Chinese Rate Crunch Exposes Cracks

December 25, 2013 Leave a comment

Chinese Rate Crunch Exposes Cracks

ARON BACK

Dec. 23, 2013 6:35 a.m. ET

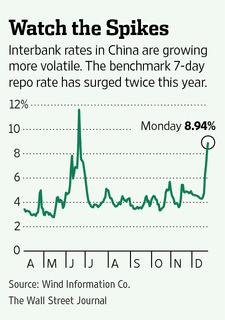

The squeeze is on—again. In an echo of last June’s cash crunch, interest rates that Chinese banks charge each other for short-term funds have again shot up to worrying levels. Despite moves by the central bank to calm the interbank market, the benchmark seven-day repo rate averaged 8.94% on Monday and spiked as high as 9.8%. That’s up from an already elevated 8.2% on Friday.

It’s common for banks in China to scramble for funds at the end of each quarter and especially at the end of the year in an effort to meet regulatory requirements such as the minimum loan-to-deposit ratio. But recent bouts of turbulence have been more severe than in past years. Major forces are moving in China’s financial system.

The most basic change is that the reform-minded central bank has become stingy in an attempt to flush out dangerous lending practices among banks. The People’s Bank of China is concerned that small banks in particular are too dependent on short-term interbank finance, and is attempting to discipline the market by withholding liquidity.

But sometimes things get out of hand and the central bank, unaccustomed to managing a market system, flinches when funding shortages become acute. After declining to inject funds in its regular open market operations since Dec. 5, the PBOC suddenly snapped into action Thursday, injecting over 300 billion yuan ($49.4 billion) in three days through a special facility.

The PBOC seems to have misjudged the potential for market strain, both in June and now. Communications have been erratic, with total silence from the central bank as concerns built last week. This was followed on Thursday by a post on the fashionable social media service Weibo announcing the injections, an abrupt change in messaging style from the secretive central bank.

The PBOC’s difficulties are exacerbated by China’s increasingly complex financial system. More interest rates are being set by market forces, rather than central bank fiat. Shadow banking institutions make it difficult to judge how much credit is being created. Meanwhile, banks are taking novel risks, finding ways around lending limits, and occasionally coming up short when bills come due.

During the June cash crunch, rumors circulated that there had been defaults in the interbank market. This was confirmed earlier this month, when China Everbright Bank601818.SH -0.37% revealed in a prospectus for its Hong Kong public offering that two of its branches had indeed been a day late on some interbank payments totaling 6.5 billion yuan, or over $1 billion.

Events six months ago seem to have made banks more cautious this time around. The PBOC says there are excess reserves of over 1.5 trillion yuan in the system, suggesting funds should be ample if only banks would lend to each other freely. But they aren’t lending to each other, spooked by the risk that they may not be repaid.

An implicit government guarantee underpins the entire Chinese financial system. This remains in place. But as Beijing pushes the system to be more market-driven, cracks aren’t being plastered over as they were before. That gives investors more visibility into what’s been an opaque market. But it also presents a new way to get hurt.