Death of the contrarian

December 22, 2013 Leave a comment

| Dec 19 16:30 | 3 comments | Share

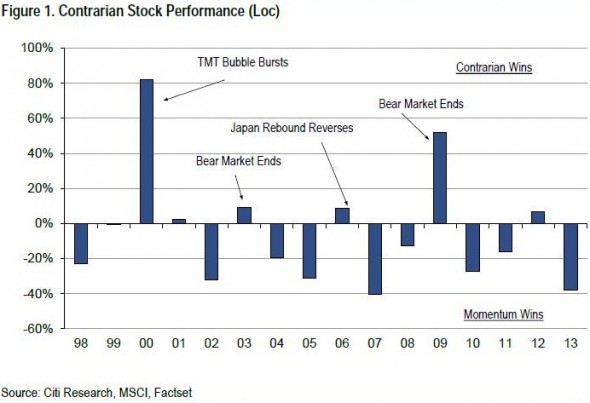

It has been a year to jump on a bandwagon sailing with the wind at the heart of the pack. Momentum, baby. Let Citi paint you a picture: A two-year, 40 per cent rally in global equities is not the time to be a contrarian (unless you were the bold type calling for it back in the dog days of 2012). Still, Citi warns that the contrarians do tend to do well in January, and they won’t give up:Their big trade for 2014 will be to buy (again) the commodity-related stocks and Emerging Market countries.

Citi has sympathy for buying the developing world, but on commodity gloom, there seems to be a lot of it about.

Meanwhile, at a more local level:

Going into 2014, contrarians in the US will be buying large tech companies and selling biotech and internet stocks. In Europe and EM, they will be buying commodity stocks and selling a mix of industrials, consumer and tech stocks.

So, do you chase fame as the heroic contrarian, knowing that ignominious defeat isnever far away?

Or will it be another year for the thundering herd?