Tips on Building a Franchising Empire; How to make the leap from one outlet to many

December 2, 2013 Leave a comment

Tips on Building a Franchising Empire

How to make the leap from one outlet to many

NEIL PARMAR

December 2, 2013

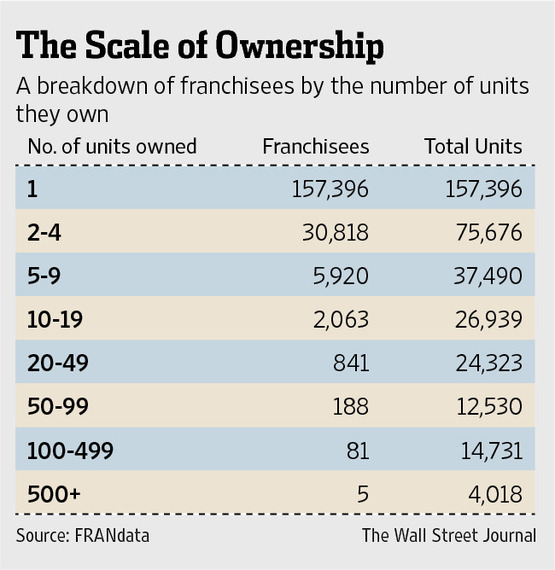

How does a franchisee get bigger? These days, many franchisers favor owners who already run multiple locations, giving them preferential treatment when selling existing stores or awarding new locations. But most franchisees—about 80%—own just one unit. So what’s the best way for them to go from small-time ownership to the kind of franchise empire that chains look for?Experts and big owners say there are several strategies that can help franchisees make the leap—but they involve a lot of work. Among other things, owners must revamp how they manage their business and aim to deliver consistently top-shelf performance in numerous areas.

Here’s some of their best advice.

Manage the Managers

Most owners who successfully expand the number of units they own figure out that they can’t oversee every store themselves. They need a strong layer of management in place in their individual cafés, floral shops or whatever type of business they own.

The realization usually comes when owners have around three to six stores. At that point, they often discover that they’re wasting time and money rushing between different locations to check up on employees. Once they figure out how to set up a trustworthy management team, scaling with new businesses becomes easier.

But some owners can never take the leap of faith and trust others to run the show while they’re away. Or they’re such micromanagers that the stores rely on them being around to deliver strong performance. These owners “need to really ask themselves if they are equipped to manage from afar,” says Richard Sharoff, a longtime franchisee and executive vice president for franchising at restaurant chain Amsterdam Falafelshop.

But knowing how to scale up isn’t enough. Owners must earn top marks from their chain in areas like customer service—and do it consistently.

Before Jim Dooney could amass nine Saladworks locations over the years, he had to perform well on 13 metrics the chain tracks, he says. For instance, he got top marks for how quickly bills get paid to suppliers, how fresh the lettuce and other produce is in his restaurants, how well he follows marketing advice from the corporate office and how regularly he generates financial statements on the sales performance of his stores.

Mr. Dooney, who now owns four stores, has consistently earned an A grade for the businesses he has run, allowing him preferential treatment in purchasing new locations, he says. Meanwhile, his B-ranked peers “are not allowed to expand unless they provide us with an action plan to increase performance in their current store,” says Paul Steck, president of Saladworks, which has more than 100 locations. “Our C-ranked operators aren’t allowed to expand—period,” Mr. Steck adds.

Consistent performance is often a byproduct of a strong management team. But oversight from the home office also helps. For example, Mr. Steck has online complaints forwarded to his mobile phone, so he can find out if, say, three customers have complained about produce that isn’t fresh from a particular store. This helps Saladworks police its owners but also helps owners improve their quality scores so they don’t consistently get a C grade, for instance.

Build Sales—and Bonds

Another thing multiunit owners figure out is that good sales numbers are vital—but aren’t enough on their own. Sales gains can dissipate if owners don’t find ways to retain customers and get involved in the community.

Franchisers look for owners who can build a business by growing word-of-mouth excitement and contribute to local activities and charitable causes, experts say. They also want to see owners who have good relationships with real-estate brokers and developers, as well as different suppliers, which helps expedite the process after an agreement is signed and before a store actually opens.

“Yes, money is important, but franchisers want someone who completely embraces every aspect of the company’s mission statement and someone who can really make a mark in the community,” says Meg Schmitz, a Chicago-based franchise broker with the consultancy FranChoice.