Fidelity Plants Flag in Hedge-Fund Turf; Fidelity Investments launched two “event-driven” mutual funds, the latest foray by the firm into a sector traditionally dominated by hedge funds

December 20, 2013 Leave a comment

Fidelity Plants Flag in Hedge-Fund Turf

JOE LIGHT

Dec. 18, 2013 7:10 p.m. ET

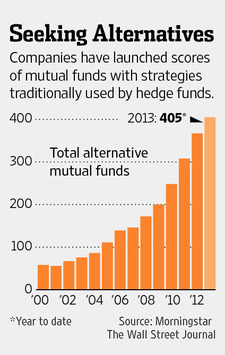

Fidelity Investments launched two “event-driven” mutual funds, the latest foray by the firm into a sector traditionally dominated by hedge funds. The launch on Wednesday of the Fidelity Event Driven Opportunities Fund and Fidelity Advisor Event Driven Opportunities Fund comes as alternative funds continue to pull in a record amount of investor cash. This year through November, alternative funds have taken in $88.55 billion, according to research firm Morningstar Inc., MORN -0.43% up from $18.34 billion in all of last year.Alternative funds use strategies typically found in hedge funds. For example, an event-driven fund could bet in advance on the completion of mergers or acquisitions. The funds have caught investors’ attention since the financial crisis, as they look for returns not dependent on stock- and bond-market gains. More recently, investors have flocked to alternative funds that invest in bonds in the hopes the funds won’t be hurt by rising interest rates.

To be sure, some analysts said Fidelity’s new funds don’t meet the criteria to be classified as alternative funds. A Fidelity spokesman said the firm wasn’t trying to position the funds as alternative products.

Unlike hedge funds, which are available only to the wealthy, alternative mutual funds can carry low investment minimums. They also have lower expenses than hedge funds, which typically charge an annual fee of 2% of assets and take 20% of gains. The Fidelity Event Driven Opportunities Fund has an annual fee of 1.3%, or $130 per $10,000 invested. The Fidelity Advisor Event Driven Opportunities Fund’s A-class shares charge 1.55%.

Arvind Navaratnam, the funds’ portfolio manager, said the rise in assets of funds that track indexes has increased the opportunities for event-driven fund managers to buy mispriced stocks. The fund will also try to find mispriced stocks in companies affected by spinoffs, reorganizations and activist investors, he said.

He said investors have increasingly sought mutual funds that are less dependent on the performance of stocks overall. Mr. Navaratnam had previously been an analyst at Fidelity.

The new funds aren’t the first step by Boston-based Fidelity to enter the lucrative alternative mutual-fund business. In August, the firm invested about $1 billion of its clients’ money in a mutual fund launched by hedge-fund Blackstone Group BX +1.71% LP.

Fidelity’s investment has made the Blackstone fund one of the fastest-expanding mutual funds this year. Fidelity last year invested clients’ cash in an alternative fund managed by Arden Asset Management LLC.

Fidelity’s own assets haven’t increased as quickly as those of some rivals. This year through November, the company’s mutual funds have garnered about $5.15 billion. That is less than other firms that tend to try to beat stock and bond indexes, such as T. Rowe Price Group Inc., TROW +3.82% and not close to the $116.7 billion gathered by Vanguard Group’s mutual funds and exchange-traded funds, which tend to use low-cost passive strategies that seek to mimic indexes.

“My guess is that they’re not happy about how far they’ve fallen behind Vanguard,” said Geoffrey Bobroff, a mutual-fund consultant in East Greenwich, R.I. “Fidelity is in a position where it needs to do something to get noticed and talked about.”A Fidelity spokesman said the launches are unrelated to competitors.

Even though the event-driven funds’ names recall other popular hedge-fund-like mutual funds, they don’t bet against stocks or use hedging strategies typical in such funds, said Nadia Papagiannis, an analyst at Morningstar. “They’re trying to jump on the alternatives bandwagon, but this is not an alternatives fund,” she said, based on the funds’ regulatory filings. Ms. Papagiannis said Morningstar had misclassified the Fidelity fund in the alternatives category but would most likely reclassify it as a traditional stock fund.