The Death Of Hedge Funds?

May 15, 2014 Leave a comment

The Death Of Hedge Funds?

Tyler Durden on 05/09/2014 21:43 -0400

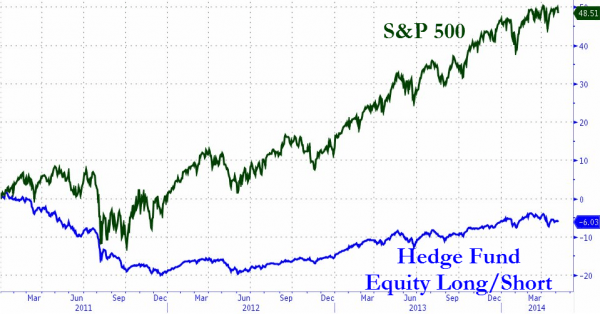

With the very largest and most experienced of hedge fund managers vociferously commenting on the “Truman Show” mirage of the markets, the danger of currently policies (there is no way to tell exactly how it all will end. Badly, we guess), and the need for stock-picking prowess, we thought the following chart might highlight the dawning of the death of an entire substrata of so-called hedge-fund managers (and not just the $0 AUM newsletter publishers) who appear unable to “stockpick” their way out of a Fed-provided paper bag. Since Q4 2010, Long/Short funds are down 6% while the immutable low-cost levered wealth creation policy vehicle of choice for the Fed (the S&P 500) is up almost 50% (dividends aside).

There’s “hedged” funds and then there’s this…

Which is not surprising given what we previously noted…

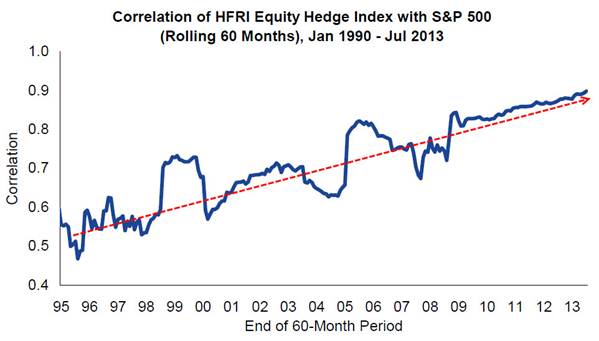

Hedge fund managers have become high cost version of their index-tracking ETF brethren…

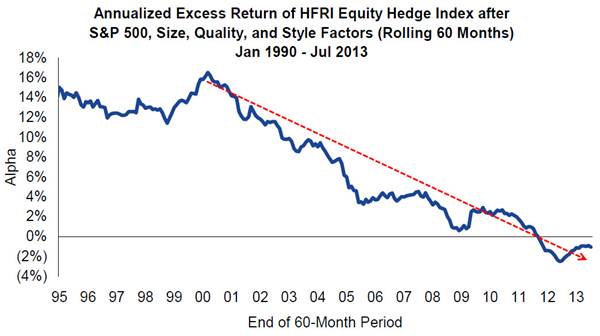

And performance advantages have dwindled…

as style tilts (growth vs value for instance) have seen increasing correlations…