The following article is extracted from the Bamboo Innovator Insight weekly column blog related to the context and thought leadership behind the stock idea generation process of Asian wide-moat businesses that are featured in the monthly entitled The Moat Report Asia. Fellow value investors get to go behind the scene to learn thought-provoking timely insights on key macro and industry trends in Asia, as well as benefit from the occasional discussion of potential red flags, misgovernance or fraud-detection trails ahead of time to enhance the critical-thinking skill about the myriad pitfalls of investing in Asia at the microstructure- and firm-level.

Dear Friends and All,

Keepers of the Flame: Revisit into the Origins of Compounders in India and Asia

“A person or an organization may be down temporarily due to circumstances beyond himself or herself. But he or she may rise up from the values they held fast as keepers of the flame”, a Tata executive shared with me this belief over lunch during our business trip to India from 7-17 Dec and he handed us the Keepers of the Flame: A Century of Trust, a limited-copy DVD film on the life and times of the three great Tata stalwarts: Jamsetji, JRD and Naval.

Tata Group, with a total revenue of over $100 billion, is special among all MNCs in the world. Its mission is more than just economic. What makes Tata different is that its societal purpose powered its economic progress. Like Korea’s Samsung Group with Samsung Electronics as the flagship cashcow vehicle accounting for 70% of the market value of the sprawling conglomerate, the flagship Tata company is Tata Consultancy Services (TCS IN) which has a market value of $67 billion. Other major listed companies include Tata Motors (TTMT IN, MV $17.7bn), Tata Steel (TATA IN, MV $6.5bn), Tata Power (TPWR IN, MV $3.5bn), Titan Industries (TTAN IN, MV $3.2 billion), Tata Global Beverages (TGBL IN, MV $1.5bn), Tata Communications (TCOM IN, MV $1.3bn), Tata Chemicals (TTCH IN, MV $1.1bn), Taj Hotels (IH IN, MV $750m), Voltas (VOLT IN, MV $610M), Tata Teleservices (TTLS IN, MV $222M) and Tata Elxsi (TELX IN, MV $182m). The increasing criticism for these mega Asian giants is that they have grown too diverse and unwieldy to manage and potential internal family conflicts fighting over the economic ownership of the flagship cashcow vehicle has distracted the management in neglecting the value creation of the other multiple smaller pieces in the entire group.

As I buy a Titan Edge watch as a gift for my dad, the Bamboo Innovator pondered upon how Tata demonstrated their commitment to the idea that local society can develop local talent in the most adverse of circumstances. In 1987, the Tata Group formed a JV with the Tamil Nadu government (TIDCO) to open a watch-making factory in the remote south Indian city of Hosur, training the locals to be world-class horologists instead of taking the “efficient” short-cut way of staffing the place with professional engineers from elsewhere. Today, Titan Industries is the world’s fifth largest wrist watch manufacturer with more than 60% domestic market share and exports watches to 32 countries around the world, with their core expertise in precision engineering powering innovations such as the world’s slimmest wrist watch branded as Titan Edge. The Tata Group talks not of conquering markets but of serving people. As JRD always say, “What comes from the people must go back to the people, many times over.” The Tata experience suggests that the most resilient value companies are those created by action, by doing things, by engaging with people, by revealing and making explicit the firm’s values and then living by them, consistently, day after day after day.

What was shared by the Tata executive echoed the lifelong research work of the Bamboo Innovator: Why is it that some companies or people are able to bounce back from a crisis or challenge to scale greater heights, while others, particularly previously successful ones, remain in a state of protracted consolidation or even decline? Answering this question will illuminate the path for value investors to identify and invest in the emerging compounders and undervalued wide-moat innovators in Asia in the next five years.

Having spent the past decade plus in the miasmic Asian capital jungles interacting with the top management of Asian companies in various countries and sectors, we started to see how the mental model of the Bamboo can help to explain the underlying sources of moat creation and sustainability in outperforming value creators. We coined these compounders Bamboo Innovators, compounders who bend, not break even in the wildest of storms that would snap the mighty resisting oak tree. Due to their unique business models, the Bamboo Innovators are often overlooked, neglected, misunderstood and underappreciated, presenting mispricing opportunities for the value investors. The usual statistically cheap stocks in Asia are Extractors, either value traps with misgovernance issues with the controlling share owners extracting wealth from minority investors or fraudulent companies with the syndicates-insiders lying in wait.

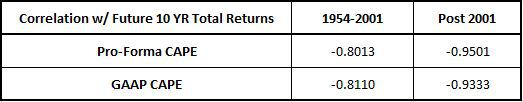

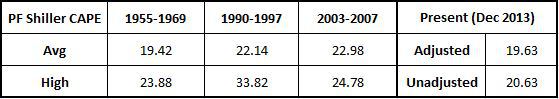

As we head towards 2014, it is worthwhile for value investors to pause and relook into the wealth creation and destruction process of Compounders Vs Extractors. Value investors need to look beyond the aggregate market PE figures since the widening valuation chasm between the Compounders and the Extractors has distorted the “average” overall PE number; the quality wealth creators are rather pricey while most of the “cheap” companies are Extractors. In one of the figures extracted from Motilal Oswal’s 18th Annual Wealth Creation Study (2008-2013) forwarded to me by the accomplished and thoughtful value investor Hemant Amin (Part 1, Part 2), also head of the BRKets (www.brkets.com), we can see that the wealth destroyed in the Indian market during 2008-13 is at an unprecedented high of INR 17 trillion ($276 billion), nearly the equivalent of the total wealth created by the top 100 companies!

Source: Motilal Oswal 18th Annual Wealth Creation Study (2008-2013)

Source: Motilal Oswal 18th Annual Wealth Creation Study (2008-2013)

Value investors in Asia cannot look purely at quant “valuation” metrics since many business models and moats are “permanently impaired” and these stocks are the fertile ground for momentum traders and nefarious insiders who have the incentive and power to manipulate prices and volumes. Value investors who attempted to invest in these statistically cheap stocks in Asia have found themselves facing deadweight losses in their portfolio. We observed firsthand how these compounders grew from strength to strength, especially in difficult times during the 2007-09 Global Financial Crisis, while others, such as some Singapore SME business owners, grew to become either contented with what they have achieved or disillusioned with their core business, straying to seek “growth” for their private interests such as property development, or simply numbing/”exciting” their senses with destructive lifestyle at the MBS/RWS casinos while treating both their listed business vehicles as a personal ATM and their employees as disposable expenses rather than as valuable intangible assets. The listed companies belonging to the latter group become dangerous value traps; some even slipped into conniving with “syndicates”. Financial numbers were “propped up” artificially with the prospects of sexy growth projects to lure in funds from investors and the studiously-assessed asset value has already been “tunnelled out” or expropriated. Western-based accounting fraud detection tools and techniques have not been adapted to the Asian context to avoid these traps. And the Bamboo Innovator has seen how the perpetrators go away scot-free and live a life of super luxury on minority investors’ hard-earned money. Of course, it is often said that if one’s hands are kept clean in the front-office of financial services industry in Asia, one cannot be wealthy. When investors have knowledge in their hands, we have a choice to stay away from these people and away from temptations and do the things that we think are right. With knowledge, we have a choice to invest in the hardworking Asian entrepreneurs and capital allocators who are serious in building a wide-moat business.

Note also that the percentage of wealth created by the top 100 wealth creators during 2008-2013 is also at an all-time high of 93%, as compared to merely 2% from the start of the Asian bull market during 2005-2010 when the Sensex index was 6,000 (now 21,000), while the Shanghai index is up from 1,200 to around 2,100 over the same period. The situation in India is a reflection of the broader Asian market: Shareholder wealth gain is increasingly concentrated amongst a core group of compounders whose management have been focused on building up scalable business models quietly to last the distance and were consolidating the industry to make market share gains or introduce new innovative products and services to fulfill unmet needs of the customers.

The Godrej Group is part of this core group of around 200-plus Asian Compounders which have the “highest order of competitive advantage” that is beyond fitting them into the usual Porter-style matrix of “low-cost” or “differentiation” strategy, as shared with us by Mr G Sunderraman, the Head of Innovation and EVP at Godrej & Boyce, the holding company of the reputable Godrej family at their corporate headquarters at Vikhroli in northeast Mumbai…

To read the exclusive article about the inner workings of the Indian and Asian compounders in full, please visit: