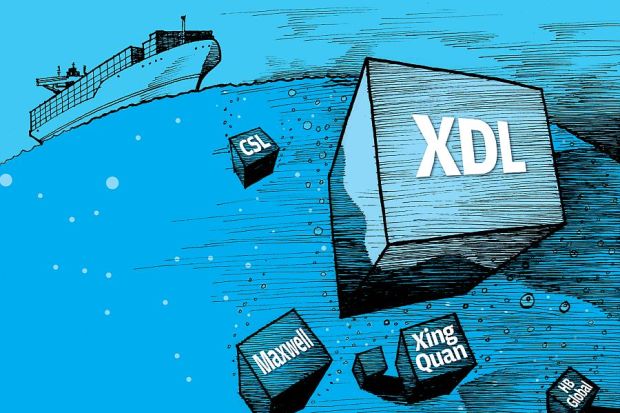

The following article is extracted from the Bamboo Innovator Insight weekly column blog related to the context and thought leadership behind the stock idea generation process of Asian wide-moat businesses that are featured in the monthly entitled The Moat Report Asia. Fellow value investors get to go behind the scene to learn thought-provoking timely insights on key macro and industry trends in Asia, as well as benefit from the occasional discussion of potential red flags, misgovernance or fraud-detection trails ahead of time to enhance the critical-thinking skill about the myriad pitfalls of investing in Asia at the microstructure- and firm-level.

The weekly Bamboo Innovator Insight series brings to you:

Dear Friends and All,

Dairy Compounders Ignore Macro QE Noises: Bega Cheese +130%, PT Ultrajaya Milk +230% YTD

At the Singapore Cricket Club last Thursday, the Bamboo Innovator had lunch with one of our subscribers, Mr Hemant Amin, a highly accomplished and astute Indian value investor who runs a global industrial raw material procurement house and his own multi-million family office with concentrated bets in stocks such as Infosys which delivered over 60 times in handsome returns. Hemant also heads a value investor group called BRKets (www.brkets.com) with 11 other members. The name BRKets (pronounced as ‘brickets’) is a fusion of Berkshire Hathaway’s ticker code BRK and the Cricket Club where they meet. 6 of the BRKets members joined us for an interesting lunch discussion on value investing in Asia where we share our investment outlook, wide-moat business model analysis and stock ideas.

When Hemant ordered cheese platter for his desert, it triggered me to think about the inspiring stories of another outstanding Indian entrepreneur Devendra Shah and Barry Irvin of Bega Cheese. Shah turned the smallish Pune-based Parag Milk Foods into a high value dairy powerhouse with his bold decision in early 2008 to invest in the untapped opportunity in processed cheese in India, doubling by end 2008 the entire country’s cheese-making capacity from 40 tonnes to 80 tonnes. Interestingly, while the world is fixated on the QE tapering macro challenges, Warrnambool Cheese & Butter Factory (ASX: WCB AU, MV A$467m) is up 90% in less than three months since Sept. This was despite WCB posting its lowest profit since 2009 with FY13 (year end Jun) net profit down over 50% as it was the subject of a three-way bidding war by Canadian giant Saputo (TSX: SAP, MV C$9.6bn), Japan’s Kirin, and Bega Cheese (ASX: BGA AU, MV A$704m). Bega is a wide-moat company in our Bamboo Innovator Index since its listing in Aug 2011 with a market value of A$240m. NZ dairy giant Fonterra (FCG NZ, MV NZ$10.9bn), after its own contamination scare in Aug, joined in the industry consolidation battle by acquiring a 6% stake in Bega on Nov 2, adding on to Bega’s spectacular share price returns of 130% year-to-date. Ongoing competition in the raw milk market with supply affected by droughts in NZ and Australia and unseasonably cold weather conditions in Europe has kept upward pressure in prices paid to milk suppliers; the surge in the GDT (global dairy trade) price index from 800 to over 1,400 in the last year-and-a-half has hurt the profitability of processor such as WCB. Yet, despite both WCB and Bega being cheese processor companies, Bega has been able to achieve FY13 EBITDA and net profit growth of 13% and 25% respectively as compared to the FY13 decline of 28% and 51% for WCB. Meanwhile, the share price performance of dairy giants Saputo and Fonterra are flat YTD.

So why are Parag and Bega outperforming Bamboo Innovators in a cyclical commodity industry, especially when they are supposedly price-taking minnows in the midst of oligopolistic giants Fonterra, Murray Goulburn, Saputo, Amul (India), Royal Friesland Campina, Arla etc? What are the lessons for value investors when investing in companies related to the volatile commodities cycle? I admit that I was also surprised by the sharp jump in share price of well-managed boring consumer food companies such as Bega. But it once again proves the wisdom of one of our subscribers, Mr K, an intelligent value investor who has nearly doubled his returns from his investment since Mar this year in DKSH Malaysia (DKSH MK) after it was highlighted as a Bamboo Innovator; his thoughtful comments:

“I’d love money making ideas, but I also very excited about education, and understanding/ navigating Asian markets. If I can avoid stupid (frauds) mistakes, I think the upside will work out.”

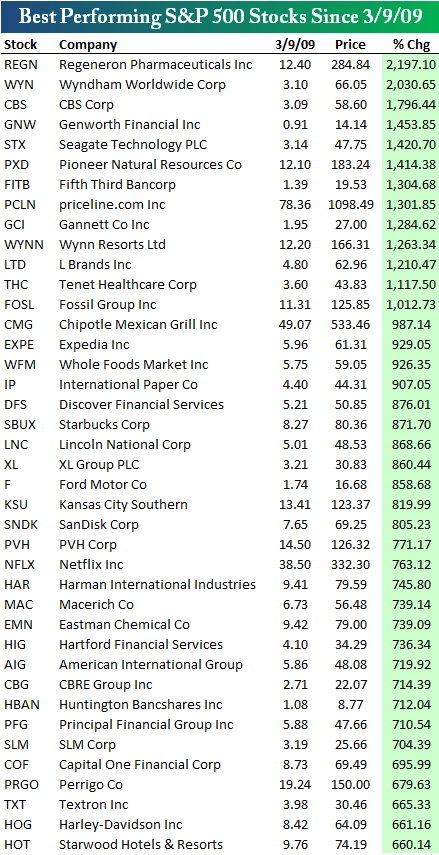

By avoiding the “set-up” fraudulent companies which are promoted with that alluring sexy growth theme by a whole gamut of syndicates, insiders and brokers/dealmakers, and by staying long-term in undervalued wide-moat businesses – even if they are boring like cheese! – the short-term returns may be unexciting or even frustrating but the longer-term upside will eventually work out for the value investor.

How did Barry Irvin grow Bega Cheese from a single-site regional dairy processor in southern New South Wales (NSW) town of Bega, with 80 employees and selling only into the domestic market, to its position today as the southern hemisphere’s largest cheese-packing and processing business, with sales nudging to over A$1 billion a year, exporting to more than 40 countries and employing over 1,600 people? What caught the Bamboo Innovator’s attention in Bega before its Aug 2011 listing was an article in May 2011 in Sydney Morning Herald about how Irvin was the parent and caregiver of his autistic child Matthew, now 22. For two decades, the 51-year-old Irvin has juggled the responsibilities of caring for a disabled child, running the family farm and steering the ambitious former dairy co-operative through deregulation, acquisition, a public float..

Barry Irvin pictured with his son Matthew.

Barry Irvin pictured with his son Matthew.

The role of a caregiver is special: they need to have that intangible quality of inner courage at its “core” to give strength to its “periphery”, much like the empty hollow center of a bamboo in which the nutrients and moisture that would have been exhausted making and maintaining this empty center can be utilized for growth of the periphery bamboo culm/stem. The architecture of the bamboo culm presents a powerful configuration: fibers of greatest strength occur in increasing concentration toward the periphery of the plant. With Irvin helming Bega, it is likely that the company will invest in the intangibles, in people and building long-term relationships..

Also, what are the lessons for value investors from the story of Indonesia’s PT Ultrajaya Milk (+230% YTD), controlled by the family of the late Ahmad Prawirawidjaja who established the business in 1958 from his house in Bandung? What are the 4 key Bamboo Innovator takeaways?