wheeled into the ballroom to Lady Gaga’s “Born this Way.” She called guests forward as candles were lighted: friends, cousins, nurses, researchers who had treated her.

She called up her dad’s colleagues from Amicus Therapeutics, the firm he heads that develops Pompe drugs. “Thank you for all that you have done for so many and for the work you continue to do to make a better medicine for me and Patrick.”

Patrick gave a short speech, saying, “I love you, Megan.” When dancing started, he grew agitated, then tearful, as he did in loud places, his parents say. A nurse sped him home to his bedroom.

In the next months, as attention turned toward planning Megan’s surgery, her parents say they asked Patrick whether he wanted the procedure, looking to make him feel included.

The repartee became a family joke. A parent would say, “Patrick, do you want…,” and they would laugh as he shouted, “no!” before the parent could finish.

On June 18, Megan’s parents checked her into the hospital with three pink suitcases. In the first of two planned surgeries, Dr. Roye drove screws into several vertebrae and cut into some of the most deformed to reshape them. He drove six screws into her forehead to attach a carbon halo to later apply traction to stretch her back.

In her room after the eight-hour surgery, Megan was unrecognizable. Her face was swollen, and her arms and legs bruised from intravenous tubes. Her parents stayed up, administering painkillers.

Later, doctors attached 10-pound sandbags on pulleys to her halo to stretch her spine. She lay faceup in traction, stitches running down her back underneath her, for two agonizing weeks, her parents taking turns holding up an iPad showing movies.

During the second surgery, Dr. Roye anesthetized her and cut her back open again, attaching metal rods to her spine. He was pulling her spine straight when the nervous impulses stopped.

The warning alarm evoked a recurring nightmare for Dr. Roye, a dream in which he takes a child’s spine apart and can’t get it together again.

He ran through a checklist he wrote for crises. Temperature? Normal. Blood pressure? Normal. Screws? None had moved into her spinal canal.

But when he woke her, nerve signals didn’t appear. He had to undo whatever damage he’d done.

He began taking out the rods. With the last out, her impulses had returned.

When Megan woke again, she knew something was wrong. Her halo was still on. With a tube in her throat, she looked at her dad and then up at the halo, demanding an explanation with her eyes.

“Megan, you did great,” he told her. “Everything went well.”

The next evening, Mr. Crowley says he finally told her the surgery hadn’t gone well. If her spine wasn’t permanently damaged, she would need a third surgery.

“You lied to me, daddy,” she repeated, crying. “You told me all my life you’d never lie to me.”

Scans showed no damage, and Dr. Roye decided to try again. “No matter what, safety must be No. 1,” Mr. Crowley says he told Dr. Roye. “If we could just have her back the way she was, we’d be happy.”

On July 12, Megan was wheeled into the operating room. At 4 p.m., Dr. Roye reported the surgery was successful, straitening her spine enough so she could appear to be sitting up.

For Patrick, though, seeing Megan in the hospital “sealed the deal” against surgery, Mr. Crowley says. He was horrified to see her in traction, wounds oozing where screws held the halo. Patrick didn’t ask to visit again.

“He doesn’t like the way he looks,” Mr. Crowley says. “But knowing what Megan went through, there’s no way he would ever consider that surgery now.”

When Megan returned home after 32 days, she set a goal: By Sept. 7, she would recover enough to go wedding-dress shopping with her engaged cousin.

That day, in a black-leather skirt and high heels—sitting up straight—Megan wheeled into a Manhattan bridal store. Gowns and mirrors were everywhere. For the first time since surgery, Megan says, she forgot she was in pain.

School started two days later. During English, Megan’s back pain grew unbearable. She left the room to cry in the hallway. “Honey, let’s just go home,” her nurse said.

“No,” Megan replied, wheeling to the classroom.

“She’s like a typical teenager in many ways,” says Mr. Condouris, her aide. “But you also see an individual who is pushing herself out there—ambitious, driven, with a real sense of who she is and what she wants to do.”

Megan and Patrick probably face lifelong complications and will need constant nursing care unless new treatments can reverse the disease. Pompe experts say they don’t yet know what life expectancy is for patients on the new drug.

Mrs. Crowley says she finds it unbearably sad knowing how frustrated Patrick is by his inability to move. But she says they take comfort that he isn’t in pain most of the time and enjoys many daily activities.

Megan has lost most leg movement. Her bones are brittle. She can move her arms enough to type on her iPhone and operate her wheelchair but is likely to lose more strength unless new treatments are found.

Still, her father says, “she thinks there’s more therapies coming for her down the road, so there’s hope.”

In the fall, he took her to buy SAT-prep books. He asked: “Are you ready yet to go to Notre Dame?” his alma mater. Megan responded that socializing was her priority.

“Notre Dame doesn’t have sororities,” her mom told her later. Megan replied: “So maybe I’ll just have to go out there and start some.”

She asked Mrs. Crowley to look at her new school photos. In years past, she approached picture day with resignation, slumped so far that her shoulder was almost at head’s level.

This time, Megan says, she rolled to the photographer excitedly.

Mrs. Crowley looked at the photos. Megan still couldn’t smile, but otherwise looked like other kids, holding up her head. “They’re really nice,” she said.

“Order some more,” Megan said. “They’re awesome.”