1% Spike In Yields = $200 Billion In Losses For US Firms

December 22, 2013 Leave a comment

1% Spike In Yields = $200 Billion In Losses For US Firms

Tyler Durden on 12/20/2013 20:58 -0500

Back in May, just after the BOJ unleashed its epic QE program, which on a relative basis was about twice the size of the Fed’s own QE, and when bond yields for JGBs suddenly soared higher before a flurry of bond market halts forced the BOJ to completely take over the entire JGB market, the key question among the financial community was how big the losses for Japan’s banks would be as a result of a big jump in yields. We provided the answer: “A 100bp interest rate shock in the JGB yield curve, would cause a loss of ¥10tr for Japan’s banks.” Or, roughly $100 billion for 100 bps. Which is why the BOJ promptly decided to take away from the market the ability to set yields on the margin: after all the paradox of pushing for inflation and keeping bond rates low did not compute so might as well do away with the bond market entirely.Fast forward to today when it is not Japan but the US that suddenly the topic of discussion over the possibility of spiking rates (thanks to the Fed’s recently announced creeping taper), and specifically how big the losses at US bond funds and various other financial institutions would be as a result of a 1%, 2% or bigger jump in rates. Now, courtesy of the Treasury’s Office of Financial Research, we know precisely how badly US investors, funds, and financial firms would be impaired should rates spike.

To wit:

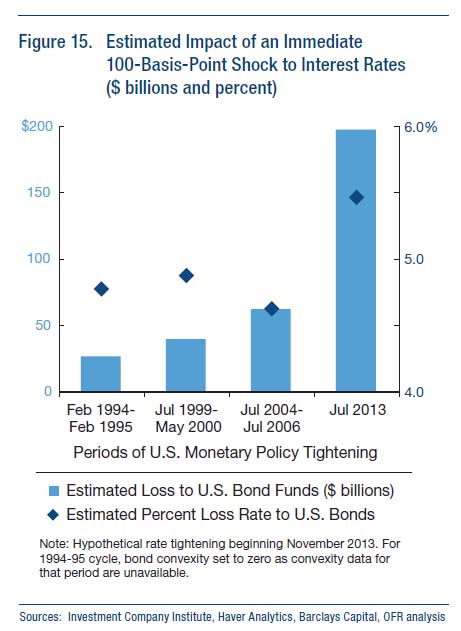

Losses from a given change in interest rates would be larger than in the past. These positions increase the vulnerability for some market participants to outsized losses that could be difficult to absorb in the event of an unanticipated increase in long-term rates. To assess the degree of vulnerability, we simulated an adverse interest rate shock to estimate losses by bond funds from an instantaneous parallel shift in the yield curve of 100 basis points from current levels. We then compared the impact of such losses in today’s context to loss rates from a similar hypothetical scenario during the three previous periods of U.S. monetary policy tightening. Losses during each tightening cycle are calculated by averaging monthly estimated losses, where the Barclays Capital U.S. Aggregate Bond Index is used as a proxy for duration and mutual fund bond holdings are based on data from the Investment Company Institute. Figure 15 shows that losses could rise to nearly $200 billion, underscoring that current bond portfolios are vulnerable to a sudden, unanticipated rise in long-term rates.

Which brings us to this simple rule of thumb:

A sharp 1% spike in yields would lead to

$100 billion loss for Japanese banks

$200 billion loss for US banks

As for European banks whose balance sheets are loaded up with sovereign bonds, the are literally off the charts.

So bring on the bond sales. Let’s hope that everyone sells in a calm, cool and collected manner or else the bond funds (oh wait, the same entities who are selling, and are thus motivated to sell first and avoid future losses) get it…