Three things long/short hedge funds cannot do (well)

December 22, 2013 Leave a comment

Three things long/short hedge funds cannot do (well)

| Dec 18 11:17 | 16 comments | Share

We have mentioned the five-year problem before. However, we suspect that theranks of the zombies will be swelling again soon, because of the simple fact that the five-year track record of stock-trading hedge funds is horrible.

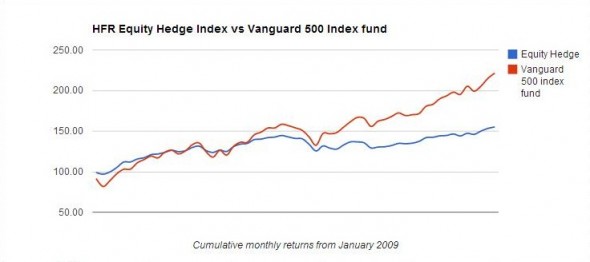

Your $100 would be worth $220 if you lodged it with Vanguard — while the Long-Short industrial complex would have turned it into $155 (after taking at least $25 in fees).

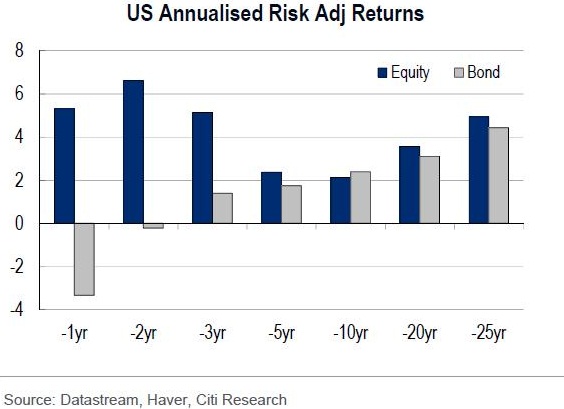

This matters because, having worked to justify hedge funds as a separate asset class, the sector is effectively competing with stocks. And as Jonathan Stubbs at Citi has been pointing out, asset-class returns for equities now look pretty good for almost every period you choose to consider, a fact which tends to be followed by higher allocations of capital.

But we are looking for reasons to explain the enormous gap between the performance of stocks and highly-paid stock traders. In particular, we think there are three fundamental things that Long/Short funds should be able to do, but clearly cannot:

1. Manage risk.

We don’t mean risk in the month-to-month trading exposure sense. We mean in the deciding when to go big and when to stay at home sense.

It may be that the desire of big institutions for monthly reporting, tight risk limits and safety has become counterproductive – that in trying to build something of “institutional quality” you destroy the nimbleness the institutions are after in the first place.

But equity hedge funds have not done a good job of managing risk. A case in point: with hindsight it is clear that the biggest risk to portfolios at the start of the year was having too little market exposure.

See also the whole of 2011.

2. Short stocks on a systematic basis

Want to go long the market? There are a host of strategies you can use – value, quality, earnings momentum, monkey darts.

To go short though, not so easy. There is no inherent return, and over the long term you are fighting the market. For the long-short model to work, hedge funds must constantly have short positions in place, and to do that well is hard to the point of impossibility for most.

One thought also for discussion. We suspect there is a temptation to use low-beta stocks for shorts as the lack of volatility makes such positions cheaper. But low beta stocks have also proved to be good performers a lot of the time.

3. Stop trading.

Friction is a killer, as those trading commissions and little losses add up. For the individual investment experts who were nimble and rose to the top in the early days, making the industry’s reputation, this was not a problem.

Scale up to thousands of funds and more than a trillion dollars in capital at work, however, and the friction will start to tell at the industry level. You might also classify this as the prime broker’s cut from the use of our imaginary investor’s $100…