Getting Too Worked Up by Workday

December 10, 2013 Leave a comment

Getting Too Worked Up by Workday

DAN GALLAGHER

Updated Dec. 8, 2013 8:30 p.m. ET

Workday WDAY -0.46% looks set to be a $1 billion business. Unfortunately, the stock has already priced that in, and then some. Workday is often referred to as “PeopleSoft on the cloud,” as most of its top executives came from the maker of human resource management software that OracleORCL +1.81% acquired in 2005. Workday has been adding customers at a rapid pace, as more businesses look to shift their software needs to cloud-computing solutions.Cloud-based software is also hot for investors, and Workday has been a top beneficiary. Already on a tear since October 2012’s initial public offering at $28, Workday shares have picked up more than 10% since last Monday’s earnings report, putting the stock above $81. Subscription revenue increased by 82% year-over-year in its last fiscal quarter.

Current Wall Street projections have Workday surpassing $1 billion in revenue by its fiscal year ending in January 2016—more than double the $464 million forecast for the current fiscal year.

Workday’s track record suggests it can hit that milestone. But it isn’t a given. Some of that growth may depend on it increasing newer offerings, such as financial-management services. And software firms like Oracle and SAP SAP.XE +0.98% are fighting to limit encroachment by cloud-based upstarts.

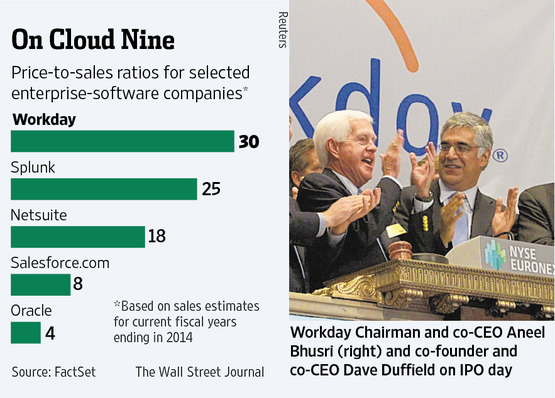

And there’s the rub. Workday is valued at about 30 times sales based on forecasts for the current fiscal year. That is above about every other enterprise-software company, even other newly public cloud-software companies. Splunk, SPLK -1.57% for one, trades at 25 times forecast sales.

At its current price, Workday with $1 billion in revenues would trade at about 14 times sales. Salesforce.com, CRM +1.56% considered the elder statesman of the cloud-based crowd with a forward price/earnings multiple of 100-plus times, trades at eight times sales. There is no meaningful P/E multiple for Workday, which is projected to lose money through fiscal 2016.

Workday’s multiple looks even higher including nearly 44 million shares related to outstanding stock options, warrants and convertible notes in its share count. These aren’t usually counted because, given Workday’s lack of profits, they would flatter the company’s losses per share by making them smaller.

But they represent a dilutive threat, adding to the view the stock is overvalued. Including them, and holding the current price constant, the multiple rises to about 38 times.

Workday’s business is in the right place at the right time. Its investors look way ahead of themselves.