Staying Away from Indian Bonds; Foreigners Are Avoiding India’s Inflation-Scarred Bond Market. Interest Rate Increases Are In Order

December 20, 2013 Leave a comment

Staying Away from Indian Bonds

Foreigners Are Avoiding India’s Inflation-Scarred Bond Market. Interest Rate Increases Are In Order.

ABHEEK BHATTACHARYA

Dec. 17, 2013 12:25 a.m. ET

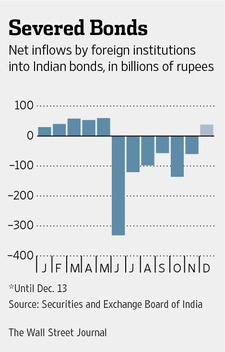

Raghuram Rajan hasn’t impressed the foreigners in India’s bond market. The chief of the Reserve Bank of India has won kudos for raising interest rates twice since he came to office in September. But foreign bond investors remain on the sidelines. Their concerns are warranted considering data out Monday that showed wholesale prices inching to a 14-month high. Consumer prices were up 11% from a year earlier in November. Investors want higher rates when the RBI meets Wednesday—or they won’t help with India’s imbalances.That is the message India’s official foreign-funds data are sending. As of Dec. 16, foreigners used up only 32% of the quotas New Delhi assigned them in the bond market. Though net flows into the bond market turned slightly positive for December as the rupee stabilized, that comes after five months of foreigners pulling more money out of the bond market than they poured in. They took away a net 802 billion rupees ($12.9 billion today) during those five months.

Indian interest rates are unattractive, especially as U.S. rates rise in contrast. Adjusting for consumer price inflation, the yield on India’s three-month Treasury bill is negative 2.3%. This dissuades investors looking for yield in short-dated securities. Those venturing into longer-dated bonds aren’t being rewarded with high enough rates to compensate for the risk the rupee will depreciate again as it did over the summer.

India needs cash to fund its current-account deficit, which may clock 2.7% of gross domestic product for the year ending March, according to Citi. This is less than last year’s deficit thanks partly to curbs on gold imports. Even then, the deficit amounts to $50 billion. If all of India’s foreign-investor bond quotas were filled, that would be $81 billion itself.

To fight India’s stubborn inflation, Mr. Rajan will likely need to raise rates even further. In so doing, he might also attract back some foreign friends.