Central Banks Warn of Bitcoin Risks; China, France Issue Stark Reports; Beijing Bars Financial Institutions From Offering Related Services

December 8, 2013 Leave a comment

Central Banks Warn of Bitcoin Risks

China, France Issue Stark Reports; Beijing Bars Financial Institutions From Offering Related Services

ROBIN SIDEL, CHAO DENG and WILLIAM HOROBIN

Dec. 5, 2013 4:15 a.m. ET

While the Chinese government doesn’t officially recognize bitcoin, buyers there are nonetheless helping to fuel a boom in the four-year-old virtual currency. Bobby Lee of BTC China, the country’s largest bitcoin exchange, tells Jake Lee what is fueling the high demand.Central bankers and regulators around the world are ratcheting up warnings about bitcoin, as prices of the virtual currency soar, more merchants accept it for payment and investors pour money into new bitcoin-related ventures.

Officials in China and France and from the European Union voiced their strongest concerns yet about the potential for speculative trading and money laundering in bitcoinand the potential risks for ordinary people using the currency.

At the same time, a currency analyst issued a positive outlook for bitcoin investors, while a university in Cyprus announced it had accepted its first tuition payment in bitcoin.

The contradictory sentiments underscore the confusion surrounding the four-year-old virtual currency.

Bitcoin isn’t backed by a central bank. Rather, it is created through a complicated computing process called mining. Once mined, the coins can be used for purchases or traded on unregulated Internet exchanges based in ports around the world.

The price of one bitcoin has surged this year from less than $20 in January to more than $1,100 now, based on the CoinDesk index of three popular exchanges. But the ride has been bumpy.

“Even if bitcoin does not today meet the conditions to become a credible means for investment that could therefore threaten financial stability, it represents a clear financial risk for those that hold it,” said the Bank of France in a report.

The People’s Bank of China said on its website that financial institutions shouldn’t take deposits from bitcoin-related businesses or provide them insurance or custody services. Chinese regulators also said online bitcoin exchanges will be required to file trading records and take measures to address money-laundering risks associated with the virtual currency.

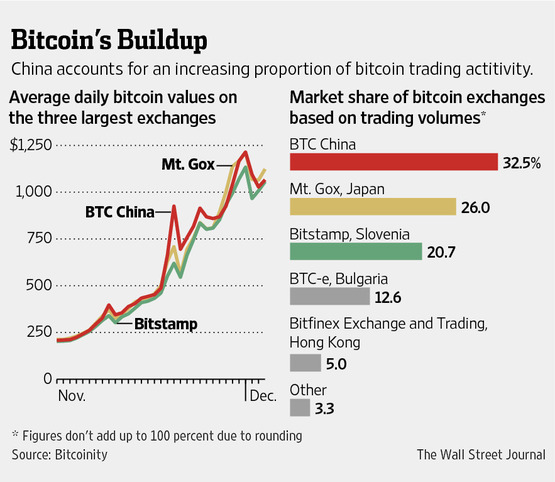

China is considered increasingly important to the fate of bitcoin.

A recent surge in bitcoin prices around the world has been attributed to rising demand from China, although it is difficult to measure the extent of the impact.

The European commissioner in charge of financial regulation said government penalties should apply if it emerges that unregulated currencies such as bitcoin are being used to commit fraud or other criminal activities.

“We are following the question of bitcoin very closely,” said Michel Barnier. “We remain vigilant and are ready to act if necessary.”

U.S. regulators and lawmakers have raised similar concerns about virtual currencies in recent months.

Roughly 35 virtual-currency companies have registered as money-transmission businesses with the Financial Crimes Enforcement Network since the unit of the Treasury Department issued guidelines in March that encouraged them to do so, according to a spokesman.

Bitcoin also is attracting attention from traditional Wall Street firms, where analysts have begun to issue research reports that assess its impact on global currencies and payment systems.

David Woo, a currency analyst at Bank of America Merrill Lynch, on Thursday issued an 11-page bitcoin report that placed a “maximum fair value” at $1,300 on bitcoin and a maximum market capitalization of $15 billion. Bitcoin’s market value is roughly $12.5 billion now, according to the CoinDesk index.

“We believe bitcoin could become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers,” Mr. Woo wrote in the report.

Mr. Woo said in an interview he wrote the report because he was flooded with questions about bitcoin from clients and colleagues.

The Bank of England is playing down bitcoin’s current significance, saying that it isn’t likely “to have a material impact on [the bank’s] monetary or financial stability objectives in the short term.”

Steven Englander, a currency strategist at Citigroup Inc., said a report he issued last month about bitcoin generated an unusually large amount of feedback from clients. The note’s popularity prompted him to issue another on Thursday in which he expressed some skepticism about bitcoin’s long-range prospects due to the potential emergence of competing virtual currencies.

Also on Thursday, the University of Nicosia in Cyprus said it had accepted its first bitcoin tuition payment. A student from South Africa paid one bitcoin, which was worth $910 at the time of payment last month, toward tuition for an online master’s degree in business administration. The university plans to launch next spring the first master’s of science degree in digital currency.

Regulators also are grappling with where bitcoin fits among traditional forms of payment. The Bank of France said bitcoin isn’t legal tender because it is possible to refuse payment in the virtual currency. Neither does bitcoin fall under the definition of a means of payment or an electronic currency because it isn’t issued in exchange for funds, the Bank of France argued in the report.

The French central bank warned that even professional speculators should be wary because bitcoin holders have no legal recourse if they are victims of theft from hackers and the convertibility of the currency isn’t guaranteed.

“The system can collapse at any moment if investors want to unwind their positions but find themselves holding portfolios that have become illiquid,” the bank said in its report.