Tata Steel’s Rise Isn’t Iron Clad

December 15, 2013 Leave a comment

Tata Steel’s Rise Isn’t Iron Clad

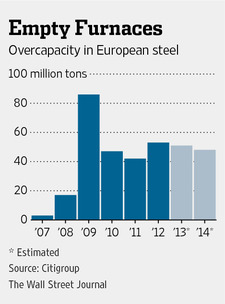

Europe Is Reeling From Too Much Steel Capacity

ABHEEK BHATTACHARYA

Updated Dec. 13, 2013 3:59 a.m. ET

Green shoots of economic revival in Europe and India are making Tata Steel500470.BY +0.20% investors euphoric. They may have gotten ahead of themselves. The Mumbai-listed steelmaker has become a play on the industrial sectors in both parts of the world. After Tata bought Britain’s Corus Steel in 2007, about 60% of its revenue comes from Europe, and most of the rest from India.Now, signals of a European rebound have catapulted Tata’s stock 108% since an August low. Investors are also encouraged about Tata’s Indian prospects: A weak rupee crimped steel imports and buoyed local prices, while economic growth looks to be on a slight upswing.

In contrast, shares in rival ArcelorMittal,MT +0.73% the biggest steelmaker in the world by volume, are up 41% since July lows, but also fell much less in the preceding period. Tata’s leverage makes it a volatile bet on steel. Tata’s net debt was 4.1 times earnings before interest, tax, depreciation and amortization as of Sept. 30, compared with 2.8 times at Arcelor.

If the green shoots start to wilt, Tata Steel investors aren’t allowing any room for error. The stock price at this point is only justified if Tata’s European Ebitda for every ton of steel more than triples from its levels in the September quarter, according to CLSA estimates.

That could be a stretch. Even if steel demand improves marginally next year, Europe is reeling from too much capacity. Europe’s economy would have to expand 26% to put enough of the continent’s steel mills to work that steelmakers gain pricing power, Citigroup says. More deliveries from China—the world’s leading source of steel overcapacity—could put a cap on prices.

Tata’s India operations aren’t immune to disappointment. Steel-intensive industries like cars and construction still look weak. Stubborn inflation means the country’s interest rate hiking cycle is probably still not done. Plus, the rupee has stabilized in recent months, which could bring cheap exports back.

While Tata’s stock remains below post-financial crisis highs, it’s getting pricey. By enterprise value, adjusting for net debt, it’s 5.8 times forward Ebitda. That’s higher than its 10-year average of 5.3.

With lots of leverage, Tata is a strong play on a genuine recovery in European and Indian steel. But since both of these sectors may yet fumble, Tata’s stock could, too.