Will Berkshire Hathaway Be Worth $1 Trillion by 2030?

May 15, 2014 Leave a comment

Will Berkshire Hathaway Be Worth $1 Trillion by 2030?

by Published on May 09, 2014

by Thomas Young

Berkshire Hathaway (BRK.A – Snapshot Report) (BRK.B – Analyst Report) is worth about $315 billion, up about $270 billion since January 2000. Given the incredible $20 billion per year average gain in market value as the backdrop, one might wonder–will Warren Buffett be alive when Berkshire Hathaway is worth a trillion? What would drive Berkshire to that level?

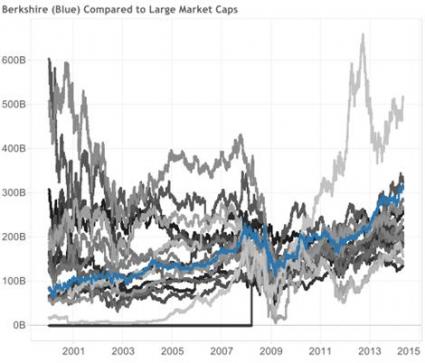

First, here’s a look at how Buffett’s empire has grown over the past 14 years.

Berkshire regularly gained ground until December 10, 2007, at which point Berkshire shed about $110 billion in market value, dropping to as low as about $111 billion on March 5, 2009. Since that March 2009 trough, Berkshire is up about $215 billion.

Here’s a look at how Berkshire has performed against the other large market cap companies in the U.S. Overall, Berkshire has gone from middle of the pack player ten years ago to third or fourth largest, depending on the month.

One Trillion Dollar Valuation… Really?

So, could Berkshire reach $1 trillion in market cap before the Oracle of Omaha moves on to the next world?

Mr. Buffett is 83 years old. Given Warren’s generally good health and active mind, it’s certainly possible, perhaps likely, that Mr. Buffett could live to be 100, or another 17 years.

At a current market value of about $315 billion, how much in market cap per year over the next 17 years does Berkshire have to gain to reach $1 trillion?

The answer is surprisingly easy. Berkshire has to grow at about 7% per year, or, on average, about $40 billion per year. In all likelihood, Berkshire will be worth over $1 trillion by 2030. Presuming Mr. Buffett wants to live to see the trillion dollar day, all he needs to do is continue to walk briskly a few miles per day and keep his mind actively engaged.

Given how “easy” it would be to reach $1 trillion by 2030, one might ask—when could Berkshire realistically reach $1 trillion in market cap?

Here are three items that Berkshire will need in order to be worth $1 trillion by 2020:

(As a note, reaching $1 trillion by 2020 equates to an average annual growth of about 18%. Berkshire’s book value over the past 48 years has averaged a little less than 20% per year.)

Great Buys

First, Berkshire owns significant stakes in a broad array of industries, including insurance, utilities, energy, manufacturing, building products, retail, media, and various other broad industries. How could Berkshire return market-beating returns while simultaneously holding such a large portion of the broader market?

The answer: acquisitions. Recently, Berkshire purchased Burlington Northern Santa Fe Corporation for $26 billion, representing the largest acquisition in the company’s history. On top of Northern Santa Fe, Berkshire’s acquisition spree has included Lubrizol Corporation for $9 billion, large portions of H.J. Heinz Co., and Gannett.

Hidden Gems

Second, Warren needs to again make great selections in terms of distressed purchases. During the deep portion of the financial recession in 2008, Berkshire purchased significant amounts of preferred stock in Goldman Sachs (GS – Analyst Report), GGE, Bank of America (BAC – Analyst Report), and Wrigley for over $25 billion.

Mr. Buffett’s shrewd and uncanny ability to buy during times of stress makes it highly likely that any downturn in the coming few years would present the opportunity for Mr. Buffett to return much higher returns than the market. History may not repeat itself, but personalities do.

These two would certainly provide the boost to beat lackluster analysts’ earnings estimates (see below).

Berkshire Hathaway Inc – Quarterly Earnings Per Share | FindTheBest

Strong Economy

Third, the economy re-accelerates. Here’s a look at analysts’ recommendations on Berkshire. Overall, a moderate buy has been the norm, with some upward movement this month. These recommendations are largely the result of analysts’ views that the economy will continue to be weak for some time.

Berkshire Hathaway Inc – Analyst Recommendations Over Time | FindTheBest

Bottom Line

In all, with a high degree of chance, Berkshire may reach $1 trillion in market cap before Mr. Buffett meets his maker. Under other various scenarios, there’s a good chance Buffett’s empire may surpass $1 trillion by 2020. All he needs is some distressed companies, fear, and/or a heating up economy.