| Dear Friends,

Buying Furniture with Warren Buffett and Mrs. B at Asia’s Wide-Moat Furniture Innovators

MUNGER: I think Warren and I can match anybody’s failures in retail.

BUFFETT: Yeah, we have a really bad record, starting in 1966. We bought what we thought was a second-rate department store in Baltimore at a third-rate price, but we found out very quickly that we bought a fourth-rate department store at a third-rate price. And we failed at it, and we failed…

MUNGER: Quickly.

BUFFETT: Yeah, quickly. That’s true. We failed other times in retailing. Retailing is a tough, tough business, partly because your competitors are always attempting and very frequently successfully attempting to copy anything you do that’s working. And so the world keeps moving. It’s hard to establish a permanent moat that your competitor can’t cross. And you’ve seen the giants of retail…a lot of giants have been toppled.

MUNGER: Most of the giants of yesteryear are done.

BUFFETT: Nobody is going to be able to compete with the Nebraska Furniture Mart. I mean, this store does more home furnishing business than any store in the country. And what are we in, I don’t know, the 50th market in the country? This store does $450 million annually… But there’s no store that remotely can offer the variety. There’s no store that can undersell us.

“Sell cheap and tell the truth.” – Rose Blumkin (Mrs. B) of Nebraska Furniture Mart (NFM)

“I’d rather wrestle grizzlies than compete with Mrs. B and her progeny.” – Buffett

Buffett in the 2004 AGM: “I cost us about $10 billion. I set out to buy 100 million sharers [in Wal-Mart], pre-split, at $23. We bought a little [5 million shares] and it moved up a bit and I stopped buying. Perhaps I thought it might come back a bit – who knows? That thumb-sucking, the reluctance to pay a little more, cost us a lot.”

What is the investment Achilles heel of Warren Buffett and Charlie Munger? How did they overcome this weakness? Are there positive inspiring entrepreneurial stories of wide-moat innovators in Asia in this area of vulnerability and how can value investors use a framework to identify them? We will travel together to Asia to examine the success factors of an Asian wide-moat innovator who still holds the record for the longest continuous sales and profit growth – 28 straight years – of any listed company in its country and its market cap had compounded over 9-folds since 2002 to $8.5bn.

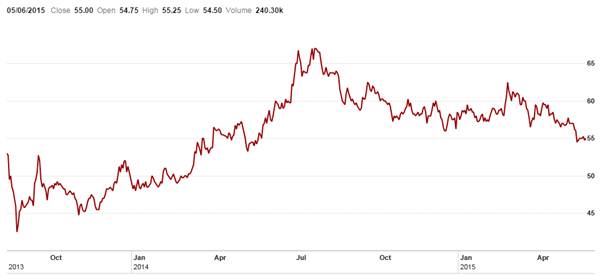

First, back to Buffett’s Achilles heel, which appears to be in the “tough, tough” retail industry, from the above CNBC interview in 2014, given that it is “hard to establish a permanent moat that your competitors can’t cross”. Also, their biggest error of omission, as Buffett admitted during Berkshire Hathaway 2004 AGM, had been his “thumb-sucking” reluctance in investing more in Wal-Mart in the 1990s because of one-eighth of a point uptick in the stock price. Buffett’s self-awareness and candor saw him making right his earlier decision in Wal-Mart by building a large position in 2005, according to SEC filings, and now owns 60.385m of its shares, at probably an average price of $51-60 as compared to the current price of $72 per share.

Thus, one of the best investment deals that Warren Buffett considered he has made was ironically in a retailer, a furniture store called Nebraska Furniture Mart (NFM). NFM was founded in 1937 by the late Rose Blumkin, fondly known as “Mrs. B”, a Russian immigrant to America, with $500 she had saved for 16 years selling used clothes. NFM was set up in Omaha with no locational or product advantage and goes up against rich, long-entrenched competition – and grew to become one of the top furniture retailers in the country and into the radar screen of Buffett. After several attempts to buy the business and rebuffed each time Buffett acquired 90% of NFM for $55m on his birthday on Aug 30, 1983 with a purchase proposal just over a page without the involvement of investment bankers or lawyers. Buffett didn’t audit her company, nor did he check her receivables, inventory, and real estate titles. Mrs. B agreed to make a deal with Buffett at the age of 89 because, she figured, if she sold the company before she died, then her children wouldn’t fight over it. After tucking in the cheque, Mrs. B reportedly said: “Mr. Buffett, we’re going to put our competitors through a meat grinder.” Mrs. B work ethics was phenomenal: “I come home to eat and sleep, and that’s about it. I can’t wait until it gets daylight so I can get back to the business.” She was on the floor until retiring at 103, and died the following year in 1998, with the business well taken care of by her capable children. Today, more than 30 years later, the Omaha-based store generated more than $450m in annual sales, with Buffett proclaiming confidently that the store will become “very big” and “will do over $1 billion”.

Buffett had tried to assemble a furniture empire since with the purchase of Utah-based RC Wiley in May 1995, Star Furniture in Jun 1997, Jordan’s Furniture in Oct 1999, and rental furniture provider CORT Business Services Corporation in Jan 2000. But none came close to matching NFM’s success. In Jun 2004, Berkshire also invested 9% In home furnishing retailer Pier 1 Imports (NYSE: PIR), an investment that did not work out. In Aug 2007, according to Bloomberg news, Buffett even mentioned about the Swedish-controlled flat-packed furniture retail innovator IKEA as a possible investment target, though the trust foundation setup at IKEA made the acquisition impossible.

Every year, when undergraduate students from 40 universities compete for a trip to Omaha to spend a day with Buffett, the Oracle would bring students to Mrs. B’s store to show what can result from hard work and sheer will. Buffett has previously told reporters that he would have rather done business with Blumkin over any highly pedigreed MBA in the country. Buffett explained the success factors behind NFM: “I have been asked by a number of people just what secrets the Blumkins bring to their business. These are not very esoteric. All members of the family: (1) apply themselves with an enthusiasm and energy that would make Ben Franklin and Horatio Alger look like dropouts; (2) define with extraordinary realism their area of special competence and act decisively on all matters within it; (3) ignore even the most enticing propositions falling outside of that area of competence; and (4) unfailingly behave in a high grade manner with everyone they deal with. (Mrs. B boils it down to sell cheap and tell the truth.)” In his 2013 letter to BRK shareholders, Buffett wrote: “Aspiring business managers should look hard at the plain, but rare, attributes that produced Mrs. B’s incredible success. If they absorb Mrs. B’s lessons, they need none from me.”

Make no mistake: NFM and IKEA are the rare exceptions. Furniture retailers face at least two critical economic hurdles and problems in building a wide moat and scaling up its business model. After all, can anyone still remember the once-mighty Heilig-Myers (HM)? HM used to the largest furniture retailer in the United States in the 1990s with over 1,000 stores nationwide – and it filed for Chapter 11 bankruptcy on Aug 17, 2000 and was also embroiled in an accounting fraud scandal.

It was distribution and delivery problems that helped bring down HM when it over-expanded nation-wide in 1993 as it buckled under the costs of operating large distribution centers and sprawling home delivery systems. Thus, the first critical problem to understanding the wisdom of Buffett beyond the usual quant screens, checklist and financial numbers when he commented why it is “hard to establish a permanent moat” in retail: Every furniture retailer hoping to go national must eventually overcome the same economic hurdle: the diminishing returns that kick in when a single distribution center can no longer serve all of a chain’s stores.

The second critical problem: HM, like other furniture retailers, relied on financing customers’ furniture purchases with installment loans, usually of two-year duration. Much like a financial services firm, HM provided its own debt servicing and realized revenue from the interest and fees collected from servicing the installment loans. That revenue accounted for up to one-third of profit in some years. HM lost focus in its core business improvement and dabbled in complex financing engineering transactions to boost short-term profits.

Specifically, HM transferred most of its installment sales to a trust account that issued certificates backed by the collection of the installment loans—asset-backed securities (ABS), and some were held by HM in a special-purpose entity (SPE) which were reported on its balance sheet at fair-market value despite the fact that these securities were never traded in a public market. When consumers with better credit quality began using credit cards for purchases rather than Heilig-Meyers installment loan plans, the loan plans were increasingly issued to consumers with low credit quality who defaulted and HM was awashed in toxic waste. The accounting fraud scandal was that Heilig-Meyers kept two sets of accounting books: the company was basing its loss and delinquency statistics on historical patterns rather than current data based on actual payments and collections which showed that HM was not as profitable as they wanted investors to believe. Heilig-Meyers used a “recency” accounting method rather than the standard “contractual” method, and that actual loss and delinquency rates on the contracts were in fact twice as high as stated by the company. In short, the ABS was based on the overly optimistic figures, which improperly inflated the true collateral behind them.

Thus, making and selling affordable furniture for the end customers is critical to avoid the temptations of financial engineering.

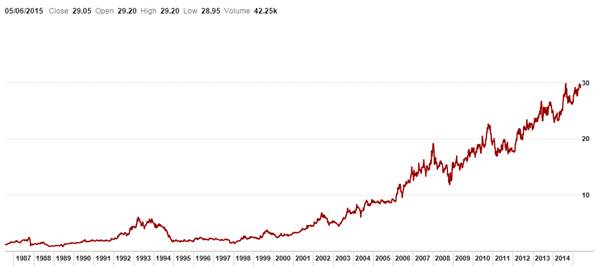

Let’s examine the success factors and business model of Nitori Holdings (TSE: 9843, MV $8.5bn) who still holds the record for the longest continuous sales and profit growth – 28 straight years – of any TSE-listed company.

Nitori is the largest furniture retailer in Japan with a 15% market share with around 300 Nitori stores, 17 Deco Home and 19 overseas stores. Rivals include Shimachu (6% market share), IKEA Japan which entered Japan in 2006 (3%), Otsuka Kagu (2%), GMS (21%) and home centers (5%), department stores (4%) and small specialist mom-and-pop stores (44%). Nitori was established in 1972 by Akio Nitori in Sapporo, Hokkaido in the northern island of Japan. Hokkaido is home to a number of innovative retailers, many of which started out in the early 1990s, when the bubble economy collapsed. Nitori first listed in the Sapporo Stock Exchange in 1989, followed by the listing on TSE in 2002.

Nitori grew by…

<ARTICLE SNIPPED>

Nitori is also renowned for its tight quality control in which less than 1% of items sold are found to be defective, winning customer’s trust. To achieve this, Nitori hired former Honda engineering specialists, many of whom are in their 60s, and gave them an engineer’s paradise. Theses engineers break chairs to see why they splinter, wash pillow covers with acid to see if their colors bleed, left lightbulbs on for hours to see how hot they get.

Like the legendary Sam Walton who has a penchant for the right analysis of data, Nitori tracks a long list of data: customer traffic; the age of every store and employee; the number of quality complaints; profit and sales area per employee. To each the company assigns a target, most of which Nitori can recite from memory.

Nitori’s motto is: “Our greatest pleasure if offering and achieving ‘true life affluence’ for our Japanese customers.” Yet, like Mrs. B, many people do not know the pains and challenges that Nitori-san had to endure and overcome in order to realize this motto. Interestingly, both Mrs. B and Akio Nitori had the same life experience when they are trying to implement their low-price strategy.

For Mrs. B, Buffett wrote that when furniture manufacturers stopped selling directly to her after bigger customers in Omaha complained about her low retail prices, she travelled to Kansas City, Chicago and New York, bought from department stores and still undersold her rivals. Her competitors used fair means and foul, and after pressurising manufacturers to stop supplying her, hauled her into court charging her with violating Fair Trade laws. But “she not only won all the cases….at the end of one case she sold the judge $1,400 worth of carpet.”

In the late 1960s, when Akio Nitori was just starting its business, local furniture wholesalers wielded enormous power, because it was relatively difficult to buy products in Hokkaido, primarily due to geographical and transport-related factors. If a company tried to accelerate its store launches by selling products at low prices, wholesalers would refuse to do business with it, as such firms were seen as troublemakers disrupting the status quo of the industry. For this reason, Nitori started buying products from wholesalers based in Niigata and Gunma prefectures. “But the transactions with them ended quickly, as information was passed on from the Hokkaido-based wholesalers,” Nitori said.

A major life-changing event was when Akio Nitori joined the Pegasus Club in 1972, the year when Nitori was officially established. The Pegasus Club was formed in 1962 to study the US and European chain-store management system and led by distribution consultant Shunichi Atsumi. Young small-business retail executives at that time, such as Daiei’s Isao Nakauchi, Aeon’s Takuya Okada, and 7-Eleven/Ito-Yokaido’s Masatoshi Ito, were among the initial participants. A core principle of the Pegasus Club is “thorough rejection of the current situation and always looking ahead to a better format in 10-30 years.” Akio Nitori’s approach of setting long-term goals and determining the right steps to achieve these goals is heavily influenced by the Pegasus Club.

The Pegasus Club organized a trip to US and Akio Nitori, 27 and the owner of two furniture stores, joined in the trip to learn more about how overseas retailers operate. Nitori spent a week in California, shopping and observing the way Americans lived. He was inspired by the insights gleaned from the US trip and was determined to achieve a “logistics revolution” to grow and scale a national chain store:

“When I visited chain stores in the United States more than 30 years ago, I was overwhelmingly impressed and marveled at the wide disparities with Japan in terms of consumer values such as low prices, merchandise selection and product quality. Creating a home that is enjoyable, relaxing, harmonious and suited to the residents’ lifestyle is a well-established activity in Europe and America, and the reason is the means exist for easily purchasing, at a reasonable price, home products that can be readily coordinated. Nitori has declared its dreams of ‘realization of a society where Japanese can enjoy true life affluence’ and by taking the excitement, stimulation and resolve of that time as its starting point, Nitori is striving to achieve a “logistics revolution” centered on the creation of a national chain store.”

Thus, to the bullying powerful local furniture wholesalers, Nitori found a solution outside the country. The company started…

<ARTICLE SNIPPED>

Besides Nitori, another wide-moat furniture innovator that we have written earlier in Mar 2014 in the article Willingness to be Misunderstood and the Swedish Corporate Model to Scale an Asian Wide-Moat Compounder: The Story of “Korea’s IKEA” Hanssem is Korea’s Hanssem (009240 KS, MV $5.6bn), whose market cap had since jumped by 270%.

********

In the 1983 annual report, Buffett explains how, at 23, Rose talked her way past a border guard to leave Russia for America. Mrs B had no formal education and knew no English. She learnt the language from her elder daughter who taught her, every evening, the words she learnt in school during the day. Mrs. B had worked in the store at age 6, talking her way into a job as a store clerk when she was 13 and becoming manager with six men working under her three years later. When her initial resources, the $500 savings that took her 16 years to accumulate to establish NFM, ran out, she sold every appliance and piece of furniture in her home to pay off a debt.

So how can value investors identify wide-moat business models and the entrepreneurial owner-operators, like the tough Mrs. B, who run them? Buffett revealed his mental model in the quote below and in a Charlie Rose:

“One question I always ask myself in appraising a business is how I would like, assuming I had ample capital and skilled personnel, to compete with it. I’d rather wrestle grizzlies than compete with Mrs. B and her progeny. They buy brilliantly, they operate at expense ratios competitors don’t even dream about, and they then pass on to their customers much of the savings. It’s the ideal business—one built upon exceptional value to the customer that in turn translates into exceptional economics for its owners.”

Charlie Rose: How was she able to kill them [the competition]?

Warren Buffett: She cared and she was smart. She knew her limitations of her knowledge and she was confident in the circle of her competence. She didn’t get outside of it and she took care of her customers. She sold cheap and it took her a long time but she built the largest home furnishing store in the country in a town like Omaha, a town of 700,000 people. She was a remarkable woman, and Charlie, she could not read or write and I think every business school should study her.

Charlie Rose: What would they learn?

Buffett: They would learn the essence of business. They would learn that taking care of customers is what it is all about. Taking care of them. I mean by that, giving them good deals, which nobody would touch. She did and working like crazy she was there day after day. She had a passion for it. The truth is, if you took the Fortune 500 CEO’s and I gave you the first draft pick on 10 of them, and I put them in competition with her; she would win.

Buffett compared her to the late Walmart founder Sam Walton:

“One thing that Sam Walton and Mrs. B had in common is they had passion for the business. It isn’t about the money, at all. It was about winning. Passion counts enormously; you have to really be doing it because you love the results, rather than the money. When we buy businesses, we are looking for people that will not lose an ounce of passion for the business even after their business is sold. After all, doing business with someone who is driven by beating the competition by creating a superior company rather than simply finding ways to build a war chest is what it’s all about.”

In essence, Buffett’s mental model beyond the numbers to identify wide-moat innovators is to sense that an entrepreneur takes care of his or her customers in a deep way and keep delivering exceptional value to them. Even if it means pains and sacrifices. Even if there are bullies. Even if it takes a long time, working crazy day-in-day-out. Even if they grow rich. All possible only because they are committed to an idea larger than themselves.

When Nitori returned from California in his life-changing trip in 1972 and inspired to carry out his “logistics revolution” to offer and achieve “true life affluence” for the Japanese customers, he did some quick calculations. It took America 120 years to develop its retail industry, and he guessed it would take him 60 years to catch up. He began crafting a six-decade plan then that he continues to refine today. With his single-minded focus on keeping prices down for customers without disappointing them on quality.

Who are your Mrs. B and Akio Nitori in Asia?

Warm regards,

KB

The Moat Report Asia

www.moatreport.com

A new monthly issue of The Moat Report Asia is now available!

Access the in-depth idea presentation:

http://www.moatreport.com/members/

In the month of June, we investigate the #1 ice cream and pasta maker in its domestic market in an Asian country. It is also the main supplier of buns to McDonald’s in its home market. Its high-speed bun production business has expanded to serve other quick-serve restaurants, including Wendy’s and KFC. The firm has nurtured a corporate culture and deep know-how in branding to establish an impressive track record in acquiring and turning small heritage brands into market leaders in different food and beverage categories. Its share price is down 37+% in the past year. This is despite resilient results announced in May. The company was incorporated in 1957 by a group of entrepreneurial families and is now led by an outstanding down-to-earth third-generation business leader. |