[TechNode 2013 Year in Review]: A Year Not So Good, Not So Bad

By Ben Jiang on January 24, 2014

After a year that saw the burgeoning entrepreneurship cutting across China in 2011 and a following year that tasted the backlash in 2012 — painfully leads to the termination of venture capital spree in addition to the shutdown of innumerable failures, we are now at the end of 2013 and looking back at a year which is neither so good nor so bad for Chinese TMT industry.

IPO Window Reopens

I’ll start with the not so bad part. Just so you know, 2012 was a dud for both the startup and venture capital world with only two startups made it to the public market — YY(NASDAQ:YY) and VIPShop(NYSE:VIPS). The gloomy picture was mostly painted by the sustained worldwide economic downturn and worries over accounting fraud that dogged and derailed several China concept stocks over the past two years. Now in 2013 that picture – which apparently was put upside down — turned around and turned out to be a masterpiece. We have six companies, including 58(NYSE:WUBA), 500Wan(NYSE:WBAI), AutoHome(NYSE:ATHM), Lightinthebox(NYSE:LITB), SUNGYMobile(NASDAQ:GOMO) and Qunar(NASDAQ:QUNR), successfully pulled off long-awaited IPO.

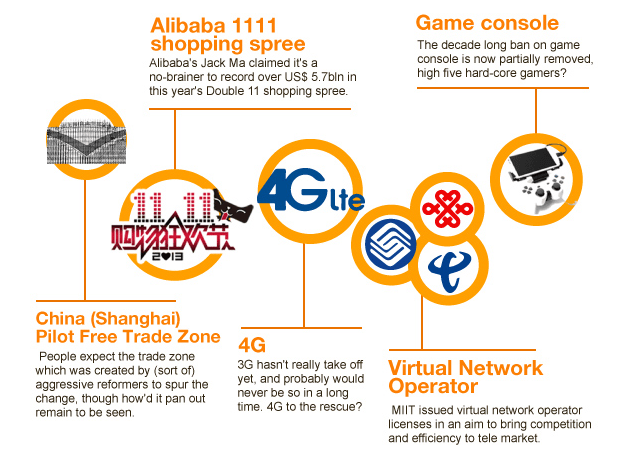

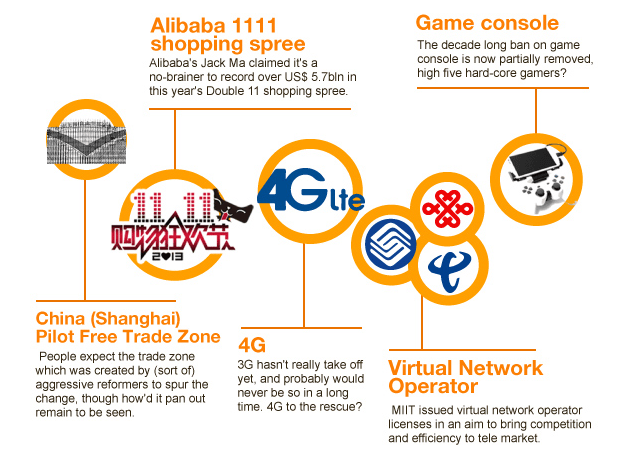

Breakthroughs that set for changes

As IPO is just one of the many facets of a vivid and persuasive evidence to testify that 2013 isn’t a bad year, We also outlined below some breakthroughs that someday in the near future would have more material influence on Chinese economy with the power of Internet, new technology as well as political reform.

I think there is little argument that the groundbreaking set-up of China (Shanghai) Free Trade Zone topped the first place of the breakthrough candidates. Despite the fact that some optimists pointed out a parallel between this and the reform and open-up policy that leads China to what it’s achieved today, we are neither too optimistic nor will we play down its significance. While the trade zone indeed was created by aggressive (sort-of) reformers to spur changes in China, how’d it pan out remain to be seen. And, economic and political significance aside, at least hard-core Chinese gamers will applaud for the FTZ as the decade long ban on the sales of game consoles are lifted within this zone. High five? Ok never mind.

3G never really took off in China. In an effort to balance the inequities among Chinese carriers, MIIT did a little gimmick to issue WCDMA – advance technology, widely adopted by manufacturers, carriers worldwide – license to China Unicom the weakest one of the Chinese carrier trilogy while China Mobile the world’s largest carrier were obligated to build up the home-grown TD-SCDMA technology.The result is palpable, a small chunk of China Mobile users fled to either China Unicom or China Telecom (operates CDMA2000) for faster mobile Internet access, while the others stick around. Out of China’s 1.1 billion or so subscribers, 3G subscribers stand at a mere 234 million.

To solve the dilemma, MIIT finally granted 4G licenses to the carriers after a whole year of speculation and wait, hoping that the new standard could get people out of the 2G camp, while all the carriers are supposed to use the Beijing-backed TD-LTE technology, China Unicom and China Telecom were also seeking to apply for FDD-LTE license “as soon as practicable”.

China Mobile, which was muted by poorly-received TD-SCDMA, has already launched commercial 4G services with enthusiasm and wall-to-wall campaign in many cities with wider and more aggressive rollout in the coming years. Personally, some of my friends who sticked around already flipped the LTE switch on by getting an iPhone 5s. Speed? Bloody fast. Disadvantage? Poor coverage.

But it’s only getting better.

Interestingly, MIIT the bureaucratic slow mover and telecoms regulator of China caught everyone off guard by announcing a flurry of announcements in the final weeks of 2013. Well, good news always comes when least expected. MIIT also issued the highly speculated virtual network operator licenses to 11 Chinese companies (including Alibaba and JingDong) on December 26. Currently Chinese telecom market is dominated by the big three carriers, the introduction of virtual network operator is expected to bring some competition and efficiency to the market.

Our readers would certainly be sure that mobile internet is now a mega trend in China: entrepreneurs are doing it, investors are checking on it, journalists are bragging about it. And a faster and more ubiquitous 4G services is expected to boost it to the next level and change Chinese people’s daily life in many ways.

Speaking of changing daily life, I guess the vigorous ecommerce empire pumped up by Alibaba deserves a vote. The company recored north of RMB 35 billion yuan (USD 5.7bln) in this year’s Double 11 shopping spree, breaking its own recored from last year. In comparison, America’s CyberMonday hit 2.29bln. Jack Ma, the legendary founder and chairman of the group later on divulged that the transaction volume was just a no-brainer, the company could easily crank it up to 100bln in the years to follow. Ambitious!

Numbers aside, we Chinese people who live here did felt the gradual and accelerated replacement of brick-and-mortar stores by virtual storefronts. What people used to say of anyone of Chna’s small commodity markets, where you could get almost anything, now they say of Taobao. The Chinese e-tailing platform provides everything ranging from clothing, food, electronics, cars, home decors to even improper items such as aircraft/island/human body parts, you name it, you find it.

2013 goes down as the most active for Internet M&A

As aforementioned are the breakthroughs emerged in the past year that’d be shaping up China towards a better direction, we also noted a maybe less profound but more practical change on the market that overrides the stereotype of Chinese Internet conglomerates. They DO know what M&A is.

Baidu grabbed 91 Wireless the largest Chinese app distribution platform from NetDragon, the whopping 1.9bln dowry made the deal the largest acquisition in Chinese Internet industry. It also gave Baidu access to a fast-growing and lucrative mobile Internet market. 91 Wireless manages 91 Assistant and HiMarket, tow of the leading app distribution service in China through which over 10 billion apps have been downloaded.

As Baidu is catching up on mobile front, Tencent and Sogou are coveting Baidu’s search business when they forged an alliance that saw Tencent bought 36.5% of Sogou with US& 448mln and packed Soso into Sogou.The new company would operate under the Sogou brand. Actually, from appearance nothing seems to have changed after the merger, Baidu 360 and Sogou ranked top 3 in terms of market share. Same old same old. But please be sure that the new Sogou is determined to take down 360 to become the second largest player.

And right after the merger, Sogou CEO Wang Xiaochuan said that some users of its Sogou Internet Browser running 360 Safe Guard complained about having the browser removed without their consent. The finger-pointing suggested that Qihoo was compromising Sogou on purpose, which came as no surprise given the company’s failed attempt in bidding for Sogou and its past repeated involvements in this kind of practice to rival against competitors.

A new acronym BAT was coined this year to represent Baidu/Alibaba and Tencent, three of the largest Chinese Internet companies with across-the-board services, as Baidu and Tencent both made fruitful deals in many areas this year, the one who is at a genuine spree should be Alibaba.

The ecommerce giant treated itself with a little bit of something in almost every sectors: from Xiami (online music), Zhong An (internet finance), Weibo (social media), AutoNavi (mobile map), Meituan (O2O, daily deal)UMeng (data analysis), Kanbox (cloud storage), LBE (mobile security), DDMap (O2O, e-coupon), Kuaidi (O2O, taxi hail app), Quiexy (overseas investment, app search service), ShopRunner (ditto, ecommerce) and Fanatics (ditto, sports retailer). Looks like Alibaba was trying to dip its toes into everywhere.

To wrap up, 2013 is a year that destined to go down as the most active for Internet M&A wave with Baidu, Alibaba and Tencent as the major drivers.

Xiaomi becomes a cult

Now let’s move on to the company of the Year. I personally haven’t tried anyone of those sensational popular Xiaomi phones, but my stubborn and ignorance did nothing to diminish Xiaomi’s status as a new cult here. According to Lei Jun, founder and CEO of the Chinese handset manufacturer founded three years ago, the company sold 18.7mln Xiaomi phones in 2013, up 160% from last year, while its revenue reached US$ 5.22 billion. The company was valued at over US$ 10bln in its latest round of financing compared to Nokia’s US$ 7.17bln sale to Microsoft. Besides, Xiaomi managed to nab Hugo Barra, a highly regarded Android team exec from Google, right in the middle of last year to steer its global expansion effort.

Good sales, wide prevalence, upbeat valuation and international effort all propelled the up-and-coming mobile vendor into our Company of the Year category.

Lei Jun, starts a business at 40

Since Xiaomi made it to the Company of the Year, the man behind it naturally emerged on top of our choices for People of the Year, and we thought Lei Jun, the founder and CEO of Xiaomi, well deserves it for a threefold reason:firstly, he made Xiaomi a huge success; secondly, he made Xiaomi a huge success; thirdly, he made Xiaomi a huge success.

In his late 30s, Mr. Lei already made his name for being a successful Jack of all trades and quite a figure in China Internet industry: as a professional manager, at him helm Kingsoft the Chinese software slash online game developer launched initial public offering; as an angel investor, his portfolios scattered around everywhere with YY landed an IPO last year; as a tech billionaire and happily married father of two, he basically had way more than what the world would expect from a middle-aged man.

Yet he didn’t feel completely fulfilled. He yearned to create a world-class company, a dream planted deeply in his heart in his early years.

The day he turned 40, he invited some friends over to a teahouse, and blew their mind by telling them he’d start a new business to make smartphone, he believed there was huge untapped potential in this area. Regardless of concerns over funding difficulty, failure among other things, he got started anyway. Now three years after, Mr. Lei’s Xiaomi not only took firm grip on its home turf, but also would expand its geographic footprints to overseas market such as Singapore soon.

Given Mr. Lei’s diligence, audaciousness and vision, we tapped him as this year’s People of the Year.

Now after all the sweet talks, it’s time to shed light on some tough realities. Just like the two sides of a coin, the past year wasn’t so bad, nor was it that good.

2013 is a lost year in terms of creativity and innovation. While people are applauding that BATs didn’t follow through on their copy-and-kill startups practice this year and generously offer them with big check instead, the unspoken fact is that M&A has replaced innovations. Now the big names couldn’t care less about curating mind-blowing new ideas that being challenged by big chances of failure despite a slight hope of becoming successful and transforming people’s life in some ways. They just went out with _strategic_ shopping and then arranged the acquiree like they’re the pieces in a chess match. All that matters is to gain the upper hand of your rivals and for that matter some pieces are doomed to be given up, the ultimate goal is to deliver checkmate.

While we couldn’t bank on the top-down innovation initiative, the bottom-up one also failed to work. The more popular Xiaomi became, the more sales-sensitive the company was. Xiaomi shipped its latest update to its handset with the launch of Xiaomi 3 and received mixed comments. Albeit a larger screen, battery that last longer, faster CPU and better camera,there’s no significant raise in price. This is one of the characteristics that made it successful – to offer high performance smartphone at relatively low price. However, some did find the iteration cycle of stacking up hardwares become more dull and less fun.

In all fairness, Xiaomi certainly isn’t the epitome of lack for creativity, the big guys are doing much much worse. Take Baidu the Chinese counterpart of Google for instance, at the company’s annual conference, it unveiled a new solution dubbed Light App to tap into mobile area. Since Light app basically is the rebranding of the web app solution once highly promoted by the search giant, what are we expecting for next year? Lighter App or Super Light App? Its pricey but worthwhile acquisition of 91 would do better to give it a quicker and easier access to mobile world.

Some might argue mentioning the smartwatch or smart router wave, aren’t those innovative enough? Listen, let’s don’t jump to conclusion so fast before you lay your hands on a smart watch, as for router, you mean a router with built-in features to block the pre-roll from online video sites? Not so much. There might be something coming out from them in the years to come, but not interesting enough for the time being.

For better or worse, 2013 is now a bygone and just like what Alfred Tennyson said, it’s not wiser to weep a lost, we might as well “trim our sails and let old bygones be” and to create a brave new tech world in 2014.