The economically acceptable limits of a Chinese property downturn

May 15, 2014 Leave a comment

Won’t somebody think of the property developers?

David Keohane | May 09 09:44 | 1 comment | Share

And so it goes, from Nomura’s Zhiwei Zhang:

Today’s 21st Century Business Herald reports that in Jiangsu Province the Rongchen Property Development Co. Ltd. defaulted on a RMB100m trust product that came due last August. The paper says that as yet the principal and interest have not been fully paid.

Separately, in Zhejiang Province, risks have increased with regard to entrusted loans totalling about RMB5bn made by 19 listed companies (as of end-2013) to mainly small and medium-sized property developers. These loans were extended at interest rates ranging from 7.25% to as high as 25%. Almost all entrusted loans made by one of the listed companies, Sunny Loan Top Co. Ltd., were extended to property developers at annual rates above 18%. The paper reports that some RMB600m of entrusted loans extended by four companies have either.

We know they said they’d tolerate defaults, but we wonder how far that tolerance will run… Separately, Barc has its report out on China’s tottering property market (click to enlarge):

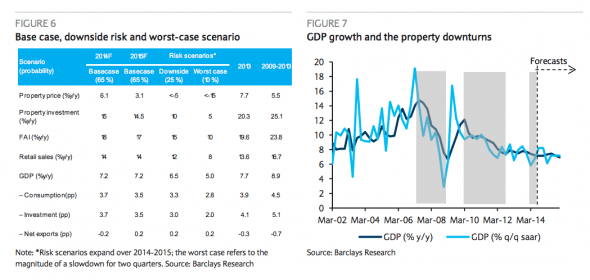

That’s a 25 per cent chance of a 10 per cent correction leading to drop in GDP to 6.5 per cent, and a 10 per cent chance of a hard landing where GDP falls below 5 per cent — not a nuts suggestion: the sector’s overall contribution to GDP is put at something close to 20 per cent and property is the main type of collateral used for borrowing by corporates and local government investment vehicles. Reduce the property values, reduce the collateral values and hit banks’ balance sheets. And that’s before getting to the shadow banking sector, which provides funding to the developers and related businesses. Similarly, UBS saw a 15 per cent probability that a sharp property downturn could lead to GDP growth dropping to a 5 per cent handle in 2015. That’s the same UBS which argues that following the post-global-financial-crisis property and infrastructure boom, and given the already high overall leverage, the room and effectiveness of policy support may be limited compared with a few years ago.

More in the usual place but here’s Barc scaring other more dramatic sell-side analystswith talk of longer-term reform over short-term stimulus and maybe saying the same thing as UBS in a slightly different way:

Since taking office, the Xi-Li government has avoided making high-profile comments on the property sector, despite the continued rise in house prices in 2013. Their only substantive comment on the sector has been: “…to improve the mechanism for providing adequate housing, curbing speculative and investment demand, and promoting sustained and healthy development of the market.” This is in contrast to the previous government, which introduced many administrative measures and have vowed repeatedly to “resolutely regulate the real estate market, and bring the house prices down to a reasonable level”.

In our view, the Xi-Li government is well aware of the risks posed by the property sector. And they do not want to prick the property bubble. Rather, we think they have in mind a package of measures, which are more structural than cyclical in nature, and more market- based than administrative, to facilitate a healthier development over the longer-term. The government recognises that the ongoing structural reforms will have important implications regulate the real estate market, and bring the house prices down to a reasonable level”.

We wonder how long they’ll stick to that, if it’s a choice of course.