China’s Debts Keep On Rolling

December 15, 2013 Leave a comment

China’s Debts Keep On Rolling

ALEX FRANGOS

Dec. 11, 2013 9:24 a.m. ET

China’s economy needs change. What it’s getting for now is more debt.

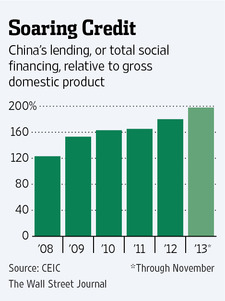

Beijing’s broadest measure of credit, total social financing, has expanded by 19% in the past 12 months through November. November’s monthly numbers were stronger than expected and lending as a percentage of the economy is close to 200%, up from 123% five years ago.With a month to go, it seems assured that 2013 will be another year of solid credit creation—and diminishing growth returns. In each of the past five years China has pumped copious amounts of credit into the economy. But each year economic growth has slowed.

That slower growth is making it harder to pay back new debts. China’s nominal gross domestic product, which includes the debt-eroding effects of inflation, grew 18% in 2010 and 2011. But nominal GDP growth slowed to 10% in 2012 and 9.5% in the year ended September. Combine higher borrowing costs expected to come from financial reforms with slower nominal growth, and borrowers get a narrower margin of error.

The credit spigot has kept China’s economy growing fast enough to keep Beijing happy. The latest batch of data out this week showed stable readings in November for fixed asset investment and industrial production. Retail sales, especially autos, continue to be strong. Consumer-price inflation edged down to 3% from 3.2% in October.

Top economic policy makers are meeting this week in Beijing to map out how to execute the economic makeover unveiled after the Communist Party’s November plenum. Some expect the government will ratchet down the national growth target to 7.0% from 7.5%.

Slower growth expectations would be a good thing, signaling China is willing to lay off the debt and start the deleveraging process. In the meantime, credit remains China’s economic lifeblood.