How China Is Eclipsing Japan in Asia

May 23, 2014 Leave a comment

May 13, 2014

How China Is Eclipsing Japan in Asia

China’s latest tangle with Vietnam plays into Japan’s bid to ramp up influence in Asia, as Tokyo offers leadership to counter Beijing’s saber-rattling. (Here, here and here.)

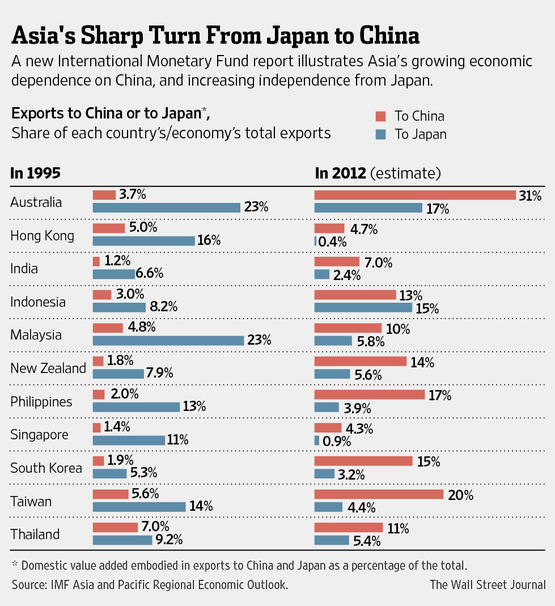

A new International Monetary Fund report offers a sobering reminder of the limits of Japanese clout, highlighting the growing reliance of regional economies on China, and the declining economic importance of Japan, as shown in the accompanying graphs.

In the latest Regional Economic Outlook for Asia and Pacific, the IMF compared how much 11 export-dependent Asian economies depended on Japan and China, first in 1995 and then in 2012. In the mid-90s, all 11 relied more on Japan than China as an export market. Less than two decades later, 10 of those countries were more dependent on China, most by wide margins. The one exception: Indonesia, which still sold somewhat more to Japan.

The numbers reflect both Japan’s dramatic decline in importance over nearly 20 years of stagnation, and China’s rapid rise.

The IMF doesn’t look at raw exports, but a country’s “value added embodied” in exports. That’s the portion of an exported product made in a country, stripping out the value of components imported from elsewhere included in that product.

By that measure, Malaysia sent nearly one-quarter of its exports to Japan in 1995 — and just 6% in 2012. At the same time, its reliance on China doubled, to 10%. Back then, Australia was about six times more dependent on Japan. Now, it’s nearly twice as dependent on China.

The data was part of a broader study looking at how economies in the region are becoming more integrated . “China is at the core of this, both as an assembly hub, and, increasingly, as a source of final demand,” said Romaine Duval, an IMF economist specializing in Asia, in an interview. “By contrast, Japan’s role, which was very crucial in the 1990s, is declining very rapidly.”

The data are a reminder of the constraints on U.S.-Japan efforts to contain China’s influence, and to build an Asian economic bloc that may exclude China, notably through the Trans-Pacific Partnership trade pact currently under negotiation.

Japanese officials say that regional influence goes beyond the size of a country’s economy. They argue that Japan — in partnership with the U.S. — offers a model of free-market democracy that other countries in the region aspire to emulate. China offers money, but no model, they assert. And China’s territorial ambitions give Japan shared cause with smaller neighbors.

And beyond the top-line data, the economic story is a bit more complex. A significant share of trade with China is in parts that ultimately end up getting sold to companies or consumers in industrialized countries. That makes the U.S., Europe and Japan more central than the data might suggest.

Mr. Duval notes that Asia’s two largest economies perform different functions in the regional production process. Japan still plays a bigger “upstream” role than China in regional trade — that is, providing sophisticated components — while China’s role is more “downstream,” that is, handling final assembly.

“Japan’s role is still big as a supplier in the region,” said Mr. Duval. “But that’s more like a footnote.”