Australia’s slowing economy needs its floating exchange rate more than ever

December 22, 2013 Leave a comment

Australia’s slowing economy needs its floating exchange rate more than ever

Dec 14th 2013 | From the print edition

THIRTY years ago this week, Australia took a big economic gamble. On December 12th 1983 Paul Keating, then treasurer (finance minister), decided to float the Australian dollar.

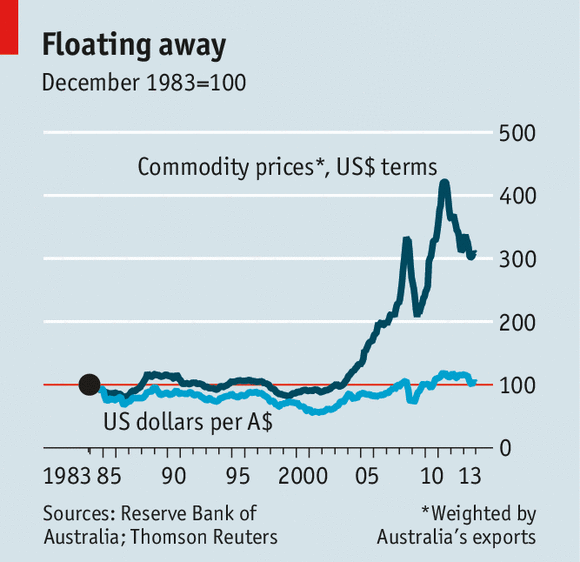

Ordinary Australians have lived with the highs and the lows of this decision ever since. In its first 20 years afloat, the dollar’s value closely followed the prices of the commodities Australia exports (see chart). But around 2003 they suddenly diverged. Over the next eight years commodity prices quadrupled; the dollar rose by much less. It no longer “has any day-to-day relationship to commodity prices”, according to Ric Deverell of Credit Suisse, a bank.Financial globalisation has helped wean the dollar off its link to commodities. The Australian and American dollars are now the fourth-most-traded currency pairing in the world, accounting for 7% of the global foreign-exchange market. As a consequence, interest-rate differentials—and a ballooning current-account deficit peaking at 6.2% of GDP in 2007—helped to stop the Australian dollar from soaring. This was a good thing: if it had increased as much as commodity prices, much of Australia’s industry would have been destroyed.

Since commodity prices starting dropping in mid-2011, the dollar has proved resilient. The prices of Australia’s commodity exports have fallen by 27% on average since then, but the dollar has lost only about 10% of its value, in part because Australian interest rates are now higher than those in many other rich countries. The dollar’s slight fall may not boost other sectors enough to overcome slumping mining investment: GDP growth has fallen by half since last year. The central bank says a lower exchange rate is “needed” to avoid recession.

A banker once said, “Currencies do not float, they sink at different rates.” Australians must be hoping theirs will submerge faster than most.