Hyundai Elevator vs. Schindler

December 10, 2013 Leave a comment

2013-12-09 16:32

Hyundai Elevator vs. Schindler

Partners become enemies following Hyundai’s capital increase plan

By Kim Rahn

They used to be partners.

Hyundai Elevator and Schindler Holding AG used to maintain friendly relations. Now they are growling at each other ㅡ the former claims the latter is attempting to take it over, while the latter denounces the former’s alleged poor management.Their ties started in 2004 when Hyundai Group Chairwoman Hyun Jeong-eun and Alfred Schindler, chairman of the Swiss elevator-maker, signed a letter of intent for the latter’s purchase of a 20-percent stake in Hyundai’s elevator arm.

The agreement came after KCC, run by the Hyundai Group founder’s brother, attempted to control the group by becoming the largest shareholder of Hyundai Elevator ㅡ an attempt that failed.

However, the agreement was annulled due to domestic regulations.

In March 2006, Schindler purchased a 25.5-percent stake in Hyundai Elevator from KCC and reported it to the Hyundai Group. The two still maintained a good relationship, announcing a strategic partnership in 2007.

However, the relationship went awry in 2010 when Hyundai Group tried to take over Hyundai Engineering & Construction, and Schindler opposed the plan. The group eventually failed to make the acquisition.

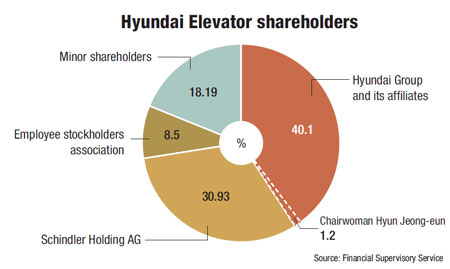

Then Schindler obtained a greater stake in Hyundai Elevator, up to 35.07 percent last year. The ratio dropped to 30.9 percent after the elevator unit increased capital through a public offering in June.

Besides buying shares, Schindler also filed a series of suits and petitions against the group and Hyundai Elevator, including those filed to prevent Hyundai Elevator’s paid-in capital increase.

Hyundai Group suspects Schindler’s stock-buying and the suits may be part of a strategic move for a hostile merger & acquisition (M&A).

The group and its other affiliates hold a 40.1 percent of stake in the elevator unit, including 1.2 percent held by Chairwoman Hyun.

The conflict reemerged on Nov. 27 when the elevator firm announced another capital increase worth 217.5 billion won ($205.5 million). The company said the increase was needed to pay debts on corporate bonds worth 100 billion won that will mature in the first half of next year, and for other expenses. It was the third capital increase within a year, following the first one in December 2012 and the second in June.

Immediately after the capital increase announcement, Schindler issued a statement in opposition, saying this will damage the value of Hyundai Elevator and its stock.

According to Schindler, the capital increase came to cover losses arising from derivative contracts in which Hyundai Elevator promised to support the group’s other affiliate, Hyundai Merchant Marine, when the marine arm’s stock price falls.

It claimed the derivative contracts were unfair to Hyundai Elevator and only inflicted losses to the elevator arm’s shareholders and employees.

“Hyundai Elevator and Hyundai Merchant Marine are two separate entities, and their only link is the largest shareholder, Hyundai Group, and Chairwoman Hyun. The group and the chairwoman used the elevator unit as a tool to maintain managerial control over the group’s affiliates, so the unit has not operated for the benefit of shareholders,” Schindler said.

Indeed, Hyundai Elevator’s stock price dropped from 131,500 won at the beginning of this year to 47,600 won on Monday.

Schindler claimed that it is the second-largest shareholder but was not allowed to participate in actions of Hyundai Elevator’s board of directors, to get prior notification about important decision-making about the firm or to access the firm’s account books.

Regarding Schindler’s statement, Hyundai Elevator issued a counter-statement, claiming Schindler has interfered in the elevator unit’s management and its goal is to take over the unit eventually.

Hyundai Elevator said Schindler kept asking that it provide confidential information about the company, saying it was beyond a shareholder’s right and amounted to interference in management.

“Since 2004, whenever Hyundai Group or Hyundai Elevator needed liquidity, Schindler asked us to hand over the elevator unit in return for offering money,” the elevator firm said.

“Schindler is attempting to drive us into a liquidity shortage and other troubles so the group will have to sell the elevator arm,” it said.

An official of the elevator company said, “Schindler filed suits to prevent Hyundai Elevator’s capital increase and opposed new business models. We don’t see many of its acts as ‘well-intentioned.’”

In response to Hyundai’s claims, Schindler Korea’s officials did not comment.