By expanding its Tommy Hilfiger brand and reuniting the Calvin Klein franchises, PVH could boost profits.

December 22, 2013 Leave a comment

SATURDAY, DECEMBER 21, 2013

Calvin Klein, Meet Calvin Klein

By JACK HOUGH | MORE ARTICLES BY AUTHOR

By expanding its Tommy Hilfiger brand and reuniting the Calvin Klein franchises, PVH could boost profits.

Calvin Klein underwear could soon feature a more flattering bottom line, with jeans to follow. Manhattan-based clothing designer PVH gained control of both product lines, the top sellers for the Calvin Klein brand, this year with a buyout of Warnaco. PVH’s rights already extended to other Calvin Klein clothing and accessory lines. The company plans to cut back on discounting the two Warnaco businesses and invest in better marketing to bring profit margins up to par with its other brands.Earnings per share are expected to rise only 7% this fiscal year, which ends in January, as a result, but that rate should double—perhaps even triple—over the following three years. Shares, recently $131, could climb more than 20% over the next year.

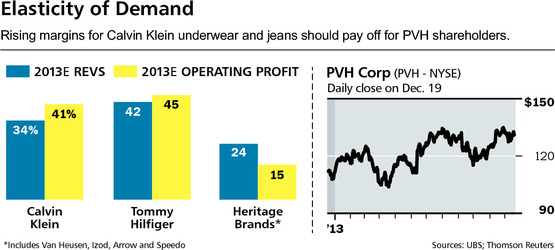

PVH (ticker: PVH), known as Phillips-Van Heusen until two years ago, has deep roots in department-store dress shirts: “The neatest Christmas gift of all!” boasts Ronald Reagan of his Van Heusen shirt in one 1946 newspaper ad. Today, PVH still has a dominant share in dress shirts and neckties, but its heritage-brands unit, which includes Van Heusen, Izod, Arrow, and Speedo, only brings in an estimated 24% of revenue and 15% of operating profit. Mostly, it serves to turn out steady free cash that PVH invests in its faster-growing divisions: Tommy Hilfiger and Calvin Klein, which fetch the rest of revenue and profits.

In 2003, PVH paid $700 million for Calvin Klein, but some Calvin product lines were already licenced to others. In 2010, PVH paid $3 billion for Tommy Hilfiger, which it calls “preppy with a twist.” This year, it paid $2.9 billion for Warnaco, which held a perpetual license for Calvin Klein underwear and a 40-year one for jeans. PVH’s chief executive, Emanuel Chirico, calls the buyout a reuniting of the house of Calvin Klein. Investors should regard it as a clear path to faster profit growth.

In the fiscal year ending in January, PVH is expected to earn $581 million, or $7.04 a share, on revenue of $8.2 billion, rising to $8.13 on revenue of $8.7 billion in fiscal 2015.

ANY COMPANY CAN BUY ITS WAY into a bigger revenue base, but PVH has a knack for making its purchases pay off for shareholders. Since its initial Calvin Klein deal in 2003, its share price has multiplied 10 times. When it bought Tommy Hilfiger in 2010, that business had operating margins of 10.5%; margins have since climbed to 13.4%. Part of the increase has come from closing unprofitable wholesale accounts and product lines, striking an exclusive pact with Macy’s, and opening more of its own retail stores, which generate rich margins. It has also invested in marketing, spiffing up its selling space at high-volume Macy’s stores and producing a YouTube music video (“Voyage Seafarius”) that’s been viewed more than 15 million times.

Over time, the Warnaco deal should yield similar results. Warnaco in recent years exemplified a problem common to licensees, according to UBS analyst Michael Binetti: It pursued fast growth and easy cash flow while letting quality slip and pushing more merchandise through deep discounters. At the same time, it underinvested in products in order to prop up profit margins. Even with the limited investment, Warnaco’s Calvin Klein operating margins were about 8%, versus 12% to 13% for PVH, says Chirico.

The weakest part of the business, and thus the part with the biggest potential for improvement, is jeans in North America and Europe. PVH has been pushing out excess inventory this year and closing unprofitable stores while reducing sales through discounters. In addition to fresh designs, what’s needed is some store-level investment in marketing, says Chirico. “If you walk into a Macy’s today, Calvin Klein is the top modern brand on the floor for many categories—but you have to search for the jeans,” he says.

UBS’ Binetti, who initiated coverage of PVH this past week with a Buy recommendation and a $160 price target, expects the Warnaco overhaul to produce choppy results through the first half of next year, followed by a sharp and prolonged acceleration. He calls two cases with other brands instructive. One is VF‘s (VFC) 2011 buyout of Timberland, which reversed a decline in selling prices of the latter’s signature yellow boots. Another is Ralph Lauren (RL), which in 2009 assumed direct control over its Southeast Asia distribution, and then dismantled much of the sales network there before rebuilding. Both stocks have sharply outperformed the market since those deals.

None

PVH’s prospects don’t hinge on an especially strong rise in consumer spending. The Warnaco purchase gives PVH an extensive sales network in Asia and Latin America, through which it can push its Hilfiger brand. A recovery from weak spending in Europe should help, too. Wall Street expects overall revenue to increase at mid-single-digit rates over the next three years, but margin gains may do more for the stock. Forecasts put earnings-per-share growth at 15% compounded over the next three years. Binetti predicts 18% a year and calls 20% “highly achievable.”

In the near term, PVH is replacing the licensing revenue it had collected from Warnaco with the upfront costs of marketing underwear and jeans for itself. Last quarter, EPS dipped 3% despite 10% revenue growth for Tommy Hilfiger and 19% growth for the preacquisition Calvin Klein business, offset by a 6% decline for heritage brands on store closings and weak results from shoe seller G.H. Bass, which PVH sold last month. Investors may be focusing too much on short-term results and ignoring the long-term potential. Although the stock has soared over the past decade, it has lagged behind the market this year, returning 18%, versus 27% for the Standard & Poor’s 500 index. That has left it attractively priced relative to PVH’s profit potential. For example, shares go for 14 times 2015 earnings estimates.

PVH pays a negligible dividend, but it should find other good uses for its yearly free cash of over $600 million, or nearly 6% of its market value. The most immediate opportunity is to pay down the $3.8 billion in debt it took on at the time of the Warnaco buyout, part of which replaced existing debt. Assuming $400 million in yearly debt reduction over the next three years, PVH could cut interest payments by nearly $50 million a year. By then, it will likely turn to some smaller deals. One opportunity is to take over Tommy Hilfiger distribution in Asia and some regional product licenses for Calvin Klein. “That would be low risk and very accretive to earnings,” says Chirico. Unlike Warnaco’s long-term licenses, remaining ones are short-term.

THIS ISN’T THE FIRST TIME THIS year that Barron’s has turned bullish on briefs. Last spring, we recommended Hanesbrands (HBI) shares (“With Hanesbrands, You’re Covered,”April 29). It, too, is driving profit margins higher, but by different means. Its “innovate to elevate” strategy involves adding features like wicking fabrics and tagless labeling, allowing it to fetch higher prices for underwear, tees, and bras. The stock is up 40% since our story, versus 15% for the Standard & Poor’s 500. While Hanesbrands looks similarly priced to PVH, at 14 times projected 2015 earnings, a stock investor only needs so much exposure here, and we’d swap Hanes for Calvins.