Gloom deepens for China property developers

May 20, 2014 Leave a comment

Gloom deepens for China property developers

May 9, 2014 11:44amby James Kynge

The torrent of bad news for Chinese property developers shows no sign of letting up.

Unsold floor space continued to surge in April. Two small developers are reported to be slipping into financial distress. The total net profits of 117 domestically-listed developers posted a 27 per cent decline in the first quarter to Rmb9.65bn. The bearishness of investment bank analysts, meanwhile, is plumbing new depths.

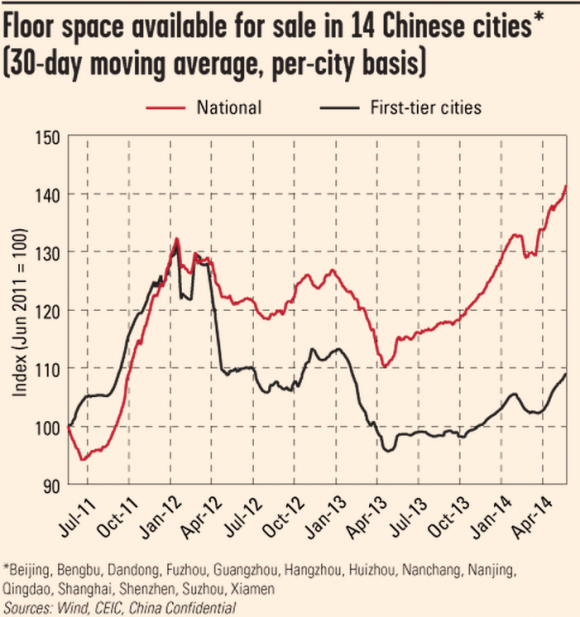

This chart from China Confidential, a research service at the FT, shows what is amiss – a surge in unsold real estate inventory. The red line shows a moving average of unsold inventory in 14 cities nationwide, while the black line shows a less dramatic trend in first tier cities – Beijing, Shanghai, Shenzhen and Guangzhou.

Source: China Confidential

The amount of residential floor space available for sale in the 14 cities monitored by China Confidential rose 25 per cent year on year in April, while in second and third tier cities the rate of increase was higher at 31 per cent year on year. Unsold housing units rose to the equivalent of 1.1 years of transactions in April in 10 cities for which data was available, up from an average 0.7 years in 2013.

Small developers in distress

Stress among smaller developers is growing more acute. The Shenzhen-based Guang Real Estate Group failed to complete and hand over homes to buyers on time in the southern city of Huizhou because of financial problems, Reuters quoted Guang executives as saying.

Meanwhile, the 21st Century Business Herald newspaper reported that a small developer, Rongchen Property Development Co, had defaulted on a Rmb100m trust product that came due last August. The principal and interest have yet to be paid, the newspaper said.

These episodes follow the distress at Zhejiang Xingrun Real Estate, a developer based in the coastal city of Ningbo, which was on the brink of bankruptcy in March. State media reports have estimated that Zhejiang Xingrun owes 15 domestic banks Rmb2.4bn and individual investors another Rmb1.1bn, but has only Rmb3bn in assets on hand.

Sales slump is hitting investment in new projects

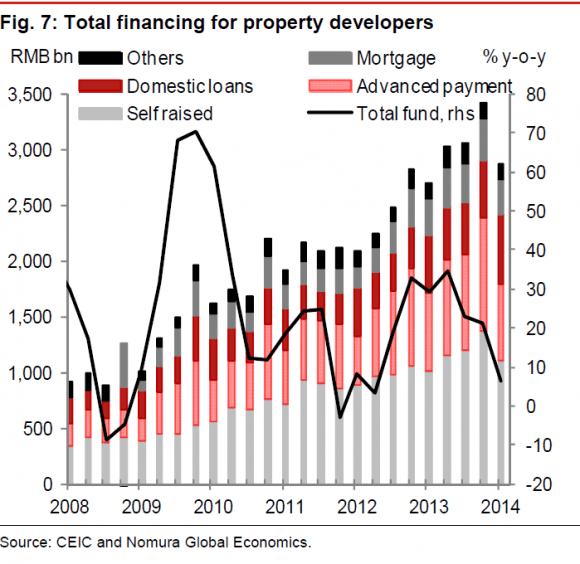

This chart from Nomura below shows the clear correlation between dwindling sales and developers’ ability to raise finance from different sources. One key source – self-financing – includes funds borrowed from shadow finance sources such as trusts, which have been hit this year.

Advance payments are also down significantly. This is mainly because revenue from downpayments from real estate buyers (at least 30 per cent of the price of a unit for first homes and at least 60 per cent for further homes) have fallen with sales volumes.

Source: Nomura Securities

Indeed, the slide in finance is already having palpable effects. The value of land bought by developers for future projects has tanked since the start of this year. According to Centaline, a consultancy, the top 20 developers by sales bought Rmb60.1bn of land in January, Rmb32.56bn in February, Rmb25.45bn in March and a paltry Rmb13.3bn in April.

But although investment growth (see chart below) has traced the plunge in sales values, it has yet to sink to the subdued levels that were seen in early 2009 or even mid 2012 – perhaps suggesting that investment growth has further to fall.

Source: Nomura Security

Analysts’ bearishness plumbs new depths

David Keohane at FT Alphaville has been tapping some of the latest analyst thinking on how far this downturn could go and what sort of an impact it may have on the wider economy.

(Barclays sees) a 25 per cent chance of a 10 per cent correction leading to drop in GDP to 6.5 per cent, and a 10 per cent chance of a hard landing where GDP falls below 5 per cent — not a nuts suggestion: the sector’s overall contribution to GDP is put at something close to 20 per cent and property is the main type of collateral used for borrowing by corporates and local government investment vehicles.

Similarly, UBS saw a 15 per cent probability that a sharp property downturn could lead to GDP growth dropping to a 5 per cent handle in 2015. That’s the same UBS which argues that following the post-global-financial-crisis property and infrastructure boom, and given the already high overall leverage, the room and effectiveness of policy support may be limited compared with a few years ago.